July Payrolls Miss Expectations At 187K, Follow Big Downward Revisions, But Unemployment Rate Drops And Earnings Come In Hot

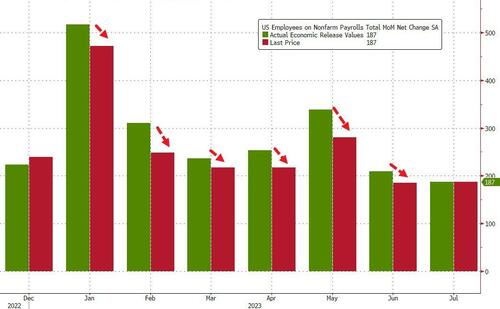

Today’s jobs report was a tale of two opposites: on one hand, the monthly payrolls change for July missed expectations of 200K (and certainly the whisper number of 222K) printing at 187K, which would have been down from 200K and the lowest since Dec 2020… if only June wasn’t revised sharply lower to 185K (more on that below).

Today’s report was the second consecutive miss in a row for a series that until June had enjoyed 14 straight beats. You add in the 49,000 downward revision in payrolls for the previous two months, and the direction of travel here is clear: The labor market is softening.

In keeping in with Biden admin’s penchant of constantly fabricating data, both May and June numbers were revised sharply lower of course:

- May revised down by 25,000, from +306,000 to +281,000

- June was revised down by 24,000, from +209,000 to +185,000.

To show just how ridiculous the data manipulation is, consider this chart – every monthly payrolls report in 2023 has been revised lower.

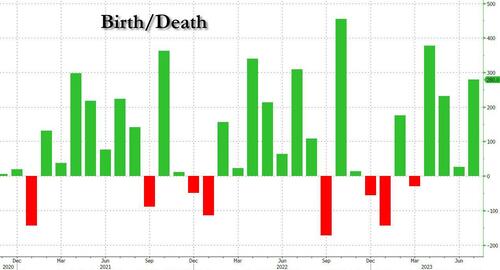

And if the rigging wasn’t enough, the Birth/Death model laughably added 280K excel spreadsheet “jobs”, the second biggest monthly increase of 2023.

Putting the month’s 187,000 gain in context, while effectively the smallest since 2020, it is still a historically strong figure for Fed purposes. Economists estimate the US needs fewer than 100,000 in net new jobs to account for increases in population. Looking at the 2018-19 period, payroll gains averaged 163,000 over those two years.

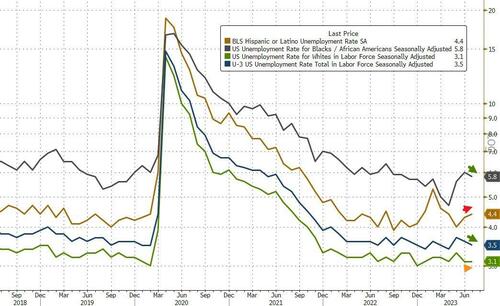

But while the headline numbers were ugly – if still allowing the White House to claim victory for a 2K rebound from the downward revised June print, where the Fed will be scratching its head is in the unemployment rate which unexpectedly dropped back to 3.5% from 3.6% (and missing exp of an unchanged print), meaning that the Fed’s expectations for an unemployment rate spike to 4% by year-end will have to be revised or Powell will have to hike even more.

The unemployment rate fell mainly because more job seekers found jobs, rather than due to people leaving the labor force.

While the jobless rate for Blacks dipped to 5.8%, that for Hispanics (4.4%) rose while whites (3.1%) were unchanged.

The labor force participation rate was 62.6% for the fifth consecutive month. The employment-population ratio, at 60.4% remained little changed in July.

There was more confusion in the wage numbers, with average hourly earnings coming in hotter than the 4.2% Y/Y expected, at 4.4% or unchanged from last month; on a monthly basis the increase was 0.4%, hotter than the 0.3% expected and matching last month’s increase.

That said, one reason why hourly earnings went up is because hours worked went down, to 34.3 hours, matching the lowest level since the spring of 2020, during the brunt of the Covid crisis. Just another sign of the job market softening.

As Bloomberg economists put it, “it is starting to look like both the all-employees and the production-and-nonsupervisory measures have been re-accelerating over the last several months.“

Here are some more details from the report:

- Among the unemployed, the number of persons on temporary layoff decreased by 175,000 to 667,000 in July.

- The number of long-term unemployed (those jobless for 27 weeks or more) was little changed at 1.2 million in July and accounted for 19.9 percent of all unemployed persons.

- The number of persons employed part time for economic reasons, at 4.0 million, changed little in July. These individuals, who would have preferred full-time employment, were working part time because their hours had been reduced or they were unable to find full-time jobs.

- The number of persons not in the labor force who currently want a job was 5.2 million in July, little changed from the prior month. These individuals were not counted as unemployed because they were not actively looking for work during the 4 weeks preceding the survey or were unavailable to take a job.

- Among those not in the labor force who wanted a job, the number of persons marginally attached to the labor force was essentially unchanged at 1.4 million in July. These individuals wanted and were available for work and had looked for a job sometime in the prior 12 months but had not looked for work in the 4 weeks preceding the survey. The number of discouraged workers, a subset of the marginally attached who believed that no jobs were available for them, changed little at 335,000 in July.

On the Household Survey side, things were a little better, with the number employed jumping by 268K to 161.262 million. This was the 2nd month in a row the Household survey showed better job gains that Establishment.

And speaking of the Establishment survey, here is the seasonally adjusted breakdown of major job categories.

- In July, health care added 63,000 jobs, or about a third of all job gains in July, compared with the average monthly gain of 51,000 in the prior 12 months. Over the month, job growth occurred in ambulatory health care services (+35,000), hospitals (+16,000), and nursing and residential care facilities (+12,000).

- Social assistance added 24,000 jobs in July, in line with the average monthly gain of 23,000 in the prior 12 months. Individual and family services added 19,000 jobs over the month.

- Employment in financial activities increased by 19,000 in July. The industry had added an average of 16,000 jobs per month in the second quarter of the year, after employment was essentially flat in the first quarter. Over the month, a job gain in real estate and rental and leasing (+12,000) was partially offset by a loss in commercial banking (-3,000).

- In July, employment in wholesale trade increased by 18,000, after showing little net change in recent months.

- Employment in the other services industry continued to trend up in July (+20,000), compared with the average monthly gain of 15,000 over the prior 12 months. Employment in personal and laundry services continued to trend up over the month (+11,000). Employment in other services remains below its pre-pandemic February 2020 level by 53,000, or 0.9 percent.

- Construction employment continued to trend up in July (+19,000), in line with the average monthly gain of 17,000 in the prior 12 months. Over the month, job growth occurred in residential specialty trade contractors (+13,000) and in nonresidential building construction (+11,000).

- In July, employment in leisure and hospitality was little changed (+17,000). The industry has shown little employment change in recent months, following average monthly gains of 67,000 in the first quarter of the year. Employment in leisure and hospitality remains below its February 2020 level by 352,000, or 2.1 percent.

- Employment in professional and business services changed little in July (-8,000). Monthly job growth in the industry had averaged 38,000 in the prior 12 months. Employment in temporary help services continued to trend down over the month (-22,000) and is down by 205,000 since its peak in March 2022. Employment in professional, scientific, and technical services continued to trend up in July (+24,000).

- Manufacturing employment dropped by 2,000. This was a standout as the sector had been expected to add 5,000 jobs. It’s a surprise given all the focus on capex in the EV, chips, battery plant and green-energy space.

Of special note, employment at full-service restaurants notched its first decline since January 2021. Overall restaurant employment eked out a small increase, however, thanks to another strong month of hiring at quick-service restaurants.

* * *

Commenting on the report, Florian Ielpo of Lombard Odier Asset Management, was downbeat noting that “the report is probably less positive than it looks at first sight. Half of the sectors reporting have now stopped hiring workers. This is the first month in ten years showing that dynamic with so much clarity. Last month 54% of sectors were hiring, in July that number has fell to 50%,” he says.

“In the end, this is not the kind of job report the Fed will be happy with: job creations have normalized, not declined. Even worse, the unemployment rate has declined not increased – markets are likely to treat that kind of details with caution and the volatility of rates is unlikely to fall back with that high a level of uncertainty.”

Others were more cheerful: former Fed Governor and University of Chicago professor Randall Kroszner said that “This is still a pretty strong report,” and adds that the hawks at the Fed will be focusing on the wage growth, and that will be the “real concern” for them.

Echoing this, Bloomberg’s Enda Curran writes that “Powell is probably pointing to the wage numbers this morning as the reason why he has been continuing his hawkish warnings. His Jackson Hole speech this month is going to be very interesting.”

Steve Sosnick, chief strategist at Interactive Brokers, agreed, noting that this report is not one that will allow the Fed to get meaningfully more dovish.

“Sure, payrolls came in a little below estimates + downward revision, but 13k or 49k (whichever way you want to read it) in a labor force of >150mm is not that meaningful. So that’s the good-ish. The bad-ish is the unemployment rate fell with the labor force participation holding steady, and MoM growth in wages was above estimate.”

Gregory Faranello, head of US rates trading and strategy for AmeriVet Securities, says the jobs report is “one data point and the Fed will continue to look at the totality of the data.” But that does not spare the bond market from its recent weakness, with a subtle shift in tone as the front end is now leading the selling pressure: “This report, unlike the downgrade narrative, is more specific to the economy and Fed policy, so a bit more sensitivity on the front end makes sense to us.”

And now, with the jobs report in the rear mirror, Treasury supply is going to be the main driver of the rates market, particularly with new sales of 10-, and 30-years next week. Long-dated Treasury yields are sharply lower in kneejerk reaction to the jobs miss, but don’t expect that status to hold: “This turns our attention back to supply,” says George Goncalves, head of US macro strategy at MUFG. “The market will try to extract as much of a yield concession as possible to push up coupon levels. The key will be post-auction price action next week versus the setup though.”

Tyler Durden

Fri, 08/04/2023 – 08:50

via ZeroHedge News https://ift.tt/gEIVQ5G Tyler Durden