NY Fed Survey Finds Sharp Deterioration In Household Finanancial Sentiment As Long-Term Inflation Seen Rising To 15 Month High

After four months of declines in the 1-Year inflation expectation as reported by the NY Fed’s consumer survey, August saw a reversal in this series which traditionally is also a proxy for the price of oil (which just hit a 2023 high this morning), however this was offset by a small decline in 3 year inflation expectations. However, the most concerning observations was that the inflation outlook at the 5-year point hit the highest since march 2022 while households turned even less optimistic about their financial situation.

Here are the details: as shown in the chart below, while inflation expectations at the one-year horizon were slightly higher at 3.63% in Aug. from the previous month’s 3.55%, three-year-ahead inflation expectations, conversely, fell to 2.79% from 2.91%. Finally, 5-year-ahead inflation expectations rose from 2.90% to 3.00%, the highest since March 2022.

The report also noted that median inflation uncertainty (the uncertainty expressed regarding future inflation outcomes) was unchanged at the one-year-ahead horizon and decreased at the three- and five-year-ahead horizons.

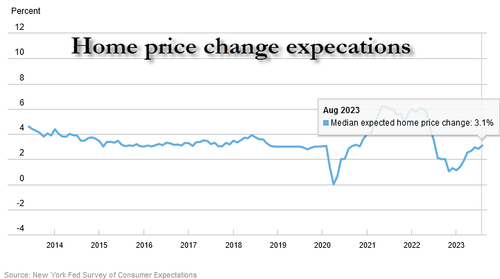

Turning to median home price growth expectations, the survey found that these increased by 0.3% point to 3.1%, its highest reading since July 2022… which of course is just the opposite of what the Fed wants to achieve, and suggests that the Fed’s tightening plans have failed miserably at slowing the growth in what is arguably the most important asset class for the US middle class. The increase was most pronounced for respondents under the age of 60 and those with a high school education or less.

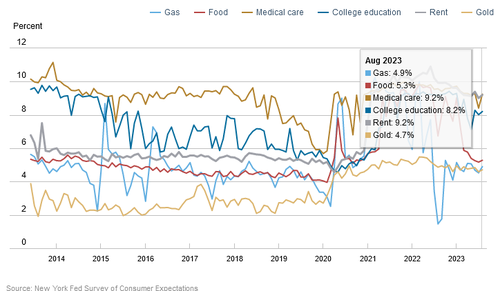

Next, turning to year-ahead commodity price expectations, these rose across the board in August, increasing by 0.4% for gas (to 4.9%), 0.1% for food (to 5.3%), 0.8% for the cost of medical care (to 9.2%), and 0.2% for the cost of college education (to 8.2%) and rent (to 9.2%).

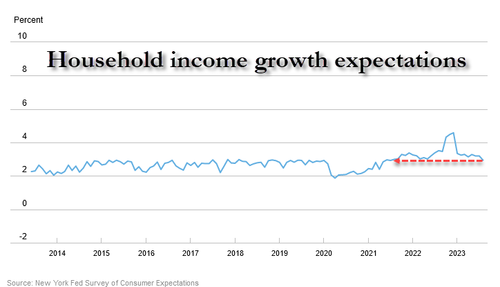

But while the latest reversal in the downward trend of inflation is troubling, what is even more concerning was the report’s finding that the median expected growth in household income fell to 2.94% (the decline was largest for respondents with a high-school education or less) to the lowest since July 2021…

… prompting the report authors to write that “perceptions about current credit conditions and expectations about future conditions both deteriorated.” Digging into the details of the household finance survey reveals substantial deterioration across all indicators, and especially when it comes to applying – or receiving – new credit:

- Median household spending growth expectations fell by 0.1 percentage point to 5.3%.

- Perceptions of credit access compared to a year ago deteriorated in August, with the share of households reporting it is harder to obtain credit than one year ago hitting a new series high. Expectations for future credit availability also deteriorated in August, with the share of respondents expecting it will be harder to obtain credit in the year ahead increasing.

- The application rate for any kind of credit over the past twelve months declined to 40.3 percent from 40.9 percent in February, its lowest reading since October 2020. Application rates declined to 11.9 percent for auto loans and 12.5 percent for credit card limit requests, but increased to 24.8 percent for credit cards, 6.5 percent for mortgages, and 5.3 percent for mortgage refinances.

- The overall rejection rate for credit applicants increased to 21.8 percent, the highest level since June 2018. The increase was broad-based across age groups and highest among those with credit scores below 680.

- The rejection rate for auto loans increased to 14.2 percent from 9.1 percent in February, a new series high. It increased for credit cards, credit card limit increase requests, mortgages, and mortgage refinance applications to 21.5 percent, 30.7 percent, 13.2 percent, and 20.8 percent, respectively.

- The proportion of respondents reporting that they are likely to apply for one or more types of credit over the next twelve months rose to 26.4 percent from 26.1 percent in February.

- The average reported probability that a loan application will be rejected increased sharply for all loan types. It rose to 30.7 percent for auto loans, 32.8 percent for credit cards, 42.4 percent for credit limit increase requests, 46.1 percent for mortgages, and 29.6 percent for mortgage refinance applications. The readings for auto loans, mortgages, and credit card limit increase requests are all new series highs.

- The average perceived probability of missing a minimum debt payment over the next three months fell by 0.6 percentage point to 11.1%.

- The median expectation regarding a year-ahead change in taxes (at current income level) declined by 0.2 percentage point to 4.1%.

- Laughably, the median year-ahead expected growth in government debt declined to 8.9%, its lowest reading since February 2020: just the opposite will happen.

- The mean perceived probability that the average interest rate on saving accounts will be higher in 12 months decreased by 0.8 percentage point to 30.1%.

- Perceptions about households’ current financial situations compared to a year ago deteriorated slightly in August, with the share of households reporting a worse situation compared to a year ago rising. Similarly, year-ahead expectations about households’ financial situations deteriorated in August with the share of households expecting a worse financial situation in one year from now rising.

- The mean perceived probability that U.S. stock prices will be higher 12 months from now decreased by 1.9 percentage points to 35.2%.

Finally, looking at the state of the labor market, we finds that…

- Median one-year-ahead expected earnings growth rose by 0.1 percentage point to 2.9% in August. The series has been moving within a narrow range of 2.8% to 3.0% since September 2021.

- Mean unemployment expectations—or the mean probability that the U.S. unemployment rate will be higher one year from now—increased by 1.8 percentage points to 38.5%, remaining below its 12-month trailing average of 40.2%.

- The mean perceived probability of losing one’s job in the next 12 months rose by 2.0 percentage points to 13.8%, its highest reading since April 2021. The mean probability of leaving one’s job voluntarily in the next 12 months also increased by 1.9 percentage points to 18.9%. Both increases were most pronounced for respondents with a high school education or less and annual household income below $50k.

- The mean perceived probability of finding a job (if one’s current job was lost) decreased by 0.1 percentage point to 55.7%.

Putting it all together, inflation expectations (especially longer-term) are once again rising and hit the highest in 15 months, while household perceptions about their current financial situations and expectations for the future deteriorated sharply.

More in the full report here.

Tyler Durden

Mon, 09/11/2023 – 12:45

via ZeroHedge News https://ift.tt/n1iUaux Tyler Durden