Futures Drift Higher Despite Sharp Drop In Chinese Exports

Futs are starting flat for a second consecutive day, having reversed earlier losses, after China reported a bigger-than-expected drop in exports and OECD warned of a weak global economic recovery. Shares are trying to build on Tuesday’s gains as a rally in megacap stocks that had propelled the S&P 500 to the edge of a bull market continued to fizzle. As of 8:00 am ET, S&P futures were modestly in the green at 4295 while Nasdaq 100 futs were up 0.2%The Bloomberg Dollar Spot Index traded near the day’s lows, boosting most Group-of-10 currencies. Treasury yields were little changed amid listless trading global bond markets. Oil and gold were flat, while Bitcoin retreats a day after climbing more than 5%. Today’s macro data includes mtge applications, trade balance, and consumer credit. Ultimately, the macro data prints are light for the balance of the week.

In premarket trading, Apple was set to extend Tuesday’s decline, falling in premarket trade along with Nvidia and Microsoft in a signal that more air is coming out of the rally in tech shares. Tech stocks continued to decline amid growing expectations that central banks will keep rates higher for longer (at least until the next big macro print), disappointing hopes they will pivot to rate cuts later this year. Here are some other notable premarket movers:

- Amazon.com was upgraded to outperform from neutral at Edgewater Research, which sees a more positive outlook for the e-commerce and cloud-computing company. Shares are up as much as 0.7%.

- Coinbase rises 2.2% after the crypto firm slumped 12% on Tuesday following the Securities and Exchange Commission’s lawsuit against the firm.

- Dave & Buster’s rises 5.1% after the food and entertainment venue operator reported first-quarter earnings per share that beat estimates.

- Herbalife slips 0.6% as Mizuho Securities initiates coverage with a neutral recommendation, saying the long-term targets of the nutrition company are achievable, but near-term visibility is limited.

- Novocure Ltd. climbs as much as 5.1% as Wedbush analyst David Nierengarten raised his recommendation on the stock to neutral from underperform.

- Petroleo Brasileiro SA’s US-traded shares are up 2.1% after Morgan Stanley upgraded the company to overweight from equal weight and raised the price target to $16.50 from $12.50, citing “further room for capital appreciation.”

- Stitch Fix rises 7.3% as analysts note that the online clothing company’s better-than-expected revenue and cost-cutting measures could pave the way for better profitability.

- Yext Inc. rallies 18% after the infrastructure-software company boosted its adjusted earnings per share guidance for the full year.

“One of the things I’m a little nervous about is that the rates market got a little too carried away about the central banks being able to quickly pre-emptively cut rates,” said Karen Ward, chief market strategist for EMEA at JPMorgan Asset Management, in an interview with Bloomberg TV. With rates markets pricing out some expected cuts, “that to me puts some of those growth, those megacap tech valuations, a little at risk,” she said.

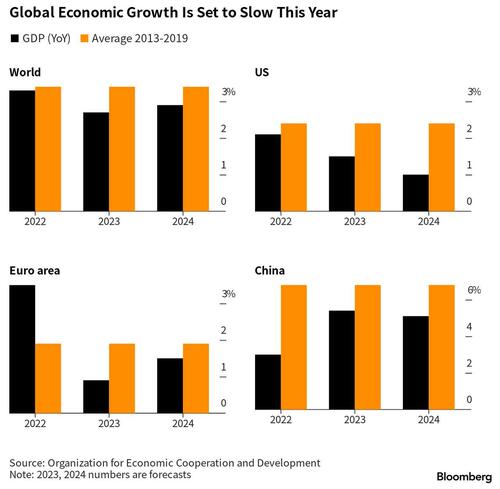

European shares wavered, with sentiment damped by a bigger-than-expected drop in Chinese exports and an OECD warning that the global economy is set for a weak recovery, dogged by persistent inflation and restrictive central bank policies. Specifically, the OECD said a global recovery that will be weaker than expected, +2.7% for FY23 and +2.9% for FY24 vs. +3.4% average over the 7 years preceding COVID; this comes amid elevated global inflation

Euro Stoxx 50 falls 0.5%. FTSE MIB lags regionals, dropping 0.9%. Autos, insurance and chemicals are the worst-performing sectors. The FTSE 100 fluctuated after UK lender Halifax said the nation’s house prices posted their first annual decline since 2012. Hermes International was among the biggest drags on the benchmark, and was set to decline for the third straight session on Wednesday. Despite some hopes over potential stimulus, conviction on the China reopening trade has faltered, with sectors such as luxury goods among the hardest-hit. Here are some notable European movers:

- Inditex shares rise as much as 6.2% to the highest since 2017 after the Zara owner reported a 1Q earnings beat and a strong start to 2Q. Analysts see potential consensus increases after the results.

- Danske Bank gains as much as 5.9%, the most since October, after the Danish lender raised its key profitability target and said it will offer more than DKK50 billion in dividends by 2026.

- Hugo Boss rises as much as 4.1% after UBS initiated coverage with buy and a Street-high price target, noting the firm’s turnaround story.

- SBB climbs as much as 14%, extending the gains triggered after Friday’s surprise announcement that the beleaguered Swedish landlord would change its CEO.

- DiscoverIE rises as much as 4.9% after the electronic components distributor reported results which analysts say demonstrate the strength of its business model, noting the firm’s positive outlook.

- Assa Abloy gains as much as 4.9% after the Swedish lock and entrance systems manufacturer announced Mexican authorities gave a green light to its acquisition of hardware unit HHI.

- 888 Holdings rises as much as 22%, extending Tuesday’s gains, after a group of gambling-industry veterans built a stake in the owner of British betting chain William Hill.

- Sectra drops as much as 10% after the Swedish medical imaging company was downgraded to sell at Carnegie, with the broker saying that the stock’s valuation has again become too high.

- BE Semiconductor falls as much as 6.4%, extending a decline that started during Tuesday’s capital markets day, with analysts flagging a delay to a key product to 2027 from earlier 2025.

- PGE drops as much as 3.4% after a court in Warsaw suspended the execution of the environmental decision for the company’s Turow open-pit lignite mine, allowing it to operate until 2044.

- KBC dips as much as 0.7% after AlphaValue/Baader downgraded the Belgian bank to reduce as it expects margins to decline in 2024 due to rate cuts and lower loan volumes than anticipated.

“Weaker global trade is not a new story but it is surprising how quickly China’s reopening boost has faded,” said Craig Erlam, a senior market analyst at Oanda. “Pressure is set to intensify on the leadership to announce new stimulus measures in a bid to revitalize the economy again.”

Earlier in the session, Asian shares were mostly stronger following the positive handover from Wall St where the S&P 500 posted its highest close YTD and the Russell 2000 rallied amid strength in regional banks, although advances were capped as the attention in Asia turned to softer-than-expected Chinese trade data.

- Hang Seng and Shanghai Comp. were positive after reports that China asked the largest banks to cut deposit rates to boost the economy and with Hong Kong led by tech strength, while price action was less decisive in the mainland after the latest Chinese trade data mostly disappointed including the wider-than-expected contraction in dollar-denominated exports.

- Nikkei 225 wiped out its initial gains in an early 700-point swing and briefly dipped beneath the 32,000 level where it found some support.

- ASX 200 was just about kept afloat but with the upside limited by the weaker-than-expected Australian GDP and hawkish adjustments to peak rate forecasts.

- Indian stocks rallied for fourth consecutive day to hover around all-time high levels ahead of interest rate-setting panel’s decision on Thursday. The S&P BSE Sensex rose 0.6% to 63,142.96 in Mumbai, while the NSE Nifty 50 Index advanced 0.7% and both gauges closed a little short of their peak levels seen in December. Reliance Industries contributed the most to the Sensex’s gain, increasing 0.7%. Out of 30 shares in the Sensex index, 20 rose and 6 fell, while 4 were unchanged

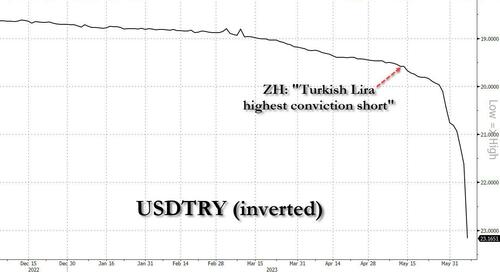

In FX, the Bloomberg dollar spot index gives up earlier gains. NZD and DKK are the weakest performers in G-10 FX, NOK and AUD outperform. the Turkey lira plunged to a record low, and is the worst-performing currency against the dollar versus expanded majors, as traders said state lenders had halted dollar sales to defend it.

In rates, treasuries are slightly cheaper across the curve with losses led by front-end and belly, flattening 2s10s, 5s30s spreads on the day. Stock futures remain inside Tuesday session range, while WTI crude oil futures advance over 1%. US session quiet for scheduled events, with minimal data, supply (except 17-week bills) and no Fed speakers expected. Yields cheaper by up to 3bp across front-end of the curve with 2s10s, 5s30s spreads flatter by 0.8bp and 2bp on the day; 10- year yields around 3.685%, cheaper by 2.5bp vs. Tuesday close with bunds and gilts outperforming by 1.5bp and 3bp in the sector

In commodities, WTI traded about 1% higher around $72.50 while ags appear to have caught a bid from the escalation of hostilities in Ukraine. Spot gold is little changed at $1,962/oz.

Looking at today’s calendar, at 7 a.m., we got the latest mortgage applications data (another drop, this time -1.4%), followed by April trade figures at 8:30 a.m and a consumer credit report at 3 p.m. The Bank of Canada will deliver a rate decision at 10 a.m. New York time. President Joe Biden will meet with his UK Prime Minister Rishi Sunak in Washington.

Market Snapshot

- S&P 500 futures down 0.1% to 4,284.00

- MXAP little changed at 163.82

- MXAPJ up 0.5% to 517.07

- Nikkei down 1.8% to 31,913.74

- Topix down 1.3% to 2,206.30

- Hang Seng Index up 0.8% to 19,252.00

- Shanghai Composite little changed at 3,197.76

- Sensex up 0.3% to 63,005.26

- Australia S&P/ASX 200 down 0.2% to 7,117.99

- Kospi little changed at 2,615.60

- STOXX Europe 600 down 0.2% to 460.81

- German 10Y yield little changed at 2.38%

- Euro little changed at $1.0686

- Brent Futures little changed at $76.30/bbl

- Gold spot down 0.2% to $1,959.65

- U.S. Dollar Index little changed at 104.16

Top Overnight News

- China’s May exports come in below plan, dropping 7.5% Y/Y in May (vs. the Street’s -1.8% forecast and much weaker than the +8.5% in April), although imports were a bit better (-4.5% vs. the Street’s -8%). China posts health commodity imports in May despite softer exports, with crude imports the third-highest monthly level on record. RTRS

- US secretary of state Antony Blinken will travel to China this month, in the latest sign that Beijing and Washington are beginning to stabilize a turbulent bilateral relationship that had sunk to the lowest point in decades. FT

- India expected to begin manufacturing GE jet-fighter engines in the country under a deal expected to be struck with Washington, part of New Delhi’s pivot away from Russian military equipment. WSJ

- The Turkish lira plunged the most in more than a year as state lenders halted dollar sales to defend it, a sign the new economic administration is giving up on costly interventions. The currency fell as much as 7.2% per dollar, weakening for a 12th day. BBG

- New York pushed past Hong Kong as the world’s most expensive city to live in as an expat, thanks to inflation and rising accommodation costs, while skyrocketing rents saw Singapore crash into the top five for the first time. Geneva and London remained in third and fourth places, according to the ECA International’s Cost of Living Rankings for 2023. BBG

- Michael Dell’s family office plans to diversify its portfolio to absorb a payday of cash and stock worth more than $20 billion after Broadcom acquires VMware. BBG

- Mike Pence kicks off his presidential campaign in Iowa, with the former VP saying “different times call for different leadership.” Pence is offering himself as the only traditional conservative who can win the nomination, defeat Biden and govern with more civility than Donald Trump. “Our party and our country need a leader that’ll appeal, as Lincoln said, to the better angels of our nature,” he said. BBG

- Wells Fargo will sell an office building in San Francisco for $42.6-46MM, a steep discount to the $108MM paid for the property back in 2005. Real Deal

- Reddit is cutting about 90 people, or 5% of its staff, and plans to slow hiring going forward, becoming the latest tech firm to reduce headcount. WSJ

- AI: Equity investors are vigorously debating the influence generative artificial intelligence (AI) may have on the future revenue growth and profitability of companies, and the valuation of stocks. We believe further upside exists to the S&P 500 index level if investors price some potential productivity and profit boost from AI adoption. Based on a range of productivity scenarios, we estimate the benefit to S&P 500 fair value could be as small as +5% vs. current levels and as large as +14%. Read Ryan Hammond and team’s full report here.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks mostly gained following the positive handover from Wall St where the S&P 500 posted its highest close YTD and the Russell 2000 rallied amid strength in regional banks, although advances were capped as the attention in Asia turned to softer-than-expected Chinese trade data. ASX 200 was just about kept afloat but with the upside limited by the weaker-than-expected Australian GDP and hawkish adjustments to peak rate forecasts. Nikkei 225 wiped out its initial gains in an early 700-point swing and briefly dipped beneath the 32,000 level where it found some support. Hang Seng and Shanghai Comp. were positive after reports that China asked the largest banks to cut deposit rates to boost the economy and with Hong Kong led by tech strength, while price action was less decisive in the mainland after the latest Chinese trade data mostly disappointed including the wider-than-expected contraction in dollar-denominated exports.

Top Asian News

- China Stocks Woes Hamper Hong Kong IPO Recovery: ECM Watch

- Blinken Plans Trip to Beijing in Bid to Stabilize US-China Ties

- China Traders Are Leveraging Up The Most on Record on Flush Cash

- Pakistan Bonds, Stocks Rise on Growing Optimism for IMF Loan

- China’s Steel Slowdown Pushes Exports to Highest Since 2016

- Air India Sends Relief Jet to Russia for Stranded Passengers

European bourses are softer, Euro Stoxx 50 -0.3%, with the complex drifting after the cash open amid a relative lack of fresh catalysts/drivers. Though, attention remains on the soft Chinese trade figures and German industrial output, on the latter ING writes that unless there is a significant pickup Germany could continue into a Q2 recession. Sectors are similarly softer though Retail names outperform amid strength in Inditex post earnings while Danske Bank is the Stoxx 600 outperformer after providing FY26 targets and a dividend update. Stateside, futures are slightly softer in-fitting with the above in similarly limited trade with the region entirely focused on next week’s CPI/FOMC; though, today’s BoC might provide an interim focal point, ES -0.1%. US lawmakers are reportedly attempting to curb Mastercard (MA) and Visa (V) fees, via WSJ.

Top European news

- ECB’s Schnabel says, on rates, “We have more ground to cover. It will depend on the incoming data by how much more rates will have to increase.”. When questioned on market expectations for two 25bp hikes: “A peak in underlying inflation would not be sufficient to declare victory: we need to see convincing evidence that inflation returns to our 2% target in a sustained and timely manner. We are not at that point yet.”

- ECB’s de Guindos says “To complete the crisis management toolkit for large banks in the EU, we also need to make progress in other areas, such as liquidity in resolution and a backstop to the Single Resolution Fund.”.

- ECB’s Knot says prolonged monetary tightening could still result in stress for financial markets, inflation expectations in financial markets seem optimistic, not convinced that current tightening is sufficient.

- UK PM Sunak seeks to forge an economic alliance with US President Biden and aims to extract concessions from the US on green technologies, according to FT.

FX

- DXY drifts on the 104.000 handle in the absence of primary US data and Fed commentary during pre-FOMC purdah.

- Yen relishes softer Treasury yields as USD/JPY retreats further from recent peaks towards 139.00 and decent option expiries.

- Yuan continues to wilt as weak Chinese trade/export metrics compound growth concerns, USD/CNY and USD/CNH top 7.1300 and 7.1400 respectively.

- Aussie underpinned near 0.6700 vs Greenback as RBA officials underline hawkish guidance, but AUD/USD is capped by tech resistance and hefty expiry interest.

- Loonie perky pre-BoC around 1.3400 handle against Buck as market pricing sits tight between pause and 25 bp hike.

- TRY depreciation is a strong signal of a move away from state controls in favour of a free market and declines in the CBRT’s reserves have stopped after signs of FX policy change, according to traders cited by Reuters.

- PBoC set USD/CNY mid-point at 7.1196 vs exp. 7.1194 (prev. 7.1075)

Fixed Income

- Bonds regroup after reversal from highs through or towards prior closing levels.

- Bunds, Gilts and T-notes back above parity within 134.67-07, 96.87-51 and 114-02+/113-26 respective ranges awaiting US and Canadian trade data pre-BoC.

- Demand for German Green Bobl exceptionally strong (record high), while 2025 UK Gilt sale reasonably well covered.

- Orders for the new 4yr BTP Valore retail bond reach EUR 11bln since the beginning of the offer period.

Commodities

- Crude benchmarks are firmer and back towards post-inventory levels as the USD dips and despite overnight trade data.

- Currently, WTI Jul’23 and Brent Aug’23 post upside of around USD 0.50/bbl; newsflow has been limited and focused on geopols and while IEA’s Birol spoke he added little aside from looking for a tight H2.

- US Energy Inventory Data (bbls): Crude -1.7mln (exp. +1.0mln), Gasoline +2.4mln (exp. +0.9mln), Distillate +4.5mln (exp. +1.3mln), Cushing +1.5mln.

- Base metals are modestly firmer and largely shrugged off Chinese trade as the import metrics seemingly indicate the overall reopening-recovery narrative remains in play.

- Spot gold is little changed as the USD pulls back to near-U/C with the yellow metal holding above the USD 1956/oz 10-DMA but unable to make much headway from session high circa. USD 10/oz above.

- Discussions on the Black Sea grain deal to occur in Geneva on Friday, via Ria citing sources.

- Indian Steel Minster says they are looking aggressively to diversify coking coal imports, requirement for this product is going to increase.

Crypto

- Binance commented on the US SEC filing a motion to freeze assets in which it stated that user assets remain safe and its platform continues normal deposit and withdrawal operations, while it added that the filing of the preliminary injunction is unwarranted and it looks forward to defending against it in court, according to Reuters.

- Coinbase (COIN) says the incident with delayed ETH transactions has been resolved.

Geopolitics

- US Secretary of State Blinken and Saudi Crown Prince MBS had an open and candid discussion covering a full range of bilateral issues, while there was a good degree of convergence in the meeting but also differences. Furthermore, they discussed the potential for normalisation of relations between Saudi Arabia and Israel, as well as agreed to continue dialogue on normalisation, while Blinken raised human rights issues with MBS both generally and related to specific cases, according to a US official.

- US Secretary of State Blinken is set to travel to China for talks in the coming weeks in a visit intended to be a major step in thawing relations between the two countries, according to Reuters citing a US official.

- EU nations are approaching a deal on the 11th sanctions package against Russia. Representatives in Brussels are aiming to get the package over the line at their meeting today. EU diplomats suggest that several questions are still open, according to Politico.

- Number of IAEA inspectors at the Zaporizhzhia nuclear plant to increase several times, via Tass citing Russia’s Rosenergoatom.

US Event calendar

- 07:00: June MBA Mortgage Applications, prior -3.7%

- 08:30: Revisions: US Trade in Goods and Services

- 08:30: April Trade Balance, est. -$75.8b, prior -$64.2b

- 15:00: April Consumer Credit, est. $22b, prior $26.5b

DB’s Jim Reid concludes the overnight wrap

Today is the day where I see whether I need to start the training clock for the 2036 Olympics as my daughter Maisie has her first ever swimming gala. It’s only against a couple of schools so if she wins her race the dream is still on and if she doesn’t I’ll conclude that unless we have all the global medalists for 2036 in the same 5 mile catchment area in Surrey then it’s probably not going to happen. Last week she swam 6 times!! If anyone can explain how you can have any kind of life with a full time job and 3 kids with various sporting commitments and parties then I’d love to know. I didn’t see my wife in the evenings last week or last weekend with all the ferrying. All answers gratefully received.

Markets are generally swimming slightly against the tide this week, with the S&P 500 (+0.22%) still not quite able to break out into bull market territory that it crossed intra-day on Monday. Having said that the index did just about close at a high for 2023 so the momentum is still there to some degree. In a week of limited data and a Fed blackout there have been a few stories swirling around in the background that have dampened sentiment without reversing it. That has included geopolitical risks, weak data releases, as well as growing scepticism that the Fed would end up cutting rates this year. In fact, by the close yesterday, the 2s10s curve had inverted to a post-SVB low of -82.3bps, which just demonstrates how various recessionary indicators are still flashing with growing alarm.

The newsflow was pretty subdued from the outset yesterday, and shortly after we went to press German factory orders unexpectedly contracted by -0.4% in April (vs. +2.8% expected). This echoed the signals in the latest manufacturing PMI for May, which hit a 3-year low of 43.2, as well as the data revisions a couple of weeks ago that Germany did experience a winter recession after all.

That weak data interacted with further geopolitical concerns, particularly after the Kakhovka dam in Ukraine was destroyed, which has led to serious flooding in southern Ukraine. A key concern is with regard to the Zaporizhzhia nuclear plant, which relies on water supplies to cool its reactors, but experts didn’t consider a nuclear incident likely. From a market perspective, the bigger concern could well be the impact on agricultural prices and hence inflation, with wheat prices (+0.52%) recording a 5th consecutive daily increase, although having pared back earlier gains when it had been up as much as +3.85%. As it happens, we flagged in our World Outlook on Monday (link here) that a widely-predicted El Nino event this year was a risk to the trend of declining food prices over recent months, so events like that and the Ukraine flooding could provide an additional inflationary impulse as growth slows. You could add in bubbling concerns about low water levels at the lake that feeds the Panama Canal to that list of supply side concerns. The Panama Canal Authority is predicting a record low water level for the end of July with weight limits and rising surcharges already in force. So one to watch in the weeks ahead.

On the theme of geopolitics/supply chains, this morning Marion Laboure and Cassidy Ainsworth-Grace on my team have published an update on the landscape for semiconductors and rare earth metals (link here). It’s a topical story, since yesterday saw Japan announce a revised chips strategy that has the goal of tripling sales of Japanese-produced semiconductors by 2030. And that follows China’s announcement in late-May that Micron’s products had failed its cybersecurity review, saying that it posed “relatively serious” cybersecurity risks. It also comes amidst a growing push towards more resilient supply chains, which was one of the themes at last month’s summit of G7 leaders.

Back to markets and risk assets were fairly steady on the whole, and the S&P 500 (+0.22%) posted only a very modest gain. Banks (+1.84%) were the main outperformer in the index, whilst the megacap tech stocks continued to strengthen, with the FANG+ Index (+0.56%) taking its YTD gains up to +67.53% by the close. With equities grinding higher, equity volatility hit a new local low as the VIX index closed under 14.0pts (13.96) for the first time since February 2020. Small cap stocks strongly outperformed with the Russell 2000 index +2.73% higher, which was its second best day since November with the only better day being last Friday. European equities also recovered from their Monday losses, with the STOXX 600 up +0.38%.

When it came to sovereign bonds, there was a mixed performance on either side of the Atlantic. US Treasuries were flat, with the 10yr yield unchanged at 3.683%. That comes with just a week to go until the Fed’s next decision, where markets are still pricing in a temporary pause as the most likely outcome, which would be a big milestone after a run of 10 consecutive rate hikes. But it was a different story in Europe, where yields on 10yr bunds (-3.0bps) and OATs (-0.6bps) both moved lower. In part, they were supported by the ECB’s latest Consumer Expectations Survey for April, which showed that median 1yr inflation expectations were down to 4.1%, which is their lowest since February 2022 when Russia’s invasion of Ukraine began.

Asian equity markets are mixed this morning after erasing their opening gains after China’s May trade data disappointed (more on this below). As I check my screens, the rally in Japanese stocks has paused for breath after recently hitting 30yr plus highs with the Nikkei sliding -1.44% and leading losses across the region. Mainland Chinese markets are also struggling with the CSI (-0.34%) trading in the red and the Shanghai Composite (+0.02%) surrendering its opening gains. Elsewhere, the Hang Seng (+0.94%) is moving higher with the KOSPI (+0.32%) also seeing a positive start after coming back from a public holiday. In overnight trading, US stock futures tied to the S&P 500 (+0.01%) are flat.

Coming back China, the data showed that exports (-7.5% y/y) fell in May for the first time since February, much faster than the market expected drop of -1.8%, after a gain of +8.5% in the preceding month. Meanwhile, imports declined at a slower pace, dropping -4.5% y/y in May (v/s -8.0% expected; -7.9% in April). The call for fresh stimulus is mounting.

Elsewhere in Australia, Q1 GDP expanded +2.3% y/y, slightly below market expected growth of +2.4% and against a downwardly revised expansion of +2.6% in the final quarter of 2022. On a q-o-q basis, GDP grew by just +0.2% in the March quarter, the smallest increase since the nation emerged from the Covid lockdown in September 2021 and compared with a rise of +0.3% expected before today’s announcement.

Staying with growth, the World Bank released their latest global outlook yesterday, which pointed to growth of +2.1% in 2023, up by four-tenths relative to their January forecast. However, they revised down their 2024 forecast by three-tenths to 2.4%. Looking out to 2025, they then see growth accelerating back up to +3.0%. Otherwise, Euro Area retail sales were unchanged in April (vs. +0.2% expected), although the previous month’s contraction was revised up to show a smaller -0.4% decline.

To the day ahead now, and data releases include German industrial production and Italian retail sales for April, along with the US trade balance for April. Otherwise, the Bank of Canada will be making its latest policy decision, and we’ll hear from ECB Vice President de Guindos, and the ECB’s Knot, Panetta and Vujcic. Lastly, the OECD will be releasing its latest Economic Outlook, and UK PM Sunak will be visiting US President Biden in Washington.

Tyler Durden

Wed, 06/07/2023 – 08:11

via ZeroHedge News https://ift.tt/GwNV4L5 Tyler Durden