“Visionary” Founders Are Starting To Crumble, Entire Sectors Will Be Next

Submitted by QTR’s Fringe Finance

Those that have been reading me over the last year know that it is my strongly held belief that—even if the market does eventually wind up moving higher over time—we must experience a swift and shocking move lower in equity markets that, I believe, we are due for at any point now.

My reasoning has been simple, and, as I have noted in numerous other articles, basically comes down to simple math. You can’t push fiscal deficits to highs, run up monstrous debt, blow up the largest liquidity bubble in the history of the world, and then jack interest rates higher at breakneck speed and expect nothing to break.

How’s that for a PhD-level economics course?

But seriously, the math behind my reasoning is starting to play out. Zero Hedge put up a few great Tweets towards the end of the day on Tuesday, with charts showing exactly how bad things are getting.

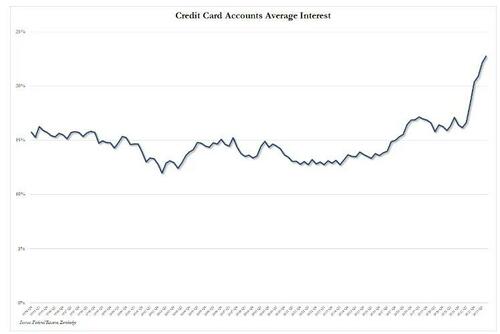

“US consumers decided they want to be the US government: max out every possible form of credit and go for it,” they wrote.

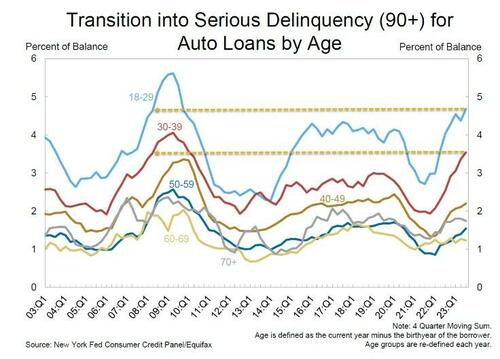

Pointing out auto loans, they noted: “For Millennials and Gen Z, it’s as bad as the [global financial crisis]”.

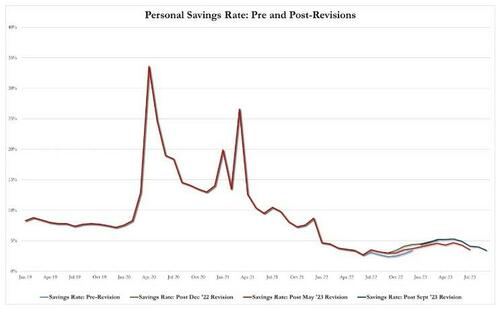

Zero Hedge also noted that personal savings is near all time lows with credit card interest rates at record highs. So, these charts all just mean that things are heading in the direction that I have predicted, but we haven’t hit that point of no return yet, or in my parlance, the “oh shit” moment, that is going to spook the rest of the market and eventually cause a self-fulfilling prophecy of relentless selling as a result of both deleveraging and panic.

And while I haven’t really been specific about what the catalyst could be that pushes us over the line, certainly a couple of new examples presented themselves this week.

First, there was the bankruptcy of WeWork. The company had previously made its founder a billionaire and was once valued at $47 billion.

It sought Chapter 11 bankruptcy protection in New Jersey, announcing deals with most of its secured creditors and plans to cut leases that aren’t central to its operations. The proceedings will affect its U.S. and Canadian locations. In its preliminary filing, the office-sharing firm disclosed liabilities of approximately $18.65 billion, with assets tallying $15.06 billion.

This is one of the most stunning reversals and evaporation of “value” (pause for laughter) in recent memory. How much of a soft landing can our economy be in for when one solitary company has been responsible for the evaporation of nearly $50 billion in perceived valuation over the course of just a couple of years?

WeWork Founder Adam Neumann/Yahoo Finance

But wait, there’s more. WeWork’s bankruptcy isn’t just a spectacle of how our public markets have become completely euphoric and have blessed business models that never should have been conceived to begin with, but it’s also a commentary on one specific industry: commercial real estate.

For those unfamiliar with why commercial real estate might be the next bubble to pop, you can read this linked primer. But to put it simply, coming out of COVID, commercial office space is in less demand than it has ever been at any time over the last half-century. This demand evaporated at a point where the consumer, corporations, municipalities, and just about everybody tied to interest rates are starting to tighten their belts.

It also comes on the tail end of one of the largest “everything bubbles” in our country’s history. As a reminder, going into COVID, everybody thought valuations of everything from housing to the stock market were astronomical. Commercial real estate was part and parcel with this euphoric bubble. Now, it could be one of the pins that pricks this “everything bubble” to a point where it finally catches the attention of everybody else.

Little signs have been bubbling under the surface. Have you noticed? For example, how about the American Dream Mall in New Jersey that features an indoor theme park, water park, ski slope, & high-end luxury stores? (Euphoria, anyone?) It experienced a fourfold increase in losses in 2022, reaching $245 million. Challenges in drawing tenants and customers, coupled with a significant debt burden, have troubled the “America, fuck yeah!” of malls, which started 2023 by missing debt payments.

American Dream: The Erection Pill Of Malls

And now, WeWork is tossing aside commercial office space leases as part of its bankruptcy. The company aims to abandon close to 70 leases, with a significant portion being inactive New York properties, including spaces in prominent areas like Union Square and downtown’s Fulton Center. WeWork cited their negligible benefit in the court filings.

If you think that the loss of these leases, for whoever the landlords are, won’t cause a chain reaction and eventually spread to other parts of other portfolios and other counterparties, you don’t really understand how an economy works. Now, multiply WeWork’s problems by the problems that everybody is having and times them by the amount of people that decided they too are no longer going to need office space after COVID. Now, multiply those problems by all of those extra counterparties and points of contagion.

50% OFF ALL SUBSCRIPTIONS: Subscribe and get 50% off and no price hikes for as long as you wish to be a subscriber.

Are you starting to conceive that perhaps something could be brewing underneath the surface in commercial real estate? If so, congratulations, you too have arrived at my monosyllabic threshold for basic thought and reasoning, which sits somewhere slightly above cavemen grunting to express feelings of hunger or displeasure.

Regardless, I would be keeping an eye on the sector very closely. It is a sector, along with REITs, that I would not rush to invest in on dips because I honestly believe the worst is yet to come.

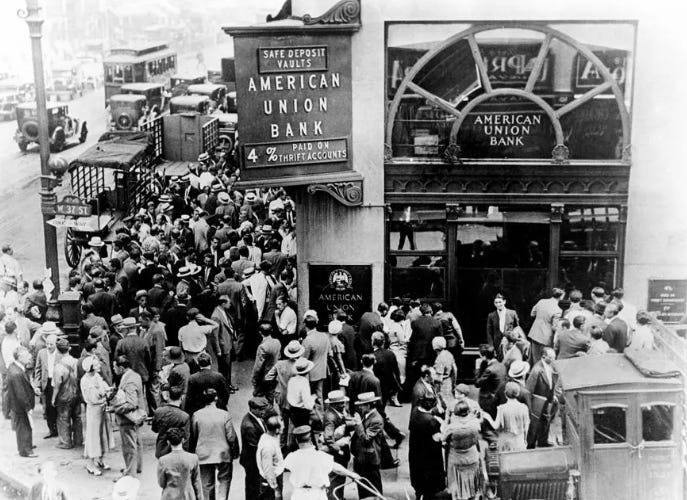

On top of this blow to commercial real estate, you have what appears to be a banking crisis that continues to develop. It was reported this week that, according to New York Federal Reserve staff, some financial institutions may face imminent funding stress and capital deficiencies.

In a Liberty Street Economics blog post, Matteo Crosignani, Thomas Eisenbach, and Fulvia Fringuellotti noted that systemic risks are on a slight rise, yet remain lower than those preceding the global financial crisis. This is mainly due to major banks being less vulnerable to capital shortfalls and bank runs, as indicated by analyses up to the second quarter of 2023.

“In the short-term, banks might suffer losses in their securities portfolio that might, in turn, induce funding dry-ups and substantially weakened effective capital levels,” they wrote.

Finally, as I have said in past articles, seven equities are driving the price of pretty much all stocks. I already identified in my previous blog posts that if companies like Apple and Nvidia start to show weakness, they could bring the entire market down with them.

But I digress. Above all, I think it’s important to note that just because all of the straws haven’t broken the camel’s back yet doesn’t mean that they won’t eventually.

The WeWork bankruptcy is multiple lessons, packaged in one: it offers us lessons about how anybody will take dogshit to the market and try to assign it a grand valuation, how nobody does due diligence, and how people can continually get bamboozled by legacy business models that are wrapped up and repackaged as something new when they aren’t. (Speaking of which, how are things going over at Tesla?)

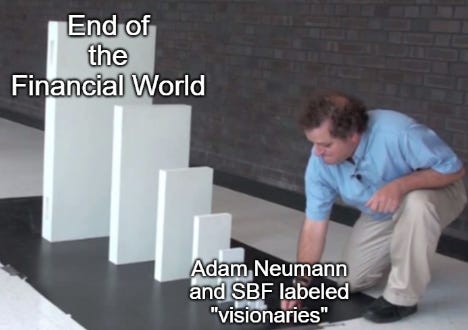

Now, zoom out a little bit further. What were some of the biggest stories over the last couple of years? FTX and WeWork were definitely two of them.

And so, we are starting to see some of the larger dominoes that were set up during peak euphoria of the COVID stimulus days starting to fall.

As anybody with experience in markets knows, this always starts with the smaller dominoes and leads to the larger ones. With interest rates at 5% and the Federal Reserve backing off the liquidity spigot – even though they have alluded to potentially stopping or cutting rates – there is no room to run and nowhere to hide when this contagion inevitably spreads.

The government and the Federal Reserve might be able to hold off catastrophe and continue to kick the can down the road with Band-Aids like they did with BTFP during the regional banking crisis, but they won’t be able to do it forever.

Similarly, the stock market may wind up going up over the course of the long term—with Larry Lepard making the best case for this on my last podcast with him while talking about a crack-up boom—but at some point, reality’s gonna have to hit and something’s gonna have to break first.

The continued talk of a soft landing is comical, in my opinion, and I believe it worthwhile to continue to harp on the fact that I believe for the market and economy, the very worst is still yet to come. With that, I continue to exercise caution.

QTR’s Disclaimer: I am an idiot and often get things wrong and lose money. I may own or transact in any names mentioned in this piece at any time without warning. Contributor posts and aggregated posts have not been fact checked and are the opinions of their authors. This is not a recommendation to buy or sell any stocks or securities, just my opinions. I often lose money on positions I trade/invest in. I may add any name mentioned in this article and sell any name mentioned in this piece at any time, without further warning. None of this is a solicitation to buy or sell securities. These positions can change immediately as soon as I publish this, with or without notice. You are on your own. Do not make decisions based on my blog. I exist on the fringe. The publisher does not guarantee the accuracy or completeness of the information provided in this page. These are not the opinions of any of my employers, partners, or associates. I did my best to be honest about my disclosures but can’t guarantee I am right; I write these posts after a couple beers sometimes. Also, I just straight up get shit wrong a lot. I mention it twice because it’s that important.

Tyler Durden

Fri, 11/10/2023 – 06:30

via ZeroHedge News https://ift.tt/XHxYotM Tyler Durden