Stocks’ Reaction To September’s ISM Will Be Telling

Authored by Simon White, Bloomberg macro strategist,

An inability to rally on a stronger ISM number today would indicate the US stock market remains at a vulnerable juncture. This would raise the risk of a deeper selloff prompted by the gamma-related selling of option dealers.

Both the September ISM and S&P PMI manufacturing indices will be released today. Each is expected to remain basically unchanged from last month (the ISM slightly stronger, the PMI exactly the same), and both remaining under the 50 demarcation level between expansion and contraction.

The new orders-to-inventories ratio gives a short-term (~3m) lead on the headline index. The ratio is turning up for the ISM and the PMI.

It is a different story for the services ISM and PMI released on October 4 (Wednesday). The two surveys are diverging, with the ISM turning up and the PMI turning down.

As I showed in a recent column, global manufacturing, and especially US manufacturing, has an undue influence on the global economy and equity markets given its small size of the economy.

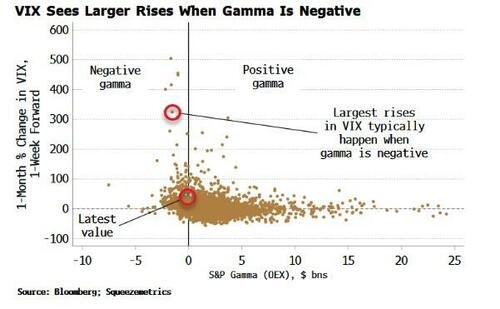

That’s why it would be revealing if the manufacturing ISM or PMI surprised to the upside today, but there was no follow through in equities. S&P gamma (the second derivative of how an option price varies with the underlying) remains still in or very close to negative territory (depending on what measure you follow).

This leaves the market exposed to bigger swings, but with a bias to the downside as there remains a wall of out-of-the-money puts that dealers are likely short of (and therefore they have to sell more S&P to hedge as the market falls).

Credit should be watched closely too. High-yield debt is functionally similar to an equity put-writing strategy; therefore, any rise in vol from a stock-market selloff threatens to lead to wider credit spreads. Spreads remain unreflective of underlying credit conditions, and are prone to an abrupt repricing wider.

Tyler Durden

Mon, 10/02/2023 – 08:30

via ZeroHedge News https://ift.tt/LIvnOiy Tyler Durden