CPI Tumbles To 2-Year Lows, But Goods Prices Reaccelerate; Inflation Outpaces Wages For 26th Straight Month

With CPI set for a ‘historic drop’, the market has FOMO’d into this print (and tomorrow’s FOMC) with the headline print expected to tumble from +4.9% YoY to +4.1% YoY. However, The Fed’s new favorite signal from The BLS is Core Services CPI Ex-Shelter, and that declined to +4.6% YoY – lowest since March 2022

Source: Bloomberg

The headline CPI was expected to rise 0.1% MoM (+4.1% YoY) and it did, but the YoY print dropped to 4.0%. That is the 11th straight monthly decline in the YoY print to the lowest since March 2021…

Source: Bloomberg

This is the longest streak of monthly headline CPI declines since 1921…

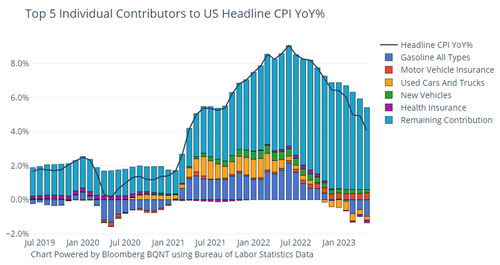

Gasoline was the biggest driver of the headline CPI’s decline…

Core CPI was also expected to drop significantly (from 5.5% to 5.2% YoY), but it printed slightly hotter than expected at +5.3% YoY – still significantly elevated but at its lowest since Nov 2021…

Source: Bloomberg

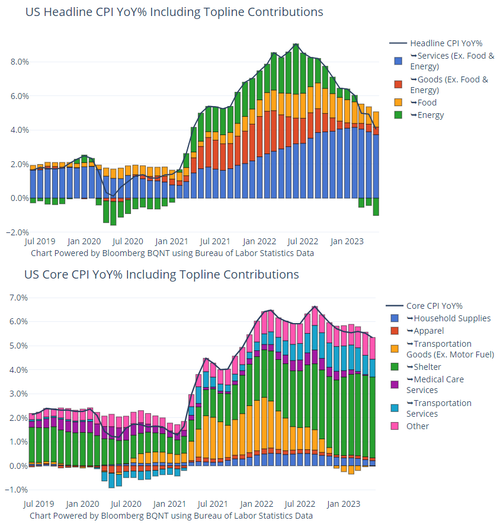

Breaking down the drivers, Energy was the biggest deflationary impulse on headline…

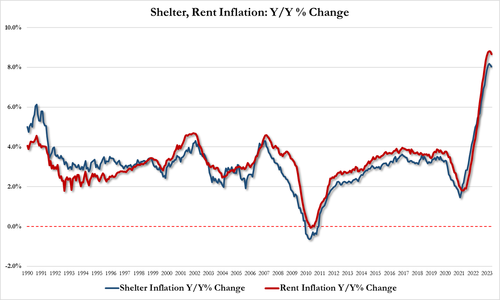

The shelter index was the largest factor in the monthly increase in the index for all items less food and energy. The shelter index increased 0.6 percent over the month after rising 0.4 percent in April. The index for rent rose 0.5 percent in May, as did the index for owners’ equivalent rent. The index for lodging away from home increased 1.8 percent in May after decreasing 3.0 percent in April.

However, Shelter/Rent are down for the second straight month on a YoY basis…

Among the other indexes that rose in May was the index for used cars and trucks, which increased 4.4 percent, and the index for motor vehicle insurance which increased 2.0 percent. The indexes for apparel, personal care, and education also increased in May.

One silver lining is that egg prices continue to come down.

They tumbled 13.8% last month compared with April, that’s the biggest drop since January 1951!

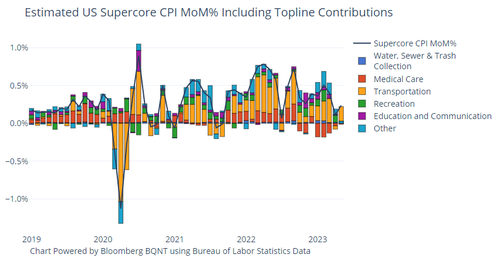

And SuperCore inflation rose 0.24% MoM, up from +0.11% MoM in April…

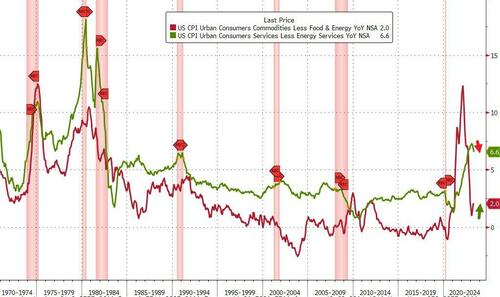

Services inflation did slow modestly but remains near 40 year highs but goods inflation reaccelerated…

Source: Bloomberg

It appears M2 signaled that the ‘stickiness’ is over and a tsunami of deflation is about to hit…

Source: Bloomberg

And inflation continues to outpace wage gains for the 26th straight month (out of 28 months of Biden’s term)…

Source: Bloomberg

Finally, here’s what to expect from markets:

-

Headline YoY prints 4.9% or higher. This tail risk scenario would like drive rate hike expectations higher and potentially leave us with an unofficial news report that the Fed will hike the next day while keeping July in play for another 25bps hike. It is possible that under this scenario we see the market price in a 50bps hike, too. SPX loses 2.5% – 3%.

-

Between 4.5% – 4.8%. This type of hawkish print will do little to dissuade markets from pricing further Fed action especially if we see Core and Core Services accelerate higher. SPX loses 1% -1.5%.

-

Between 4.2% – 4.4%. This scenario confirms the disinflationary trend but at the upper-end of the range it would do little to aid the “Fed is done” narrative. The key would be the reaction in the bond market as yields moving higher on the back of this print would provide a near-term headwind for stocks. SPX is flat to up 0.5%.

-

Between 4.0% – 4.2%. Our most likely scenario and one that will have the market inching closer to “Mission Accomplished” on breaking inflation. This should also cement the Fed being paused in June with the print more integral to the July Fed meeting. SPX adds 0.75% -1.25%.

-

3.9% or lower. Another unlikely scenario that could see the bond market remove all hiking expectations aiding stocks, but specifically the Tech trade. With another significant step down expected in July, you could see the narrative around rate cuts shift from one relating to recession/bank contagion to one of the Fed moving from less restrictive territory given the progress on inflation. SPX adds 1.5% – 2%.

So, expect the buyers to be in charge for now (but will it last into tomorrow’s FOMC?)

Tyler Durden

Tue, 06/13/2023 – 08:45

via ZeroHedge News https://ift.tt/0Job1pI Tyler Durden