A Recession Is Coming, Or Is It?

Authored by Lance Roberts via RealInvestmentAdvice.com,

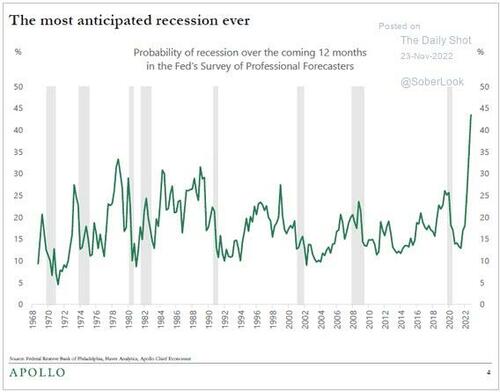

Since the beginning of 2022, the media has regularly warned a recession is coming. As we suggested previously, if a recession DID occur, it would be the most well-forecasted recession ever on record.

“While the ‘probabilities’ of a recession in 2023 seem far more significant, what bothers us with the recession/hard landing view is that everyone thinks the same. As Bob Farrell once said, ‘When all experts agree, something else tends to happen.’”

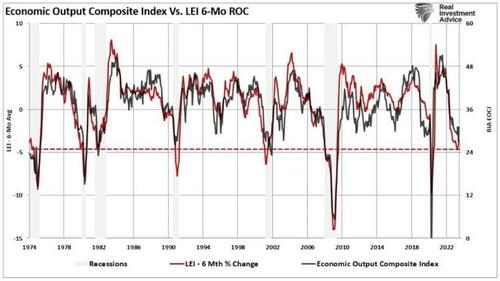

Something else has indeed happened. As discussed in “Signs, Signs, Everywhere Signs,” numerous measures suggest a recession is forthcoming. However, that recession has yet to reveal itself. Such has led to a fierce debate between the bulls and the bears. The bears contend that a recession is still coming, while the bulls are betting more heavily on a “no landing” scenario or, instead, avoiding a recession. Even the Federal Reserve is no longer expecting a recession.

But how is a “no recession” outcome possible amid the most aggressive rate hiking campaign in history, deeply inverted yield curves, and other measures warning of its inevitability?

We find the answer in the “money trail.”

Follow The Money

Let’s review the actions to date to keep some consistency in the analysis.

As the economy shut down in March 2020 due to the pandemic, the Federal Reserve flooded the system with liquidity. Simultaneously, Congress passed a massive fiscal stimulus bill. That bill extended Unemployment Benefits by $600 weekly and sent $1200 checks directly to households.

Then in December, Congress passed another $900 billion stimulus bill. That bill again extended unemployment benefits at a reduced amount of $300 per week, plus sending $600 checks to individuals again.

Not to be outdone, after Biden took office, the Administration passed the solely Democrat-supported $1.9 trillion “spend-fest.”

In that bill, $900 billion went to individuals through $400 extended unemployment benefits and $1400 checks directly to households. The remaining $1.1 trillion had little economic value as bailing out municipalities and funding pet projects didn’t boost consumption.

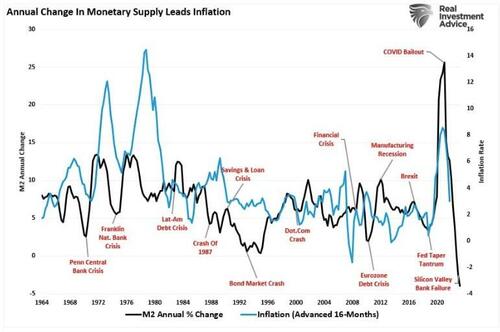

Unsurprisingly, the result of stopping supply by shuttering the economy and flooding households with money was, you guessed it, inflation.

M2 As A Percentage Of GDP

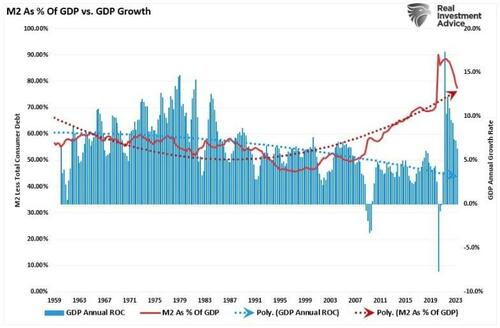

However, this surge in money supply also explains why a recession remains so elusive. While the annual rate of change in the money supply has plunged, which is why inflation is contracting, the money injected into the economy is still in circulation. We know this by examining the money supply as a percentage of the economy.

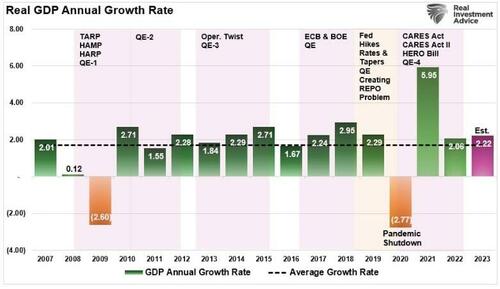

Yes, M2 as a percentage of GDP spiked during the pandemic-driven spending frenzy, but notice that M2 has risen steadily since the “Financial Crisis.” As shown below, such explains why the economy held up over the last 13 years to various economic events that should have likely resulted in a recession. (Based on the growth rates for the year’s first half, I have estimated GDP growth for 2023.)

Avoiding a recession is easier to understand when put into the context of the surge in money supply derived from continued fiscal and monetary inputs.

However, as discussed in “Why $32 Trillion Matters,” the cost is subpar economic growth and lower standards of prosperity.

But that, as they say, is “history.” With all of those Covid-era programs ending, the Fed hiking interest rates, and reducing their balance sheet, how is the economy still avoiding the “inevitable recession?”

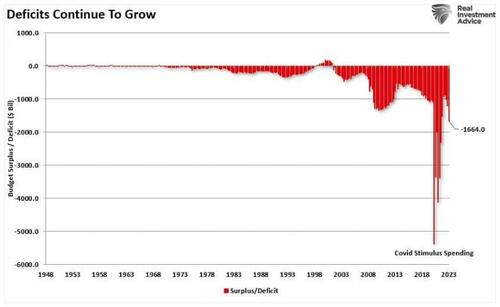

The Invisible Hand

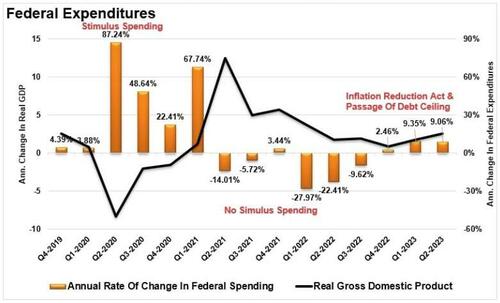

While many economists and analysts expect a recession due to the many historically accurate indicators, one thing continues to get overlooked. That is the $1.7 Trillion “Inflation Reduction Act” passed by the Biden Administration in 2022. While the bill did pass, it has nothing to do with reducing either inflation or the deficit. While the deficit did decline along with inflation, such was a function of the massive stimulus not being renewed and the normalizing of supply and demand. Secondly was the passage of the most recent “debt ceiling” bill, which automatically increases spending by 8% each year due to baseline budgeting in Washington. Such is why the deficit continues to swell each year.

Unsurprisingly, considering there is no fiscal responsibility in Washington, D.C., Federal spending continues to rise markedly. That spending continues to keep the economy from the widely expected recession.

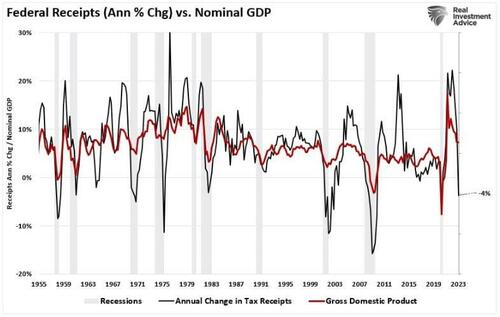

However, such may not always be the case. As noted above, the massive flood of monetary stimulus is still working through the system. When combined with increases in the deficit, the economy has managed to maintain some growth. However, as discussed in a recent post, “Tax Receipts Are Falling,” which has long been a leading recessionary indication.

“Notice that while Federal expenditures are rising, Federal tax receipts are falling. Such is why the national deficit is increasing, which, as noted above, is simply the difference between income and expenditures that must be financed through debt.

We are watching the change in Federal receipts as the Government’s income is derived from the taxes on both corporate and individual incomes. Logic dictates that if incomes are falling, then less taxes are getting paid. Unsurprisingly, if revenues and incomes decline, such would reflect economic activity. As shown below, there is a very high correlation between the annual change in Federal receipts and economic growth. Historically, when the annual change in Federal receipts falls below 2% annual growth, such has historically preceded economic recessions. Federal receipts’ annual rate of change is currently a negative four percent (-4%).“

The recessionary onset remains delayed as the Federal government continues its spending orgy. However, if or when some fiscal sanity returns to Washington, the spending contraction will likely trigger the recession’s onset.

However, until then, the “no recession” view may continue to support the bullish case.

Tyler Durden

Fri, 08/18/2023 – 12:25

via ZeroHedge News https://ift.tt/dj1AurW Tyler Durden