Citigroup Takes Delivery Of 100,000 Tons Of Aluminum And 40,000 Tons Of Zinc

Authored by Mike Shedlock via MishTalk.com,

Citigroup is one of the world’s largest metal speculators. Hello Fed, FDIC, am I the only one who thinks banks should be banks, not hedge funds?

Citi’s Mega Metals Trade Shows Global Markets Turning to Glut

Bloomberg reports Citi’s Mega Metals Trade Shows Global Markets Turning to Glut

Citigroup Inc. has been buying large volumes of physical aluminum and zinc on the London Metal Exchange, in a bold metal-financing trade that’s made it one of the biggest players in the market in recent months.

In the last few months, Citi requested delivery of about 100,000 tons of aluminum and 40,000 tons of zinc — worth over $300 million, according to people familiar with the matter. The purchases are for Citi’s own trading book and are part of a metal financing play, said the people, who asked not to be identified discussing private information.

Citi has struck a rent agreement with at least one warehousing company to store metal in Taiwan’s coastal city of Kaohsiung, and intends to ship metal there from LME warehouses in Korea and Singapore, the people said, although they cautioned that its plans could still change. Citi may ultimately decide to deliver the metal back on to the LME, one of the people said.

Much if not most of these metals are of Russia origin. But that’s OK because the Biden administration placed no bans on Russian aluminum or zinc.

Financing plays were a dominant theme of the LME’s market in the years after the global financial crisis, when banks and traders bought up warehousing companies and engaged in battles to control and profit from a critical mass of inventory in a period known as the “warehouse wars.”

The trade has thrust Citi into the spotlight at a time of upheaval for some of its biggest rivals in metals trading. JPMorgan has pulled back from parts of its metals business after playing a central role in the nickel crisis on the LME last year,

Too Big to Fail

I would not give a rat’s ass what Citi did with its own money.

But as long as it is deemed too big to fail, it should not act like a hedge fund.

Banks Should Be Banks, Not Hedge Funds

Citi is now one of the biggest players is metals speculation.

In practice, I doubt this position is big enough to matter, but it’s another example of the willingness of banks to make speculative bets.

Silicon Valley Bank Speculation

Earlier this year, Silicon Valley Bank blew up by making speculative bets on interest rates.

The 2023 bank failures arose from what the banks did with uninsured deposits, not the fact that the deposits were uninsured.

Banks could easily have parked the money back at the Fed collecting generous amounts of free money because the Fed pays interest on reserves.

Instead, the banks made enormous bets that interest rates would not rise rapidly. When rates rose, paper losses soared, and the banks became capital impaired.

Fed Admits Mistake

The Fed even admitted a mistake. For discussion, please see The Fed Admits a Mistake in Collapse of SVB, Seeks More Power Anyway

This borrow-short, lend-long issue applies to all banks, not just the troubled banks that failed.

And the Fed has done virtually nothing to address speculative risk seeking.

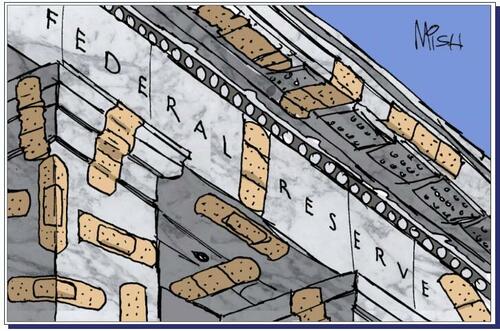

Dear FDIC and Fed, We Need a Genuine Safekeeping Bank, Not Band-Aids

On June 18, I commented Dear FDIC and Fed, We Need a Genuine Safekeeping Bank, Not Band-Aids

I offered a 10-pronged solution to what caused the failure of Silicon Valley Bank. Please check it out.

Today, I will add another idea. Break Citigroup in two. Create a safekeeping bank and a hedge fund.

Let the hedge fund do whatever the hell it wants as long as there is no chance of any bailout ever. Let the bank be a bank.

Tyler Durden

Wed, 10/11/2023 – 09:30

via ZeroHedge News https://ift.tt/sn4Yoab Tyler Durden