Stocks & Bonds Rip, Dollar Dips After Anti-Stagflationary GDP Data

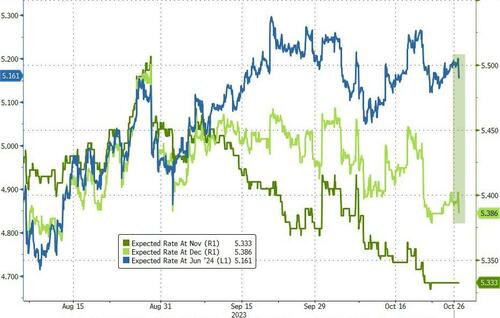

Q3 is signaling the opposite of stagflation with stronger than expected GDP growth and weaker than expected core PCE (durable goods orders were hot and continuing claims worse than expected) and that has pushed rate-change expectations lower (dovish)…

Source: Bloomberg

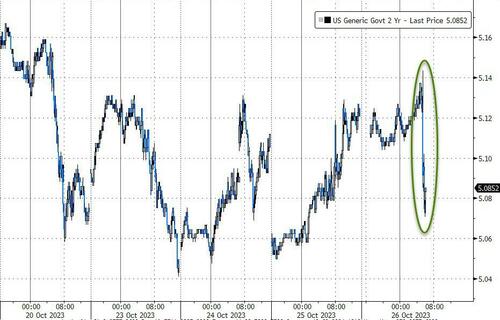

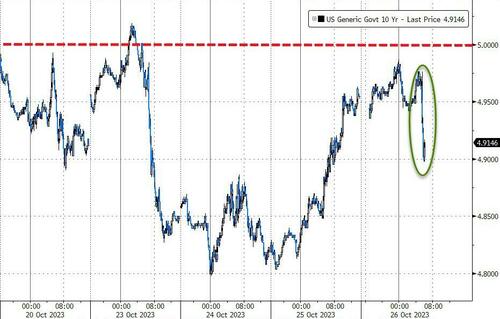

Treasury yields all fell on the print (down around 5bps or so)….

Source: Bloomberg

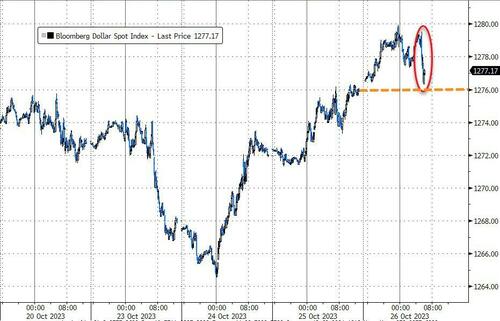

The dollar dropped back to unchanged on the day after the ‘dovish’ core PCE…

Source: Bloomberg

Gold is lower…

Source: Bloomberg

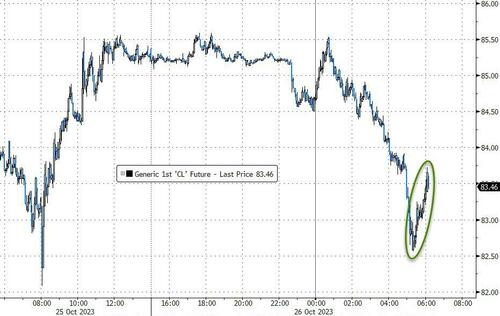

…and oil is up (demand)…

Source: Bloomberg

And stocks are higher… for now… with The Dow and Small Cap back in the green while S&P and Nasdaq remain red…

Can it hold until the close?

Judging by analysts’ calls post-GDP, we suspect… no.

Lindsey Piegza, chief economist for Stifel Financial Corp., told Bloomberg Television:

“The market is discounting the third-quarter number and is focusing on the latest central bank decisions, and what it might mean for what the Fed does next week.”

Goldman strategist Lindsay Rosners said that:

“…while this number is unsurprising, our expectations are for slower GDP going forward as positive contributions from volatile net exports and inventories are unlikely to be repeated…

While this one number makes the Fed weary of cutting rates, it does not move the needle for the November FOMC meeting which is certainly a skip. Higher and hold, yes. Higher and hiking, no.”

Rubeela Farooqi, Chief US economist at High Frequency Economics:

“We continue to forecast ongoing expansion in activity but expect the pace to slow quite significantly in the fourth quarter, as household spending slows…

…not only on payback for an unusually strong third quarter but also from the cumulative effects of rate hikes and tighter borrowing conditions, which should have a more material effect on both consumers and businesses going forward.”

Capital Economics:

“the acceleration in inventory-building in the third quarter leaves more scope for a reversal in the fourth quarter and beyond.

That is a key reason why, despite the strength in the third quarter, we still expect GDP growth to slow to below potential soon with outright declines still a distinct possibility.

That weakness, together with further signs of improvement in core inflation is why we expect the Fed to cut rates more aggressively next year than current market pricing assumes.”

Sell-the-kneejerk-higher-on-the-news?

Tyler Durden

Thu, 10/26/2023 – 09:21

via ZeroHedge News https://ift.tt/SzoHTq4 Tyler Durden