Student Loan Payments Officially Resume After Three-Year Pause

On Sunday the Trump administration’s pandemic-era student loan pause officially ended, re-saddling more than 28 million borrowers with the consequences of their own actions (granted, colleges virtually assured 18-year-olds six-figure salaries amid ridiculous tuition hikes before ‘bidenomics’ and the Ukraine war resulted in scorching inflation).

Despite pleadings from advocates, the Biden administration has reactivated payment requirements, The Hill reports.

“It’s a sad day for student loan borrowers and for the country that student loans have to come back on, especially with the threat of a looming government shutdown, potentially on the same day. It’s just wild,” said the president and founder of the Student Debt Crisis Center, Natalia Abrams, apparently unaware that nobody forced anyone to take on all that debt.

According to a July survey by Life and My Finances, half of borrowers don’t make enough to afford their student loan payments, while 22% had a plan on how they would make ends meet once payments resume.

Some borrowers are going on a “student debt strike” and refusing to make payments as a way to show their discontent with the system.

Meanwhile, President Biden, who had made relief a key pledge of his 2020 campaign, has released an “on-ramp” repayment plan that allows borrowers to miss their monthly payments for the next year with fewer consequences than before. The Department of Education will not put borrowers in delinquent status if they miss payments, garnish their wages or send them to debt collectors.

But borrowers will still see interest accrue on their loans, and their credit score could be affected, despite the department saying they won’t report the missed payments to credit card companies. -The Hill

“There could be situations where potentially because you’re not making your payments, the value of your loan is increasing because it’s collecting interest, so you will owe more money. The credit bureau takes that into account, and maybe your credit score gets dinged a little bit,” said Lending Tree senior economist and student loan repayment expert, Jacob Channel.

As we’ve noted for years, student loans were an albatross around the necks of young borrowers even before the pandemic pause, delaying home ownership and throwing retirement savings plans into disarray. In 2019, nearly half of student loan borrowers delayed a home purchase due to educational debt, according to real estate site Cleaver.

“In typical pre-COVID times, when people are paying their student loans, they’re not buying their children’s medication, they’re not able to save for a house or retirement. We know from polling borrowers for so many years that they were using their COVID pandemic money to pay for basic needs, and so the worry is that now they won’t be able to,” according to Abrams.

In June, the Biden administration took the flatly unconstitutional step of forgiving at least $10,000 in student debt for all 45 million borrowers, however it was (predictably) struck down by the Supreme Court in June. The reason only 28 million borrowers will be affected by the resumption is because the rest are either paused because the borrowers are in school, in default, or waiting in the hopes that their debt will be discharged.

That said, the administration was able to create a new income-driven repayment program known as SAVE (Saving on Valuable Education), which rolls out in two phases. In the first phase coming later this year, the income exemption is raised from 150% to 225% above the federal poverty guidelines, which grants an individual borrower making up to $32,800 per year a $0 monthly payment on their student loans. The same $0 payment scales to a family of four making under $67,500.

Next year, monthly payments will be cut in half, moving from 10% of discretionary income to 5%.

“The SAVE plan is a lifeline if you’re able to get on a $0 payment, and we have worked with some borrowers, especially older borrowers on Social Security” to get on that plan,” said Abrams.

“But the folks that we’re seeing it harm or not be helpful for is our folks that may have seen an increase in their income during the pandemic. And then when they go to apply, the people who were on a previous IDR plan … they realize they have to pay a much higher payment.”

According to Republicans, none of this addresses the root of the problem.

“This conversation distracts us from the core problem, which is making student loan money too easy, which causes tuition to rise and does not address what’s needed, which is that colleges need tough love to end their addiction to tuition,” according to Adam Kissel, a visiting fellow in the Heritage Foundation’s Center for Education Policy.

“Republicans have brought forth a solution that holds colleges accountable for rising costs and empowers students and families to make the best decisions for their college careers and beyond. But if Congress fails to act, students will continue to drown in debt without a path to success,” said Sen. Bill Cassidy (R-LA), ranking member of the Health, Education, Labor and Pensions Committee.

And then there’s the economy

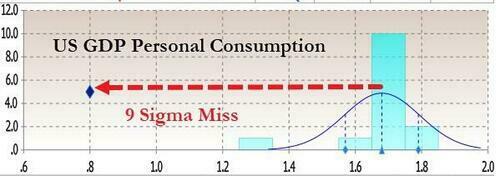

As we noted last week, personal consumption collapsed in the latest GDP revision – in fact, printing at 0.8%, down 80% from 3.8% in Q1, it was a downright disaster. As shown in the chart below, Personal Consumption was expected to print unchanged from the 1st revision to Q2 GDP at 1.7%. Instead, it came in less than half at 0.8%, a 9-sigma miss to expectations!

Of course, when it comes to the US economy which is 70% spending-driven, all that matters is consumer spending, and the sudden collapse there confirms what we have been saying: the US is about to careen into economic contraction once the various factors that will slam Q4 GDP come into play including:

- the resumption of student loan payments, which will subtract (at least) 0.5% (and likely much more) from quarterly annualized GDP growth

- the federal government shutdown, which will reduce quarterly annualized growth by around 0.2% for each week it lasts

- reduced auto production from the ongoing UAW strike which will reduce quarterly annualized growth by 0.05-0.10% for each week it lasts.

Hey, at least the government averted a shutdown, so at least we’ve got that going for us.

Tyler Durden

Mon, 10/02/2023 – 08:45

via ZeroHedge News https://ift.tt/sk492mz Tyler Durden