Money-Market Fund Inflows Resume As Bank Bailout Fund Hits New Record High

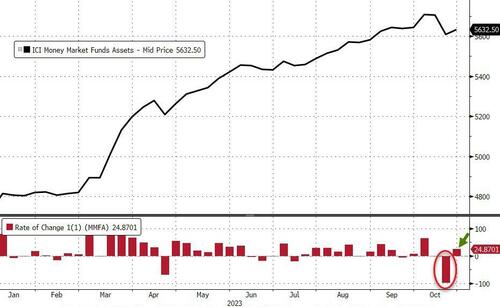

After last week’s massive (biggest since Lehman) outflows, Money Market funds saw a return to inflows last week (+24.9BN)…

Source: Bloomberg

Both Retail and Institutional funds saw inflows (+8.6BN and +$16.3BN respectively)…

Source: Bloomberg

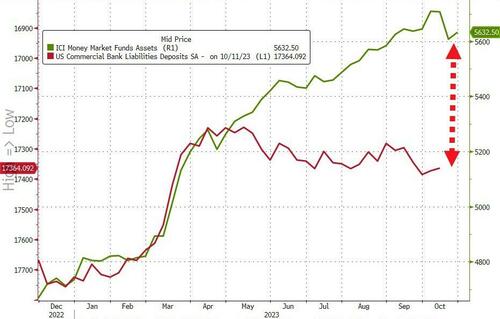

But bank deposits remain completely decoupled from money market fund assets still…

Source: Bloomberg

The Fed’s balance sheet continued to contract, down $25BN last week to its lowest since May 2021…

Source: Bloomberg

QT continues with $18BN in securities sales last week, down to its lowest level since June 2021…

Source: Bloomberg

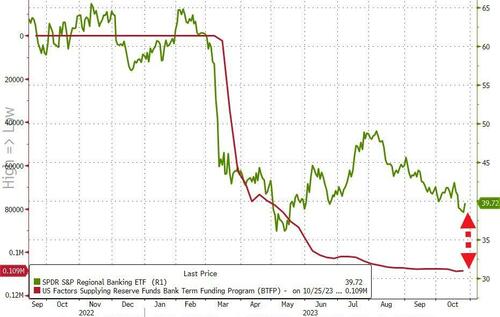

Usage of The Fed’s emergency bank funding facility rose $250MM lasty week to a new record high over $109BN…

Source: Bloomberg

Banks reserves at The Fed and US Equity Market Cap have recoupled from the AI Boom decoupling…

Source: Bloomberg

And the regional banks are also continuing to catch down to the reality of the $109BN hole in their balance sheets…

Source: Bloomberg

And they only have until March to fill it…

Tyler Durden

Thu, 10/26/2023 – 16:55

via ZeroHedge News https://ift.tt/cFDIB2i Tyler Durden