Futures Tumble On OpEx Day As Global Markets Close Worst Weekly Rout Since March

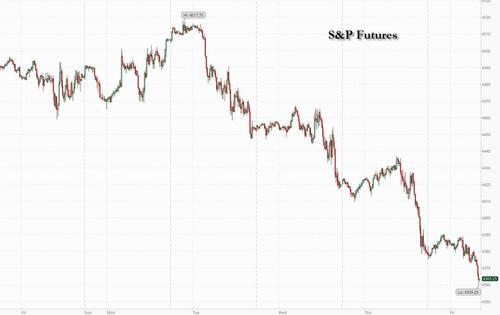

After another very weak session in the US which saw the S&P500 and Nasdaq close lower by -1.2% and -1.1% respectively, with the S&P dropping below 4,400 for the first time since June, today’s $2.2 trillion option expiration session has started on the back foot as stocks slumped putting MSCI’s global benchmark on track for the biggest weekly loss since the March bank crisis, as worries about China and higher global interest rates sapped sentiment.

Europe is red across the board and Asia was down again this morning heading for its 6th consecutive daily decline, with S&P futures trading near session lows down more than 0.5% at 7:45am ET, although there is some respite compared to yesterday’s losses as 10Y Treasury yields retreat mildly from their near 15Y highs this am (yields are modestly lower across the rest of the curve currently too); Nasdaq futures are down more than 0.7%. Treasuries are slightly higher, in line with bonds in Europe, as their declines in recent days take a pause. Iron ore prices are bouncing, oil is marginally lower, while bitcoin is nursing losses from the $2000 flash crash that came out of nowhere late on Thursday afternoon.

In premarket trading, Applied Materials rose 3.5% after the largest US maker of chipmaking machinery issued a bullish forecast for the current quarter. Bloomin’ Brands rose 6.3% after the Wall Street Journal reported that Starboard Value has built a stake of more than 5% in the restaurant chain operator. Here are some other notable premarket movers:

- Cryptocurrency-exposed stocks fall after the Wall Street Journal reported that SpaceX has sold off its Bitcoin holdings. CleanSpark -8.4%, Hut 8 Mining -8.2% (HUT US), Stronghold Digital Mining -6.9%.

- Farfetch Ltd. (FTCH) plummets 42% after the online luxury-fashion retailer cut full-year projections for gross merchandise value and adjusted Ebitda margin while reporting weaker-than-expected revenue for 2Q. Analysts flagged weakness in the US and China as well as integration issues at Reebok for the guidance cut.

- Keysight Technologies falls 11% after the manufacturer of electronics test and measurement equipment forecast fourth-quarter adjusted earnings per share that missed estimates.

- BILL Holdings Inc. falls 6.2% after the application software company gave a full-year revenue forecast that was largely below analysts’ expectations. The company also reported fourth-quarter results that beat expectations.

- Keysight Technologies drops 12% after the manufacturer of electronics test and measurement equipment forecast fourth-quarter adjusted earnings per share that missed estimates. Analysts flagged a worsening demand outlook, while Barclays cut its rating on the stock to equal-weight, citing expectations of a lack of growth catalysts before the second half of 2024.

- WeWork Inc. sinks 15% after the flexible office space firm said it will proceed with a 1-for-40 reverse stock split to regain compliance with listing requirements.

- XPeng Inc. falls 7.7% after the Chinese electric vehicle company reported gross margin for the second quarter that missed the average analyst estimate.

With some $2.2 trillion in stock and index options expiring today and about to “unclench” even bigger market moves and volatility, in another sign of nervousness, the VIX climbed to 18, the highest level since May. Bank of America’s Michael Hartnett warned that stocks may drop another 4%, given China’s economic turmoil and jump in bond yields.

Meanwhile, as stocks extended their slump bond markets finally staged a rebound on speculation losses may be overdone. The yield on 10-year Treasuries fell five basis points, pulling back from levels that were approaching the highest since 2007. UK and German bonds also advanced. Still, even with today’s retreat in yields, investors are still contending with the risks of entrenched inflation and rates that have moved sharply higher in recent weeks. China’s property crisis and troubles in the shadow banking system have also added to the anxiety in markets and raised questions about possible spillover effects.

The rise in yields “has the ability to dent what has been a very resilient year for risky assets,” said Tim Graf, head of macro strategy for EMEA at State Street Global Markets. “We are in the seasonally weakest time of the year for equities.”

In bond markets, strategists pointed to dip buying as the catalyst for modest respite after days of losses. The yield on 10-year UK gilts fell six basis points to 4.68%. The global retreat in fixed-income was turbocharged by Wednesday’s publication of minutes from the last Federal Reserve meeting that suggested officials are considering tighter policy, slamming hopes that the central bank was done raising rates. Now, investors are looking to next week’s gathering of policymakers at Jackson Hole in Wyoming to gauge Fed sentiment.

“Markets are being hit by a perfect storm amid surging rates, worsening data in China and poor summer liquidity,” Barclays’ Emmanuel Cau wrote.

Europe’s Stoxx 600 dropped 0.9% after the SX5E closed down by -1.3% with mining, retail and real estate leading declines. One of Tech sector’s bellwether stocks, Adyen, seeing €18bn wiped off its market value, post disappointing results. Here are the biggest European movers:

- European chip-tool maker ASML gains as much as 1.2% after Applied Materials, the largest US maker of chipmaking machinery, gave a bullish forecast for the current quarter, indicating that an industry slump may be fading. Other stocks to watch include BE Semi, VAT Group, Aixtron.

- Suse shares gain as much as 60% in Frankfurt after its majority holder EQT Marcel LUX III agreed to buy shares it doesn’t already own in the German software firm at a price of €16 per share, less an interim dividend payment.

- Kojamo shares rise as much as 4.9%, recovering from the stock’s lowest closing price since Jan. 2019, as Nordea says the Finnish residential property company is well positioned to benefit from its ongoing projects and rights portfolio.

- Adyen trades as much as 6.6% lower, adding to its record 39% drop on Thursday. A rout in the shares deepened as multiple analysts cut ratings or price targets based on lowered revenue growth estimates.

- U-blox shares fall as much as 16%, the steepest drop since March 2021. The Swiss semiconductor company reduced full-year sales and margin guidance, citing currency headwinds and an inventory correction at its clients.

- Shares exposed to French airports and infrastructure decline after Les Echos says France is pressing ahead with plans for higher taxes on airline tickets and operators of highways and airports. Toll-road operator Vinci, Aeroports de Paris, and LVMH all fall.

- RS Group shares drop as much as 4.4%, hitting to the lowest intraday level since November 2020, after the distributor of industrial and electronics products was downgraded to neutral from buy at UBS, which sees a bigger profit unwind for the company.

- European retail stocks lag behind all other sectors on Friday after UK retail sales fell more than expected in July, following a spell of cool and rainy weather that kept people out of shops. Inditex, H&M, Next are trading lower.

Earlier in the session, Asian stocks fell headed for their worst week in eight, as a selloff in China resumed despite further steps by policymakers to shore up the market, while worries about higher US interest rates kept traders on edge. The MSCI Asia Pacific Index dropped as much as 0.4%, set for a sixth-straight day of losses. Technology shares including Alibaba, Tencent and TSMC were among the biggest drags on the benchmark. Most regional markets were down, including Hong Kong, Japan and South Korea.

No respite appears to be in sight on the China front this morning driving the entire region’s shares lower with the HSI (-1.44%), HSCEI (-2.32%) and HSTECH (-1.46%) indices currently the worst performing. (Nikkei -76bps, CSI 300 -60bps, Shanghai -37bps, Shenzhen -1.04%, ASX +9bps, KOSPI -63bps, Nifty -46bps, Taiex -82bps, STI -66bps).

The Hang Seng Index was set for the biggest weekly drop since June amid China’s ongoing housing crisis as well as a slumping yuan, which bodes ill for corporate earnings. The People’s Bank of China escalated its intervention after the currency fell to the weakest level since October. Confidence in Chinese assets is weak after a slew of disappointing data confirmed the nation’s economic downturn, while developers’ rising default concerns and a spiraling crisis in the shadow banking industry dealt a further blow to sentiment.

Japan’s Nikkei 225 was choppy and briefly clawed back its opening losses as bargain buying kicked in and following the latest inflation data from Japan which printed in line with expectations. Australia’s ASX 200 was kept afloat but with price action rangebound amid a lack of pertinent catalysts and with gains in real estate and the commodity-related sectors counterbalanced by losses in tech, telecoms and consumer stocks.

In FX, the Bloomberg Dollar Spot Index is flat, though the greenback is poised for its fifth week of gains, the longest streak since May 2022. It fell as much as 0.2% earlier as the People’s Bank of China delivered its strongest ever push-back against a weaker yuan via its daily reference rate. The pound dropped as much as 0.3% against the US dollar after UK retail sales fell more than expected. The yen led gains among G10 currencies, rising as much as 0.5% against the dollar before paring gains

In rates, treasuries are in the green with the US 10-year yields falling 5bps to 4.23%. Treasuries richer across the curve, following wider gains for core European rates amid weakness in risk assets and curtailing this week’s global bond rout. Gains led by belly of the curve, sharply tightening 2s5s30s spread. There are few scheduled events Friday. Late Thursday it was announced that Fed Chair Powell will speak at the Jackson Hole economic policy symposium on Aug. 25 at 10:05am New York time. US yields richer by up to 6bp across belly of the curve, tightening 2s5s30s spread by 5bp on the day; 10-year yields around 4.22%, with bunds and gilts outperforming by 4.5bp and 2bp in the sector.

Crude futures decline, with WTI falling 0.4%. Spot gold adds 0.1%. Bitcoin traded around $26,000. Elon Musk’s SpaceX sold the cryptocurrency after writing down $373 million, according The Wall Street Journal reported.

To the day ahead now, and it’s a quiet one on the calendar. Data releases include UK retail sales for July, and the final Euro Area CPI reading for July. Meanwhile in the political sphere, US President Biden will be hosting Japanese PM Fumio Kishida and South Korea President Yoon Suk Yeo.

Market Snapshot

- S&P 500 futures little changed at 4,381.00

- MXAP down 0.7% to 157.71

- MXAPJ down 0.9% to 496.71

- Nikkei down 0.6% to 31,450.76

- Topix down 0.7% to 2,237.29

- Hang Seng Index down 2.1% to 17,950.85

- Shanghai Composite down 1.0% to 3,131.95

- Sensex down 0.2% to 65,045.49

- Australia S&P/ASX 200 little changed at 7,148.06

- Kospi down 0.6% to 2,504.50

- STOXX Europe 600 down 0.8% to 447.58

- German 10Y yield little changed at 2.63%

- Euro little changed at $1.0876

- Brent Futures up 0.2% to $84.29/bbl

- Brent Futures up 0.2% to $84.29/bbl

- Gold spot up 0.2% to $1,892.77

- U.S. Dollar Index down 0.17% to 103.40

Top Overnight News from Bloomberg

- China delivered its strongest ever pushback against a weaker yuan via its daily reference rate for the managed currency, as it sought to restore confidence to a market spooked by disappointing data and heightened credit risks.

- Japan’s core consumer inflation slowed in July in line with the central bank’s view that upward pressure on prices is easing, but pockets of sticky price growth will keep monetary authorities on alert to upside risks.

- UK retail sales fell more than expected in July after a spell of cool and rainy weather kept people out of shops at a moment consumers are becoming more cautious with spending.

- China’s state-owned property developers are warning of widespread losses, fueling concerns that the housing crisis is expanding from the private sector to companies with government backing.

- New Zealand’s central bank sees a risk that a strong housing recovery could keep inflation elevated for longer, underscoring policymakers’ decision this week to signal they’re in no rush to lower borrowing costs.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded mostly lower after the early reprieve from the recent global rout petered out. ASX 200 was kept afloat but with price action rangebound amid a lack of pertinent catalysts and with gains in real estate and the commodity-related sectors counterbalanced by losses in tech, telecoms and consumer stocks. Nikkei 225 was choppy and briefly clawed back its opening losses as bargain buying kicked in and following the latest inflation data from Japan which printed in line with expectations. Hang Seng and Shanghai Comp were subdued with pressure seen in tech names and as property concerns lingered after state-owned developers warned of widespread losses, while Evergrande Real Estate Group filed for Chapter 15 bankruptcy in New York to protect US assets as it works on a restructuring of debts. Participants also await the results of today’s Hang Seng index review, while the losses in the mainland were stemmed after the PBoC’s liquidity efforts resulted in the largest weekly net injection since March.

Top Asian News

- China Evergrande (3333 HK) filed for Chapter 15 bankruptcy in New York to protect US assets as it works on a restructuring of debts, according to Bloomberg and Reuters.

- China Evergrande (3333 HK) wishes to clarify pushing forward its offshore debt restructuring as planned; application is a normal procedure for offshore debt restructuring and does not involve bankruptcy petition, according to Reuters.

- Chinese securities regulator says it will steadily defuse bond default risks at large property developers; Will step up communications between government bodies to study measures to boost the market, according to Reuters. China’s Shanghai, Shenzhen and Beijing stock exchanges on Friday announced that they will further lower the transaction fees by up to 50% starting from August 28, as a part of broader efforts to revitalize the Chinese stock market, according to Global Times.

- China has reportedly urged buybacks at STAR bourse companies as the market tumbles, according to Bloomberg.

A more detailed look at global markets courtesy of Newsquawk

European bourses are once again on the backfoot as the downtrend in the equity space continues. Selling pressure in stocks picked up after the open without much in the way of fresh drivers behind the move and as such, appears to be a case of “more of the same” with regards to price action. Sectors in Europe are lower across the board with underperformance in UK retail names following disappointing UK retail sales data. Elsewhere, other lagging sectors include Basic Resources and Consumer Products and Services. Stateside, equity futures are trading on the back foot as sentiment continues to slump, extending the downward price action seen yesterday. Some analysts note that the recent uptick in yields has made equities too expensive and this may have been weighing on the market.

Top European News

- ECB is to write a letter to Italy to object the Italian government’s windfall tax on their profits, according to Corriere.

FX

- DXY is resilient after absorbing more pressure from China via various forms of intervention to prop up the Yuan, including the most heavily skewed PBoC midpoint fix for the CNY on record (1000+ pips above expectations in onshore terms), and the index withstood the Yen’s ongoing recovery amidst markedly softer US Treasury yields and ongoing risk aversion.

- GBP reversed to the brink of 1.2700 again and was derailed by dire UK retail sales data, irrespective of the ONS blaming the weather or the fact that the weak consumption figures are highly unlikely to deter the BoE from a 25bps hike in September.

- PBoC sets USD/CNY mid-point at 7.2006 vs exp. 7.3065 (prev. 7.2076)

Fixed Income

- Bunds are leading the latest recovery rally in core debt, irrespective of the fact that Gilts may have more fundamental rationale given the magnitude of weakness in UK retail sales against consensus and outright terms.

- T-note is hovering near the top of its 109-28+/14 overnight range and the curve is flatter with the 10-year yield back below the psychological 4.25% level.

Commodities

- WTI and Brent front-month are choppy within tight ranges and moving between mild gains and mild losses. The crude complex is awaiting the next catalyst which in recent days has been the broader risk sentiment.

- Spot gold is trading flat as the Dollar inches higher in European trade despite a lack of catalysts this morning, with the yellow metal around the USD 1,890/oz mark after printing a range of USD 1,885.9-1,903.43/oz yesterday.

- Base metals are mixed but contained to tight ranges, with 3M LME copper finding resistance at USD 8,300/t before pulling back to the low-USD 8,200/t marks.

- Iran set September Iranian light crude price to Asia at Oman/Dubai + USD 3.45/bbl, according to a Reuters source.

- Australian union said protected industrial action ballots opened at Chevron’s Wheatstone downstream and Gorgon facilities in Australia and the protected industrial action ballot will open on Monday at the Wheatstone platform.

- Australian LNG update: Based on industrial rules, the ballot for workers a Chevron’s (CVX) Gorgon and the Wheatstone downstream facility must close by Aug. 24. A separate ballot for the Wheatstone offshore platform workers must close by Aug. 28, according to Reuters.

- Italian Energy Minister said Italy’s gas storage facility is 90% and they look forward to the winter with more confidence than 2022, via Il Messaggero.

- Russian media suggests a fire broke out at a freight station in Novorossiysk and emergency services arrive at the site, according to Al Jazeera

- NHC said Hurricane Hilary has reached Category 4 intensity, according to Reuters.

Geopolitics

- Russia’s military said Ukraine attacked Russian warships near Crimea with an unmanned boat, while Russian warships destroyed the boat and repelled the attack, according to TASS and Reuters.

- Russian air defences shot down a Ukrainian drone in Moscow, while reports also noted that a building was damaged by the Ukrainian drone attack, according to Reuters.

- US approved sending F-16s to Ukraine from Denmark and Netherlands as soon as pilot training is completed.

- Russian Defence Ministry said Russian and Chinese navy ships are jointly patrolling the Pacific Ocean and held an exercise in the East China Sea.

- Japan Defence Ministry said China and Russia’s joint bomber flights, naval passage around Japan is serious concern for Japan’s security, according to Reuters.

- Japan, US and Australia are to carry out joint Naval drills in the South China sea on August 23rd, according to Kyodo News.

- Indian Trade Secretary said India plans to hold bilateral trade talks with the UK, EU and Canada on G20 sidelines, according to Reuters.

US Event Calendar

- 06:00: Bloomberg Aug. United States Economic Survey

DB’s Henry Allen concludes the overnight wrap

The relentless bond selloff continues to be the biggest story in markets right now, and yesterday saw yields hit multi-year highs across several countries. Lots of new milestones were reached, but the biggest was that the 10yr US Treasury yield rose another +2.4bps to 4.274%, which is its highest closing level since 2007. This morning yields have come down a bit once again, but yesterday’s moves meant the 10yr yield surpassed the 2008 closing peak of 4.267%, even with the rally towards the end of the session. There wasn’t a specific new catalyst driving this, yet the move remained global in scope, which reflects ongoing concerns about inflationary pressures, the prospect of more rate hikes still ahead, and even a focus on persistent budget deficits. This proved to be more bad news for equities too, and the S&P 500 (-0.77%) lost ground for a third day running as investors grappled with the prospect of rates remaining higher for longer again, along with ongoing concerns about China’s economy. It’s also the third day in a row that both bonds and equities have sold off together.

When it comes to the US, the data releases over the last 24 hours continued to paint a picture of economic resilience that contributed to that upward pressure on yields. For instance, the weekly jobless claims fell to 239k over the week ending August 12 (vs. 240k expected), and the Philadelphia Fed’s manufacturing business outlook survey for August surged up to 12.0 (vs. -10.4 expected), marking its highest level since April 2022. Some of the forward-looking indicators also pointed to strong price pressures ahead, with the future prices paid indicator for six months’ time up to a 14-month high of 53.0, whilst the future prices received indicator hit a 13-month high of 40.6.

With nothing putting the brakes on the current moves, yields on US Treasuries continued to climb higher. In fact, not only did the 10yr yield hit a post-2007 high, but the 30yr yield (+3.5bps) also broke through its closing peak from last October yesterday to hit a post-2011 high of 4.39%. Longer-dated real yields saw a pronounced move higher at the same time, and the 10yr real yield (+1.1bps) moved higher for a 7th consecutive session to hit another post-2009 high of 1.94%. The 30yr real yield (+2.1bps) also hit a post-2011 high of 2.06%. So a lot of new records across the board. These came despite a sizeable rally in the US afternoon, which saw yields 4-5bps lower across the curve. Indeed, the US 10yr yield had traded as high as 4.326% at its intraday high after the European close.

Over in Europe, gilts led the selloff once again, building on their existing underperformance so far this year. That saw the 10yr gilt yield (+10.0bps) hit a post-2008 high of 4.74%, and the 10yr real gilt yield (+8.0bps) hit its highest level since last year’s mini-budget turmoil, at 0.94%. Furthermore, the spread of 10yr gilt yields over 10yr bunds widened to 204bps, which is similarly the biggest since the mini-budget turmoil last year.

In the rest of Europe, yields on 10yr bunds (+6.0bps) moved up to 2.70%, marking their highest level since SVB’s collapse back in March, whilst those on 10yr OATs (+5.9bps) and BTPs (+6.3bps) also moved higher. That came amidst growing confidence that the ECB would deliver another rate hike by the end of the year. In fact, overnight index swaps this morning are now pricing in an 88% chance of another hike by the December meeting, up from 58% on 2 August. In the meantime, we did get a rate hike from the Norges Bank yesterday, who delivered a 25bp hike in their policy rate as expected.

With all those new records for sovereign bonds, equities had another rough session on both sides of the Atlantic. In the US, the S&P 500 was roughly unchanged for a good chunk of the day but sold off in the afternoon to close -0.77% lower. The megacap tech stocks struggled, with the FANG+ index down -1.56% to its lowest level in 2 months. It has now retreated by more than 10% from its all-time high on 18 July. There was a similar story for the Russell 2000 (-1.15%), which lost ground for a 4th consecutive session. Energy stocks were the only sector to post a gain (+1.22%) as WTI crude oil rebounded by +1.27% to $80.39/bl. Bank stocks also showed some stabilisation, with the KBW Bank Index near flat (-0.05%) after falling by -6.2% over the first three days of the week. In Europe, equities saw similar declines, which left the STOXX 600 (-0.90%) at a fresh 5-week low.

That downbeat tone has continued in Asia overnight, with all the major indices losing ground. The Hang Seng (-1.29%) has seen some of the biggest declines, and as it stands right now, the index is more than -20% beneath its recent peak in late January. Elsewhere in the region, we’ve seen losses for the KOSPI (-0.61%), the Nikkei (-0.55%), the CSI 300 (-0.32%) and the Shanghai Comp (-0.06%). In China, there was also some fresh support for the yuan, since the People’s Bank of China set their fixing at 7.2006 per dollar, which compared to the Bloomberg survey estimate of 7.3047, and was in fact the biggest gap relative to estimates since the poll began in 2018. Looking forward, futures are pointing to another negative start in Europe, with those on the STOXX 50 (-0.24%) and the DAX (-0.33%) edging lower. Meanwhile in the US, S&P 500 futures are unchanged right now.

The main data of note has been Japan’s CPI inflation overnight. However, the reading came in exactly in line with expectations, with headline CPI remaining at 3.3%. Another big milestone was that the services CPI hit 2.0% for the first time since 1998.

To the day ahead now, and it’s a quiet one on the calendar. Data releases include UK retail sales for July, and the final Euro Area CPI reading for July. Meanwhile in the political sphere, US President Biden will be hosting Japanese PM Fumio Kishida and South Korea President Yoon Suk Yeo.

Tyler Durden

Fri, 08/18/2023 – 08:16

via ZeroHedge News https://ift.tt/KSQcXEJ Tyler Durden