Taylor Rule Shows Fed Has Unfinished Work On Rates

Authored by Ven Ram, Bloomberg cross-asset strategist,

If the labor market continues to stay robust, the Federal Reserve will be forced to tighten again after a pause in June to prevent its benchmark rate from falling behind the curve, an application of the Taylor Rule shows.

Given still-resistant core inflation, the restrictive rate for the US economy is between 5% and 6.55%, meaning the Fed’s mid rate at 5.125% isn’t yet getting the job done on curbing price pressures.

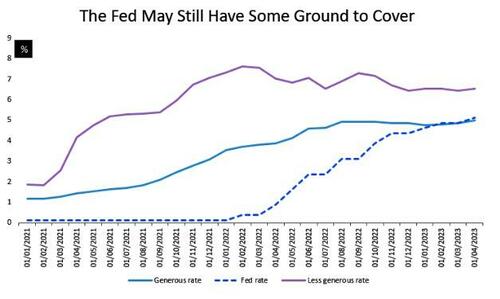

The chart above shows the Fed’s benchmark rate juxtaposed against a more generous application of the Taylor Rule and a less generous interpretation.

The more generous version is derived from using the Dallas Fed trimmed mean PCE and also assumes that the Fed’s real policy neutral rate is -50 basis points, which in the words of Fed St. Louis President James Bullard represents “an approximate pre-pandemic value” for the US economy. It also uses a phi value – which captures policymakers’ reaction to deviations of inflation from target – of 1.25.

The less generous version is bootstrapped from current inflation, a higher real neutral rate of +50 basis points that is more consistent with the macroeconomic momentum that we have seen in the aftermath of the pandemic, and a phi value of 1.5, which is closer to standard literature.

Core PCE inflation is now running at 4.7%, way above the Fed’s estimate that sees it crumbling to 3.6% this year before settling at 2% over the longer run.

Even though the Fed has raised rates by a phenomenal 500 basis points in the current cycle, core PCE has come off just 70 basis points from its peak of 5.4%.

While Chair Jerome Powell remarked recently that Fed’s “stance of policy is restrictive and we face uncertainty about the lagged effects of our tightening so far,” the stickiness of core inflation will force policymakers to raise rates further, though it doesn’t look likely that they will do so next week.

However, the findings of the analysis aren’t lost on the hawks of the Fed’s policy committee, who underscored in recent weeks that rates may have to climb higher to be restrictive. Back in March, when the economy was passing through the peak of the banking turmoil, seven of 18 members estimated that the Fed’s upper end of its funds rate needed to be at least 5.50% to be restrictive enough. With the stress in the banking sector now appearing to have settled, it is presumable that their numbers may grow, especially considering that core PCE is nowhere near the Fed’s comfort zone.

Interest-rate traders are yet to fully wake up to the possibility that the Fed will have to raise rates again. They are currently assigning only an 80% chance of one 25-basis point move in the cycle. As the analysis shows, the Fed may well have to hike by more than that.

Tyler Durden

Wed, 06/07/2023 – 09:05

via ZeroHedge News https://ift.tt/0Od6cUq Tyler Durden