Expensive US Retail Stocks Will Soon Succumb To Higher Rates

Authored by Simon White, Bloomberg macro strategist,

US retail stocks have held up well despite rapid rate rises, but as one of the most expensive sectors, they will soon face formidable headwinds from a slowing in retail sales.

With heightened tensions in the Middle East raising risks, portfolios without any short exposure are increasingly vulnerable. However, one sector in the US that looks prone to further underperformance is retail.

Retail sales, as yesterday’s seasonally-adjusted data showed, have been remarkably resilient given headwinds to consumer spending from higher rates and tighter credit, with both nominal retail-sales growth and the control group showing tentative signs of an upturn.

[ZH: We noted yesterday when the data hit that non-seasonally-adjusted retail sales plunged over 5% MoM…]

But that is unlikely to be sustained. Two key drivers of retail sales (which are ~40% of private consumption) are banks’ willingness to make consumer loans and mortgage rates.

As credit has tightened, banks have signaled they are far more reluctant to make loans for consumption, and this has reliably led to weaker retail-sales growth over the next three-to-six months.

Mortgage rates have risen sharply too, eating up an increasing amount of household budgets. A mitigating factor, though, is the long average duration of mortgage terms in the US. Even though the current 30-year mortgage rate is approaching 8%, the effective rate is only 3.6%.

Still, this too is now rising as adjustable-rate mortgages (ARMs) refix. The relationship with retail sales and current mortgage rates is weak and has quite a long lead; however, the relationship with retail sales and the effective mortgage rate is stronger, with a shorter lead of about six months. Retail sales are likely to be contracting on an annual basis very soon as effective mortgage rates continue to rise.

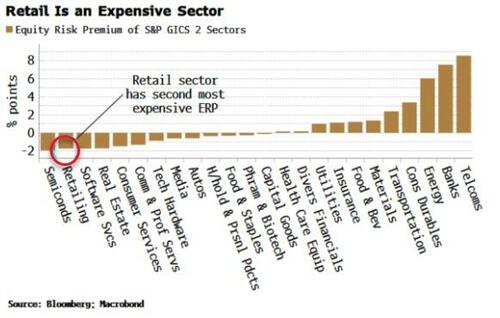

The retail sector has held up well, with it being the sixth highest GICS 2 sector year-to-date, up almost 25%. It is also the most expensive sector from an equity risk premium perspective, with only semis having a lower ERP.

The short-interest ratio in the XRT retail ETF is also historically on the low side. Reality is poised to catch up with retail, with the sector soon seeing significant underperformance.

Tyler Durden

Wed, 10/18/2023 – 09:50

via ZeroHedge News https://ift.tt/eP3WQTc Tyler Durden