Lagging Tech Sector A Sign Stock Rally Is Running Out Of Steam

Authored by Simon White, Bloomberg macro strategist,

The US tech sector has begun to lag suggesting the market is prone to consolidation, or some further short-term downside. Nonetheless, puts on the S&P are currently cheap.

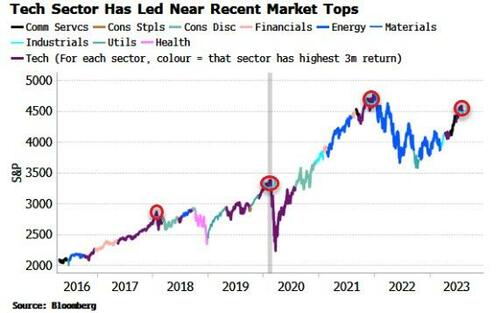

Over the last month, the tech sector has been the poorest performing sector. But on a slightly longer scale – three months – AI-fervor has pushed tech to the top of the sector-leadership table.

However, as the chart below shows, in recent years this has often coincided with the latter stages of a rally, before a correction is seen (either one that is on the small side, as in early 2018, or a larger one as in 2022).

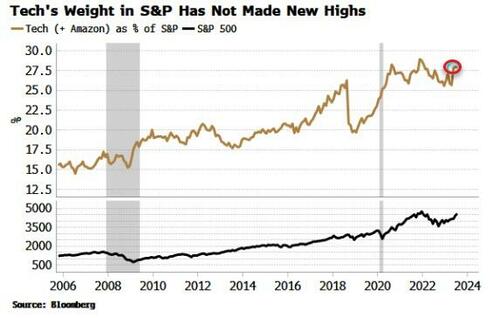

It is also notable that the weight of tech (+ Amazon) in the S&P 500 has failed to eclipse the high it made in November 2021.

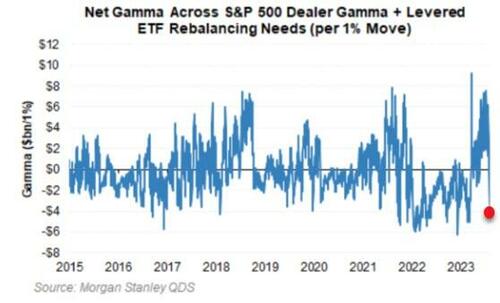

Moreover, some measures of gamma have turned negative. Both Goldman Sachs and Morgan Stanley’s (chart below from the latter) measures of gamma have just turned negative.

Gamma can be measured in different ways, but it is notable both banks’ gamma estimates are now negative. When gamma is negative bigger swings in price are more likely as the behavior of option dealers shifts from becoming volatility-repressing to volatility enhancing, as they have to chase the market to hedge their positions, rather than leaning against it.

Typically, though, there is a downwards bias when gamma is negative as it is mainly out-of-the-money puts dealers are short, and they must sell the market increasingly more as it sells off to hedge their positions.

Of note for investors is that puts on the S&P (e.g. 90% out-of-the-money) are about as cheap as they have been since before the pandemic.

Tyler Durden

Mon, 08/14/2023 – 10:00

via ZeroHedge News https://ift.tt/vRm1c7S Tyler Durden