Yields Remains At Session Lows After Medicore, Tailing 10Y Auction Which Sees Jump In Foreign Demand

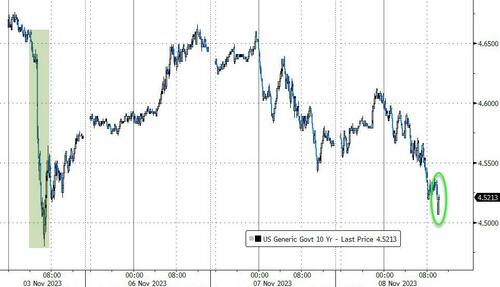

Moments ago the week’s second, and most important, coupon auction priced when the Treasury sold $40BN in 10 year paper, in a sale that was mediocre and tailing, yet had enough foreign demand to be strong enough not to disrupt the sharp rally that has taken yields to session lows.

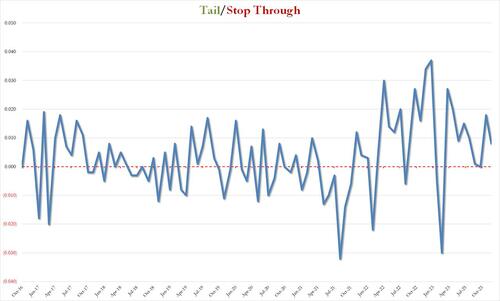

With on concession to speak of thanks to the sharp intraday rally which pulled yields lower by 7bps, the 10Y auction priced at a high yield of 4.519%, down notably from the 4.610% last month, if still the second highest going back all the way to 2007. Perhaps more notably, the auction tailed the When Issued 4.511% by 0.8bps. This was the 9th consecutive auction where we have not seen a stop through (i.e., either tailed, or was “on the screws”); as shown below, the last time a 10Y auction stopped through was February 2023.

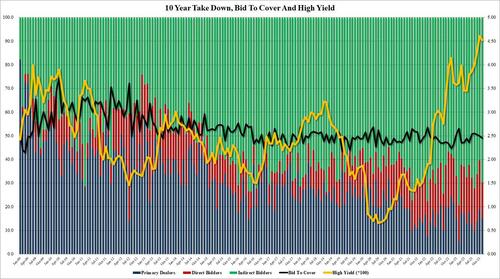

Going down the list, the bid to cover was also subpar, dropping to 2.45 from 2.50, the lowest since June and below the six-auction average of 2.49.

The internals were the only bright light, with Indirects rising sharply from 60.3 to 69.7%, the highest since August, and above the recent average of 66.1%. And with Directs awarded just 15.2, the lowest since February 2022, Dealers also saw a drop in their award, which at 15.1 was the lwoest in two months, if fractionally above the 14.2 recent average.

Overall, this was a mediocre tailing auction (due to lack of concessions) yet one which failed to have an adverse impact on the market due to the jump in Indirects.

Tyler Durden

Wed, 11/08/2023 – 13:21

via ZeroHedge News https://ift.tt/k3TA8Vy Tyler Durden