Unemployment Rate Unexpectedly Surges As BLS Revises Payrolls For Every Month In 2023 Sharply Lower

Ahead of today’s payrolls report consensus was already ugly enough, with some of the largest banks expecting a number well below expectations (JPM was at 125K, Citi at 130K, Goldman at 149K vs median consensus of 170K). And while moments ago we got a number which was at least nominally stronger than expected, the report in general was weak enough to suggest that – as we expected – the wheels are finally coming off the US labor market (as this week’s JOLTS report strongly hinted).

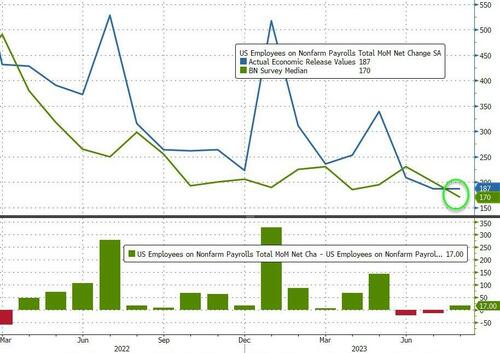

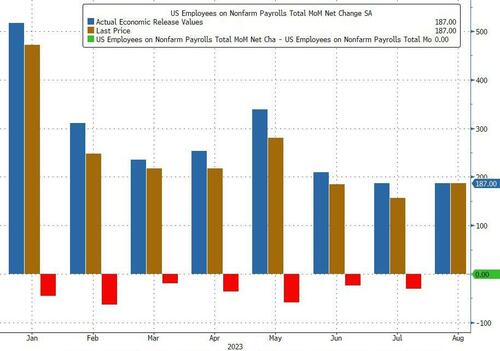

With that preamble out of the way, moments ago Biden’s BLS (Bureal Of Lies and Statistics) reported that in August, the US added 187K jobs, and beating the consensus estimate of 170K…

Superficially this would have meant an unchanged print from last month when the BLS also reported 187K jobs, however in keeping with recent trends that number was revised – drumroll – lower again, to 157K, meaning that every single monthly payrolls print in 20-23 has been revised lower (see chart below), a 12-sigma probability and virtually impossible unless there was political pressure to massage the data higher initially and then revise it lower when nobody is looking.

But wait there’s more: while July was revised down by 30K from +187,000 to +157,000, June was revised even more, by 80,000, from +185,000 to +105,000, which means that a number that was originally reported as 209K has been reivsed 50% lower, to 105K and a collapse vs original expectations of 230K. Here, the BLS was proud to report that “with these revisions, employment in June and July combined is 110,000 lower than previously reported.”

In other words, we now wait for the August payrolls number to be revised sharply lower as well because that’s how Biden’s handlers roll.

Turning to the unemployment rate, things here get really ugly: instead of the 3.5% expected print, in August the unemployment rate jumped to 3.8%, up sharply from 3.5% in July, and the result of 514K newly unemployed workers as the total civilian labor force increased by 736K individuals, as there were 597,000 new entrants in the labor market, people looking for work for the first time, and the highest level since October 2019. This confirms what we have been seeing: the savings are tapped out and credit cards are maxed out.

The jump in the unemployment rate means that the economy was only able to absorb a net 77K of them in August. At the same time, this surge in new workers also suppressed wage growth (as noted below).

Among the major worker groups, the unemployment rates for adult men (3.7 percent), Whites (3.4 percent), and Asians (3.1 percent) rose in August. The jobless rates for adult women (3.2 percent), teenagers (12.2 percent), Blacks (5.3 percent), and Hispanics (4.9 percent) showed little change over the month. The silver lining was that the participation rate actually rose from 62.6% to 62.8%, and is gradually catching up to where it was before the pandemic.

Next, turning to wage growth, August payrolls rose 0.2% MoM, down from 0.4% last month and missing expectations of 0.3%. On an annual basis, the 4.3% print came in as expected, and down modestly from 4.4% last month.

Some more details: In August, average hourly earnings for all employees on private nonfarm payrolls rose by 8 cents, or 0.2 percent, to $33.82. Over the past 12 months, average hourly earnings have increased by 4.3 percent. In August, average hourly earnings of private-sector production and nonsupervisory employees rose by 6 cents, or 0.2 percent, to $29.00.

The average workweek for all employees on private nonfarm payrolls edged up by 0.1 hour to 34.4 hours in August. In manufacturing, the average workweek was 40.1 hours for the fifth month in a row, and overtime edged down by 0.1 hour to 3.0 hours. The average workweek for production and nonsupervisory employees on private nonfarm payrolls edged up by 0.1 hour to 33.8 hours.

Of note, as the WSJ fed whisperer Nick Timiraos reminds us, “July had two more weekend days than June, which tends to bias upwards the monthly wage print. August went the other way (two fewer weekend days than July). It doesn’t affect the YoY number, but it likely overstates July m/m wage gains and August wage softness.” In other words, wage growth was even lower.

Looking at the goalseeked data in more detail we find the following sector breakdown:

- In August, health care added 71,000 jobs, following a gain of similar magnitude in the prior month. Over the month, job growth continued in ambulatory health care services (+40,000), nursing and residential care facilities (+17,000), and hospitals (+15,000).

- Employment in leisure and hospitality continued to trend up in August (+40,000). The industry had gained an average of 61,000 jobs per month over the prior 12 months.

- Employment in social assistance increased by 26,000 in August, in line with the prior 12-month average gain (+22,000). Over the month, job growth continued in individual and family services (+21,000).

- Construction employment continued to trend up in August (+22,000), in line with the average monthly gain over the prior 12 months (+17,000). Within the industry, employment continued to trend up over the month in specialty trade contractors (+11,000) and in heavy and civil engineering construction (+7,000).

- Transportation and warehousing lost 34,000 jobs in August. Employment in truck transportation fell sharply (-37,000), largely reflecting a business closure. Couriers and messengers lost 9,000 jobs, while air transportation added 3,000 jobs.

- Employment in professional and business services changed little in August (+19,000) and has shown essentially no net change since May. Professional, scientific, and technical services employment continued to trend up over the month (+21,000).

- Information employment changed little in August (-15,000). Within the industry, employment in motion picture and sound recording industries decreased by 17,000, reflecting strike activity. Job losses continued in telecommunications (-4,000).

- Employment showed little change over the month in other major industries, including mining, quarrying, and oil and gas extraction; manufacturing; wholesale trade; retail trade; financial activities; other services; and government.

Of note here, the Hollywood strikes removed 17,000 from August payrolls. Within the information category, employment in motion picture and sound recording industries was down. The BLS also highlighted that the “employment in truck transportation fell sharply (-37,000), largely reflecting a business closure” referring to the Yellow bankruptcy, the first of many.

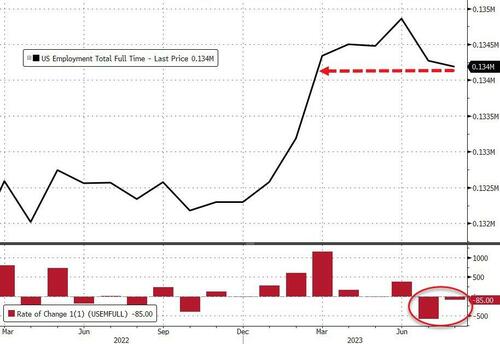

The data is even uglier if one looks at the composition because in August, the number of full-time workers tumbled by 85K. Add that to the 585K full time jobs lost in July and you get a whopping 670K full-time jobs lost. This however has been “offset” by 1 million part-time jobs gains. And that’s all you need to know about “Brandonomics” folks.

Bottom line: as we said in our preview, that wheels are indeed coming off the labor market, but the BLS is doing its best to make the hit as comfortable as possible. Meanwhile, as Bloomberg’s Enda Curran writes, on a net basis, “these figures probably don’t change the Fed debate. They broadly show a labor market that’s cooling at a very controlled space, in line with slowing inflation. That’s a good outcome, but it’s unlikely the Fed will declare mission accomplished.”

Below we share some more hot takes on today’s print:

li Jaffery, an economist at CIBC Capital Markets, has this take:

“Overall, today’s report underscores that rebalancing in the labor is picking up pace and softening in labor demand could translate into even weaker income and spending ahead.”

Rubeela Farooqi, chief US economist at High Frequency Economics:

“We think these data support the case for no rate hike at the September FOMC meeting. As for the rate path past September, our base case remains that the Fed is at the end of the rate-hiking cycle. However, with the economy reaccelerating, posing a potential upside risk to inflation, another increase in rates later this year cannot be taken off the table.”

Richard Flynn, managing director at Charles Schwab UK:

“While Jerome Powell recently reassured the market that progress is being made against inflation, he did so with the caveat that if the labor market remains strong, more work still might be needed. Today’s report may signal to the Fed that inflation could remain elevated, prompting them to continue rate hikes in months to come.”

Peter Tchir of Academy Securities

“I think today’s number is perfect for that and think we could squeeze nicely into a new month!… If anything, the data is almost weak enough to spur recession fears, but I don’t think there is enough in here for that, and the reality is the Fed must be jumping up and down with joy about the unemployment rate — not just that it moved higher, but that it moved higher for all the right reasons!”

Derek Tang, economist with LH Meyer/Monetary Policy Analytics.

“Under the surface of the strong headline payroll print there is some support for the doves’ preference for no more hiking. After all, we are seeing negative revisions to previous months, slightly lighter wage growth, and still-rising participation. A September hike hasn’t been the base case, and this only rules it out more. The real issue is how to square it with the super-strong growth numbers we’re seeing. That will keep the FOMC hesitant to declare an end to rate hikes. The window for another hike begins in November.”

Ali Jaffery, economist at CIBC Capital Markets:

“Overall, today’s report underscores that rebalancing in the labor is picking up pace and softening in labor demand could translate into even weaker income and spending ahead.”

Ian Lyngen at BMO Capital Markets says:

“Monetary policy implications are relatively straight forward — it just got a lot harder to justify a hike in the fourth quarter.”

d

Tyler Durden

Fri, 09/01/2023 – 08:59

via ZeroHedge News https://ift.tt/wIAOe95 Tyler Durden