Strong 5Y Auction Prices At Highest Yield Since Summer Of 2007

The last time a 5Y auction priced here, quants suffered a historical meltdown.

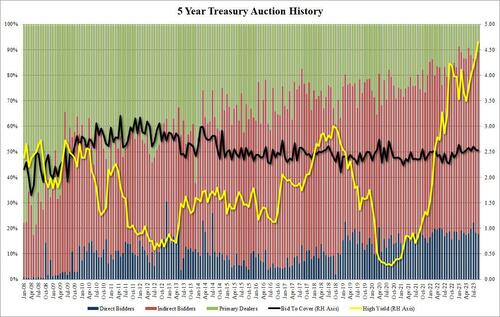

We are of course talking about the summer of 2007, and just like then, moments ago the 5Y auction priced at a high yield of 4.659%, and up 16bps from August. But thanks to the ongoing collapse in rates across the curve, the auction stopped through the When Issued 4.671% by 1.2bps, the biggest stop through since May (when it was 1.4bps) and follows three consecutive tailing auctions.

And while the Bid to Cover was just 2.52, down from 2.54 last month and tied for the lowest since March, internals were quite solid, with foreign demand surging to a 4 month high as Indirects took down 71.15%, up from 67.9% last month and one of the highest on record. And with Directs awarded 17.6%, below the 6-auction average of 18.9%, Dealers were left holding 11.2%, the lowest since May’s 9.3%.

Overall, there was solid demand for today’s auction, largely thanks to the yield which at 4.66% was the highest in 16 years. As a reminder, the 5Y at 5% is what BofA’s Michael Hartnett called the Big Cyclical Buy signal. We are now just over 30bps away.

Tyler Durden

Wed, 09/27/2023 – 13:21

via ZeroHedge News https://ift.tt/lkhfW2o Tyler Durden