“Nervous And Squeezy” – Nomura Warns Of Imminent VIXplosion

We warned Friday, ahead of the payrolls print, that the data could be the catalyst that finally shakes the VIX from its mid-summer slumber.

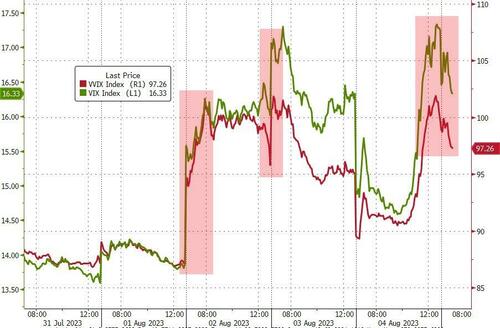

And so it should not be a huge surprised that the VIX complex is increasingly acting the way we’ve anticipated – what Nomura’s Charlie McElligott calls “nervous and squeezy”.

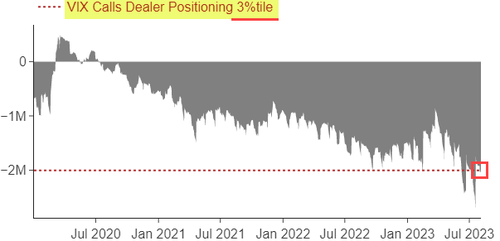

VVIX is evidencing the challenged Dealer positioning dynamic into August expiration, being extremely short VIX Calls (and as McElligott notes, Dealers pretty short PUTS too for that matter – thus the Vol of Vol expansion!)…

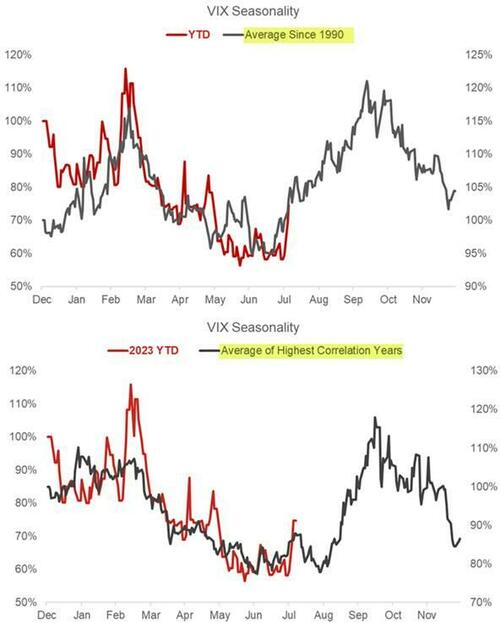

particularly into the well-socialized scar-tissue of August’s past and ugly seasonality…

…but of course with the risk that these Calls decay hard into VIXpery which could dictate a Vol selloff / Equities rally, in the potential absence of more Equities Spot selloff follow-through this week.

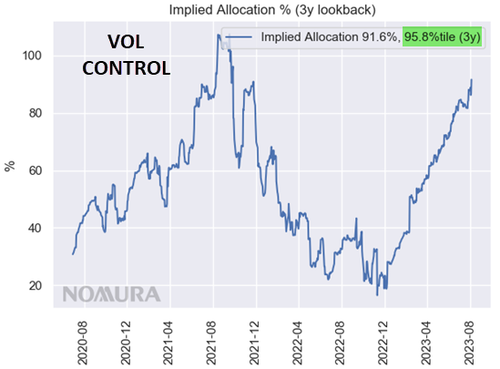

However, a VIX squeeze remains a significant potential issue because of Systematic Vol Control positioning, as highlighted here for weeks – VC now 95.8%ile Equities exposure on 3Y lookback…

As such, the Nomura MD warns that Vol Control is a lumpy seller if the daily SPX range were to widen-out…

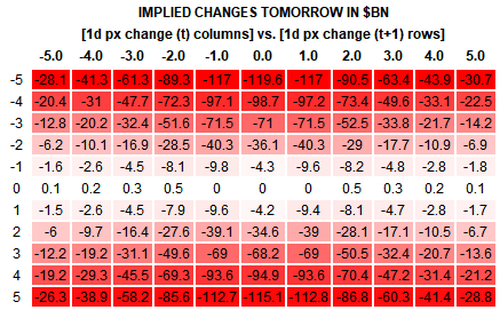

With UX1 ~17.3, this is implying a ~ 1.1% daily range in SPX; and IF we were to see a -1%/+1% move today, McElligott estimates a modest ~-$4.2B of de-allocation selling. However, a -2%/+2% move today would lead to ~$35B of Spooz selling…

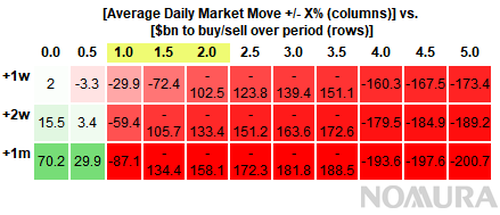

…while a whole week of -1%/+1% would be closer to ~-$30B of selling, with a lot of convexity on any wider range…

The next major data points come in on the 10th, with CPI & continuing claims. SPX upside is likely now limited to 4,550 until the 10th, as implied volatility holds a relative premium due to these data points.

Tyler Durden

Mon, 08/07/2023 – 13:45

via ZeroHedge News https://ift.tt/nlNyG31 Tyler Durden