Signal From Liquidity Is Becoming Loud And Clear

Authored by Simon White, Bloomberg macro strategist,

The outlook for risk assets such as stocks and commodities is materially improving as excess liquidity continues to rise.

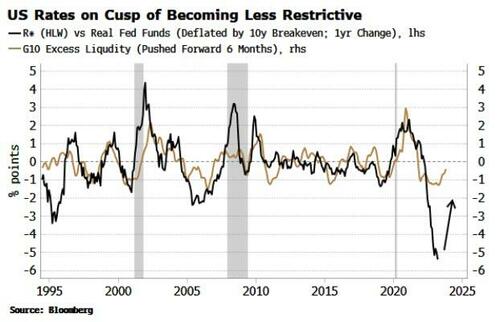

Quantitative tightening may be ongoing and rates at decade highs, but excess liquidity – the difference between real money growth and economic growth – is rising decisively off its lows. This points to an improving backdrop for equities and other risk assets in the coming months.

The most restrictive rates for decades have been a formidable headwind for markets and the economy. But the nascent rise in excess liquidity points to US rates finally beginning to become less restrictive, turning a headwind for risk assets into a tailwind over the next 3-6 months.

But why should you listen to the message from excess liquidity?

-

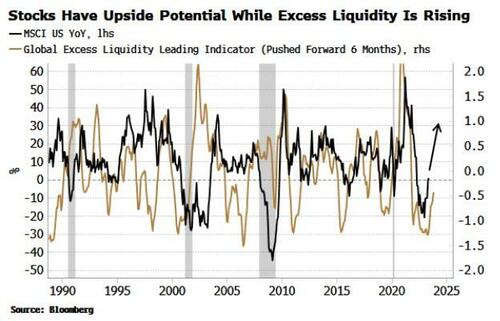

First, it has an excellent empirical record of leading the turns in risk-assets.

-

Second, the logic is simple: money is created by banks and central banks, and what is not used by the real economy is “excess”, and therefore available to support risk assets.

-

Thirdly, it is inherently contrarian. It is typically rising rapidly when inflation and growth – which are both heavily lagging – are at their nadir. Thus sentiment is at its weakest precisely when markets unexpectedly rally due to a surfeit of liquidity.

It has utility at market peaks too, when typically sentiment is very bullish but excess liquidity is already falling, leading to weaker asset prices.

Excess liquidity’s contrarianism is on show now.

Despite global rates near decade-highs, excess liquidity has been rising quietly in recent months. Growth and inflation – the latter is expected to show a further fall when the data for May is released later today – are now falling, freeing up liquidity to boost risk assets. As the chart below shows, equities have more upside potential in the coming months from rising excess liquidity.

Commodities should also benefit from an increase in excess liquidity.

This comes at a time when sentiment for commodities is poor after a decline of more than 25% since last year.

How will excess liquidity be affected by the deluge of Treasury issuance now expected? The risks were tilted toward this having a detrimental effect on liquidity conditions overall, but the Treasury’s actions since the debt ceiling are encouraging.

Firstly, so far the Treasury has favored issuing bills over longer-term types of debt. For June, to date they have announced $205 billion of bill auctions versus $92 billion of bond auctions.

Bill issuance should have less impact on excess liquidity as the buyers are more likely to be money market funds (MMFs), who can withdraw liquidity from the RRP facility. If households or corporates are the buyers it would entail a loss of bank deposits and thus reduce M1 (the money input used in my preferred version of excess liquidity).

Over the last four weeks, the rise in MMF assets is similar in size to the fall in the RRP (see chart below), inferring that it is indeed MMFs who have been buying newly issued bills. Higher yields on bills than the RRP is incentivizing MMFs to buy them (that may change, though, if and when the market prices deeper cuts, and term bill rates drop below the spot RRP rate).

The chart above also shows that the Treasury’s account at the Fed (the TGA) has not so far risen aggressively. That is another reason why the Treasury-induced liquidity drain may not be as bad as feared, as a slower build-up in the TGA means liquidity will be siphoned off more gradually.

This will be especially helpful when the Treasury auctions bonds as it is the household sector that has been the largest net buyer in recent quarters. It is also possible MMFs can support bond issuance by funding buyers through lending via SOFR.

Further, we can see in the chart above that reserves have been rising of late. QT may still nominally be in play, but the BTFP and other Fed facilities taken up in the wake of the banking turmoil have introduced a new source of reserves, providing another boost to M1 and hence excess liquidity.

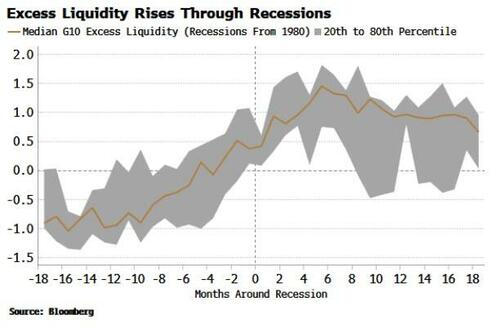

Finally, what about the specter of a recession?

That is a certainly not a zero risk for equities, but perhaps the potential damage is not as high as in previous downturns. Importantly, though, excess liquidity tends to rise through recessions, as central banks are easing (or tightening less) while growth and inflation are falling.

Tighter monetary policy, recession, and fevered speculation in some stocks are all risks currently faced by the market. But the positive signal from liquidity – the ultimate arbiter of asset prices – is getting louder.

Tyler Durden

Tue, 06/13/2023 – 10:05

via ZeroHedge News https://ift.tt/8OxTV6v Tyler Durden