Stock Market Needn’t Be Fearful Of Negative Payrolls

Authored by Simon White, Bloomberg macro strategist,

The monthly payrolls report is unlikely to be negative for a few months yet, but when it does, stocks typically perform better overall than when prints are positive.

Leading data continue to project the downwards trend in annual payrolls growth persisting.

For instance, the sharp drop in banks’ willingness to extend consumer credit is a building headwind in the coming months.

If payrolls growth continues to decay at the rate it has over the last six months, we would get the first negative monthly change in December. However, it could come quicker if the decay rate increases (as the chart above suggests could happen).

Moreover, temporary help is already contracting on an annual basis and average weekly hours worked continues to fall, suggesting employers are running out of options before they have to start laying workers off. This sort of dynamic means job losses can rise quickly as pressures have been building under the surface.

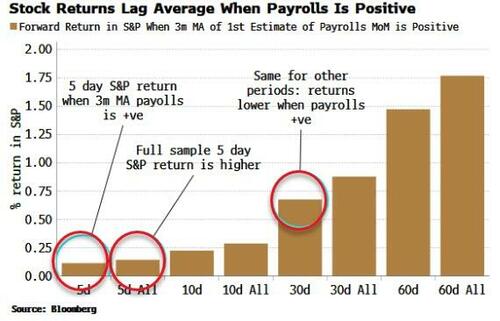

Nonetheless, negative payrolls have historically not been bad for equities. Consider the times when the 3-month moving average of the first estimate of the monthly change in payrolls is negative, and look at forward S&P returns. We find that on different horizons (5, 10, 30 and 60 day), the S&P outperforms its mean full-sample return over each period.

It’s thus the opposite case when payrolls is positive. Over each horizon, the forward return in the S&P is less than its full-sample return.

It’s not necessarily the first negative payrolls print that does the most damage to equities (unless it was wildly unexpected), but the big unanticipated drops lower. Jobs data is heavily lagging, and by the time monthly payrolls is firmly in negative territory (i.e. the 3-month MA is negative), stocks have historically moved on, and are beginning to anticipate the upswing.

As mentioned above, today’s print is highly unlikely to be negative. But we should be alert to a downwards miss (August does have some form in that department). And if it was big enough, knee-jerk selling could overwhelm any “good news is bad news” dynamic in the shorter term.

Tyler Durden

Fri, 09/01/2023 – 08:25

via ZeroHedge News https://ift.tt/X1zOqsV Tyler Durden