Fed Balance Sheet Plunges By Most In Over 3 Years As Retail Money-Market Inflows Continue

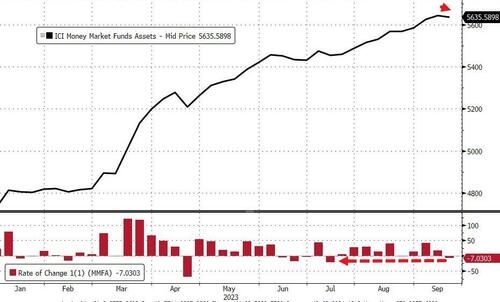

Money market funds was outflows of over $7BN last week – the biggest weekly outflow since July – inching the total assets back from record highs…

Source: Bloomberg

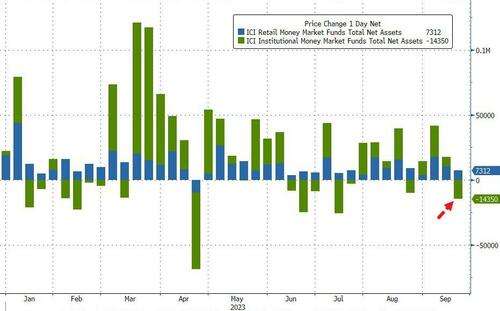

The net outflow was driven by institutional funds losing over $14.3BN (while retail funds saw $7.3BN inflows – the 22nd straight week of retail money market fund inflows)…

Source: Bloomberg

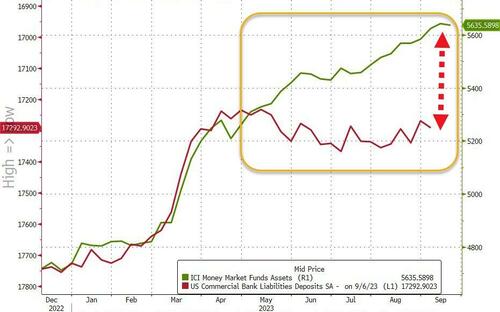

Is the decoupling between bank deposits and money-market funds beginning to converge?

Source: Bloomberg

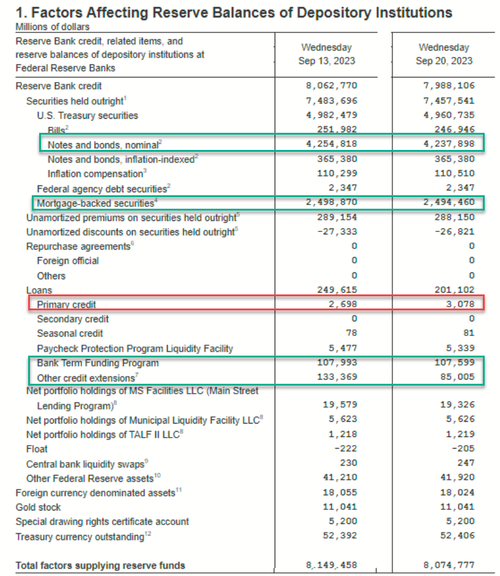

The Fed’s balance sheet plunged by almost $75BN last week – its biggest weekly drop since July 2020

Source: Bloomberg

With regard to The Fed’s QT program, it sold down $26BN in securities last week

Source: Bloomberg

Banks’ usage of The Fed’s emergency funding facility remains around $108BN (a modest decline on $394mm last week)…

Source: Bloomberg

The full breakdown shows a big slidew in ‘other credit extensions’

-

QT – notes and bonds – declined by $17BN to $4.238TN

-

MBS declined by $4BN to $2.499TN

-

Discount Windows increased by $0.4BN to $3.1BN

-

BTFP dropped by $0.4BN to $107.6BN

-

Other credit extensions dropped by $48BN to $85BN

The gap between bank reserves at The Fed and the US equity market cap diverged again…

Source: Bloomberg

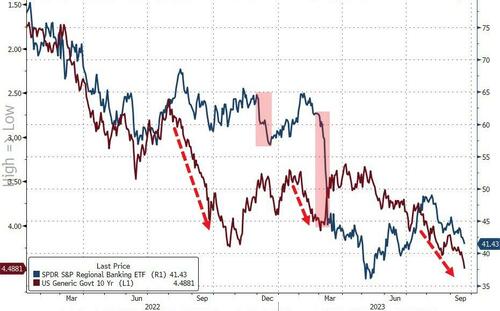

Finally, we leave you with one thought – in 6 months and counting, America’s ‘smaller’ banks will need to find that $100-billion plus from somewhere as that is when the BTFP bailout program ends (theoretically). Will regional bank balance sheets be stabilized by then?

Source: Bloomberg

Given the current bloodbathery in bond-land, we suspect we will know sooner rather than later.

Tyler Durden

Thu, 09/21/2023 – 16:40

via ZeroHedge News https://ift.tt/dSpCQtc Tyler Durden