‘Scary’ Cross-Asset Swings Bring Back Stress

Authored by Michael Msika and Jan-Patrick Barnert via Bloomberg,

Risk sentiment has been hit lately and while investors can find some green shoots of market stabilization in the past few days, it would be brave to call a bottom just yet.

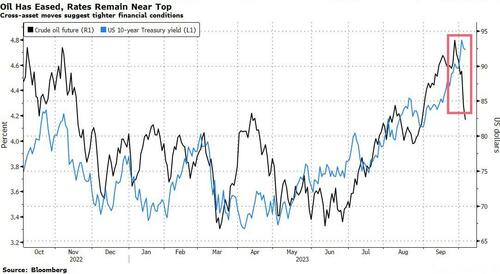

Markets have been served a toxic cocktail of higher real and nominal yields, a strengthening US dollar and rising oil prices in combination with automated selling and forced de-risking of portfolios. This big multi-asset wave came at the wrong time for a stock market left vulnerable by summer weakness and low liquidity.

“What’s scary is that thematically, we are seeing cross-asset markets voting with their feet and lending credibility to the idea that the recent shock tightening move in US financial conditions is indeed going to accelerate hard landing risk,” notes Nomura strategist Charlie McElligott.

He adds that the threat of an economic slump is being priced higher “impulsively” for the first time since the US regional banking crisis in March.

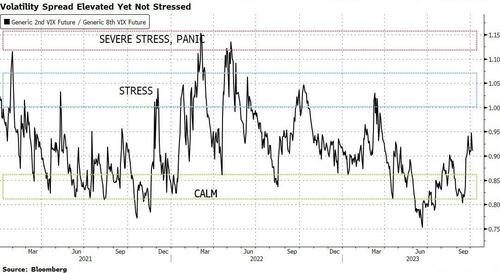

Seasonal patterns for volatility still allow for a move higher and a reading of future spread levels for the VIX is elevated, but not yet at levels considered to be stress or even severe panic. That suggests the point of capitulation for investors might not yet have arrived.

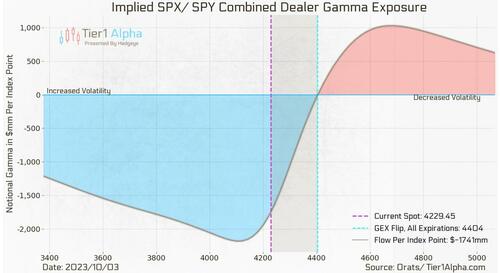

“While we’d lean toward support developing as rates are showing signs of stabilization, lower from here likely starts to meaningfully raise VIX levels,” strategists at Tier1Alpha wrote in a note. Option trading desks have been pushed deep into short gamma, a sign of increased volatility and a greater risk of moves accelerating toward the downside. With pressure points from tail hedges for hedge funds and institutional investors much closer than in the past, there is a risk of a “collective scramble to reduce high levels of equity exposure,” they say.

Some market headwinds appear to have started easing, with oil prices falling back. Rates look toppish, but have yet to follow crude’s lead in reversing direction to fully give stocks a chance to catch their breadth.

“On broader sentiment indicators, we would note that bearishness has ticked up, but not at an extreme,” says Carl Dooley, head of EMEA trading at TD Cowen. He points out that the VIX is higher, but nowhere close to panic indicator levels, while tail risk protection demand hasn’t spiked and volumes haven’t exploded, in contrast to previous periods of stress.

“While not at a technical extreme either way, I think the current despondency around buying stocks makes a short-term rally quite likely,” Dooley says. “Feels as though stocks will react asymmetric to the upside around any sudden retracement in yields.”

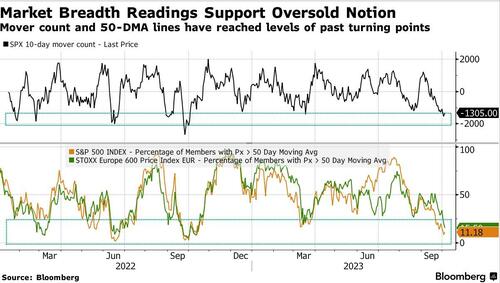

Momentum remains deeply negative across all major markets, with some early signs of oversold territory emerging. Most benchmarks are trading near their 60-day lows and RSI indicators have fallen below 30 for some benchmarks. In addition, market breadth readings taken from the S&P 500 Index’s advance/decline picture and the percentage of Stoxx 600 Index members trading below the 50-day moving average suggest the market is at least near a point where it started to turn in the past.

It’s too early to treat those as signals to buy, says DayByDay technical analyst Valerie Gastaldy. “The low that traditionally occurs in October is still ahead of us,” she says. “Recently, investors have been trading more calls, showing that they are not worrying much about the correction. We cannot share this laid-back attitude.”

Tyler Durden

Fri, 10/06/2023 – 10:30

via ZeroHedge News https://ift.tt/B12uIit Tyler Durden