61% Of US Workers Live Paycheck-to-Paycheck, 21% Struggle With Bills

Authored by Mike Shedlock via MIshTalk.com,

More consumers of all income brackets reported living paycheck to paycheck in July 2023 than last year. Spending shows why…

Real Personal Consumption Expenditures (PCE) and Disposable Personal Income (DPI) from the BEA, chart by Mish. Disposable means after taxes.

Personal Current Transfer payments (PCTR) primarily includes Social Security, Medicare, Medicaid, and Food Stamps.

New Reality Check: Paycheck-To-Paycheck

Please consider the LendingClub New Reality Check: Paycheck-To-Paycheck report for July 2023.

Key Points

-

In July 2023, 61% of U.S. consumers lived paycheck to paycheck, unchanged from June 2023, but 2 percentage points higher than July 2022.

-

The number struggling to meet bill payments remains at 21% since June 2023, which represents an increase of 2 percentage points from a year ago but is consistent with the 2021 and 2020 data.

-

More consumers of all income brackets reported living paycheck to paycheck in July 2023 than last year. The data indicates the persistent financial challenges and inflationary pressures a significant portion of the U.S. population faces.

-

16 million U.S. consumers claim that nonessential spending is the primary reason they are trapped in the paycheck-to-paycheck cycle.

-

Twenty-one percent of paycheck-to-paycheck consumers cite nonessential spending as one reason — but not the top reason — for their financial lifestyle.

Nonessential Spending

A notable 29% of Gen Z consumers living paycheck to paycheck cite nonessential spending as one of the factors contributing to their financial distress, with 15% citing it as the top factor, marking them the most affected demographic. In contrast, only 12% of baby boomers and seniors in similar financial situations attribute nonessential spending as a factor for their struggles. The likelihood of citing nonessential spending as a reason for living paycheck to paycheck decreases with age, making younger consumers more vulnerable to its adverse effects. The study also finds that male consumers are slightly more likely than female consumers to attribute their financial strain to nonessential spending.

Shoppers who say they engage in indulgent spending are also more likely to say they made payments related to credit cards, personal loans and buy now, pay later plans in the 30 days prior to the survey. Overall, credit product usage is 11 percentage points higher for consumers who cite indulgent spending than those who do not cite such spending. Higher credit usage among indulgent spenders suggests that credit usage on nonessential categories, such as clothing or travel, is more common than on essentials, such as groceries or household supplies.

April CNBC Report Shows 58 Percent Live Paycheck to Paycheck

Also consider the CNBC|Momentive Your Money Financial Confidence Survey.

-

Just 13% of Americans say they are confident in America’s banking system according to a new poll from CNBC and Momentive fielded in the weeks after the collapse of Silicon Valley Bank.

-

Seven in 10 people say they are stressed about their personal finances, and about half say their overall financial stress has increased since before the COVID-19 pandemic began.

-

More than half of Americans (58%) describe themselves as living paycheck to paycheck, including a third of people with household incomes in the six figures.

-

On top of all this, most Americans do not have an emergency fund to help buffer them in times of financial stress; among those who do, 40% say that have less than $10,000 saved for a time of need.

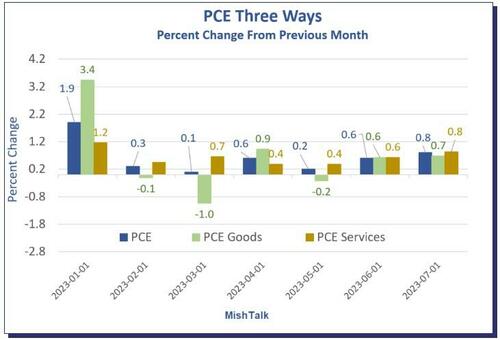

Personal Consumption Expenditures

The above chart shows nominal numbers. Inflation-adjusted, spending rose 0.6 percent in July and 0.4 percent in June as the lead chart shows.

Consumers Go on a Spending Spree in July, but Income Doesn’t Match

Consumers has gone on a huge spending spree in the last two months.

For more details, please see Consumers Go on a Spending Spree in July, but Income Doesn’t Match

In response, a reader commented “I think the consumer is much more robust than most of these comments suggest. Especially millennials. Their incomes are way up, they’re spending & they’re savings are up. All is well.“

What a hoot

By the way, if 61 percent live paycheck to paycheck but only 21 percent struggle, the rest are one unexpected expense or loss of income away from somewhere between struggling and outright disaster.

Don’t Subscribe Unless You’re Ready To Make Money!

It’s your time future millionaires and The Juice newsletter has you covered. We don’t just tell you what stocks and ETFs are worth your energy, we tell you why and when! Sign up now!

* * *

Tyler Durden

Sat, 09/02/2023 – 12:30

via ZeroHedge News https://ift.tt/WlvP6Ve Tyler Durden