Malaysia Aims To Become A Semiconductor Powerhouse

Locals are telling Nikkei that Kuala Lumpur’s semiconductor industry is bustling in a way it hasn’t in 34 years.

Speaking to Ng Kok Tiong, a senior vice president at Infineon, it’s becoming clear that the semiconductor industry in Malaysia is attempting to ramp up. As one example, Ng told Nikkei he is experiencing daily traffic jams that he’s never seen before

Ng would have his finger on the pulse of the industry in the country. He is also chairman of the Semiconductor Fabrication Association of Malaysia, the report notes. His company, Infineon, is in the process of building a $7 billion facility that’ll be used as a production site for silicon carbide chips.

He told Nikkei this week: “Malaysia benefited quite a bit from this diversification of the supply chain. Traffic increased a lot because of so many factories coming. The government is now widening the road, and that will likely be complete by next year.”.

Once a forerunner in Asian semiconductor production, Malaysia garnered the epithet “the Silicon Valley of the East” in the 1970s. However, it ceded its leadership position to South Korea and Taiwan due to the meteoric rise of native firms like Samsung Electronics and Taiwan Semiconductor Manufacturing Co. during the 1990s. Amid escalating U.S.-China tensions, Malaysia now eyes resurgence as the sector seeks to broaden its production base.

Boosting this aspiration are significant foreign investments: U.S.-based Intel intends to invest $7 billion in Malaysia, making it the focal point of the company’s Asian operations. Furthermore, in the Bayan Lepas industrial park, southeast of Penang Island, Intel is constructing its most extensive facility focused on state-of-the-art 3D chip packaging—a critical frontier in the race for more potent chips.

Intel’s vice president of manufacturing and supply chain, AK Chong, commented: “There is a saying that goes, ‘A rising tide lifts all boats’. You’re bringing in a lot of ecosystem suppliers. Like our advanced packaging — you need a new chemical solution and new equipment. So you expect a lot of these investments coming in. It’s like a chain effect.”

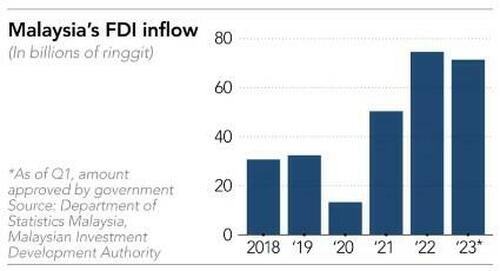

Nikkei writes that Foreign direct investment in Malaysia soared to an all-time high in Q1 2023, reaching $15.25 billion, more than doubling the entire amount for 2019.

Primarily driven by global tech and semiconductor firms, Malaysia holds a 13% share in the global market for chip packaging, assembly, and testing. However, the country’s chip industry is overwhelmingly reliant on foreign giants like Intel and NXP, with domestic firms playing a minor role. Additionally, the sector faced a bottleneck in 2020 due to COVID-19 restrictions.

Post-pandemic, Malaysia is promoting its stable geopolitics and low natural disaster risk to attract foreign investment. Companies like Jabil, Micron, and Bosch are expanding their operations in the Penang region, while DHL Express is adding logistics centers. Lam’s CEO identified Malaysia as one of Asia’s three key chip production hubs, alongside Taiwan and South Korea. Intel’s local head emphasized Malaysia’s strategic location and the English proficiency of its workforce.

“We are now finalizing a project to build new production sites soon in either Malaysia or Vietnam because of demands from clients. No matter whether the cost is higher, that’s a trend we have to follow,” concluded Scott Lin, president of Marketech International Corp., a leading chipmaking facility builder and equipment supplier to TSMC, ASML and Applied Materials.

Tyler Durden

Fri, 09/29/2023 – 12:00

via ZeroHedge News https://ift.tt/APXdvsx Tyler Durden