CRE Troubles: US Office Space Set To Contract For First Time

The US has nearly 1 billion square feet of empty office space, according to commercial real estate services company JLL. Things could worsen in the CRE market (mainly office) in the coming quarters due to the Federal Reserve’s 16 months of aggressive interest rate hikes. This will continue to pressure property owners who have built their real estate empires on a mountain of debt, potentially triggering a wave of delinquencies and defaults due to high borrowing costs. All this is happening when the office sector is already struggling with reduced demand due to the proliferation of remote work, as well as some companies fleeing progressive metro areas because of soaring violent crime.

The latest sign the office sector has not hit bottom and values unlikely to return to pre-pandemic peaks this decade is the total amount of US office space is set to decline for the first time in history, according to Bloomberg, citing new data from JLL.

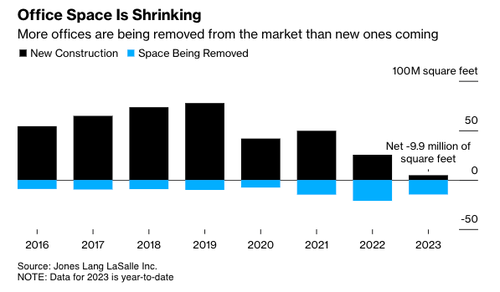

A lack of new construction and a plethora of aging office space being repurposed or destroyed will lower the amount of office space, according to Jones Lang LaSalle Inc. Less than 5 million square feet (465,000 square meters) of new offices broke ground in the US so far this year, while 14.7 million square feet has been removed, often to be converted into buildings for other uses.

That would mark the first net decline in data going back to 2000, JLL reported, adding that it’s most likely the first ever. –Bloomberg

This means demolitions and conversions of these worthless assets are underway to correct the supply imbalance.

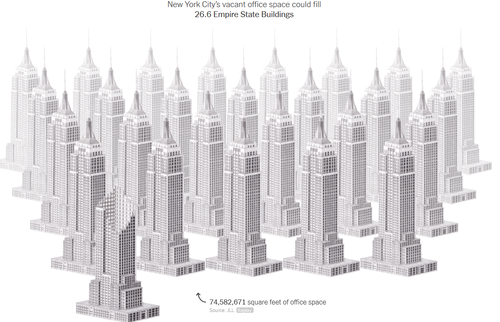

Things are so bad in New York City that 26 Empire State Buildings could fit all the empty office space in the metro area, according to the chair of Harvard Economics Department, Edward Glaeser and MIT’s Carlo Ratti.

Parts of San Francisco have been transformed into a ghost town as office vacancy rates soar.

Many downtown districts across major cities in the US are effectively ghost towns as office vacancy rates soar. This has rippled across local communities, forcing retail shops to close because of declining foot traffic.

In Baltimore City’s Inner Harbor district, things are so bad that office towers are being dumped at massive losses or reassessed at half the values.

- Beginning Of CRE Firesale? Baltimore Office Tower Dumped At 63% Discount

- CRE Panic Hits Baltimore As Second Office Tower Dumped At 69% Discount

- “I See A Wave Coming”: Assessed Value Of Baltimore City Office Tower Nearly Halved Amid CRE Panic

We first pointed out the CRE dominos would begin to fall just days after the regional bank failures in March. We wrote in a note titled “Nowhere To Hide In CMBS”: CRE Nuke Goes Off With Small Banks Accounting For 70% Of Commercial Real Estate Loans.

Across the nation, underperforming CRE office towers and buildings will be sold or reassessed at massive discounts. Many will be demolished, and some will be converted, as the ‘Great CRE Office Reset’ is underway.

Let’s remember there’s a multi-trillion-dollar CRE debt maturity wall over the next five years, according to Morgan Stanley.

Tyler Durden

Fri, 07/28/2023 – 16:40

via ZeroHedge News https://ift.tt/q06MAiG Tyler Durden