Moody’s US Downgrade Shows Why Treasury Yields Are Sticky

By Ven Ram, Bloomberg Markets Live reporter and strategist

Moody’s downgrade of US credit-rating outlook to negative isn’t likely to rattle the markets unduly this week, but it offers a stark reminder as to why Treasuries find it so hard to rally despite it being so late in the economic cycle.

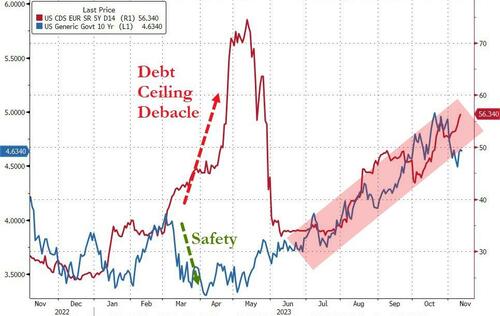

With S&P Global Ratings having downgraded the US more than a decade ago and Fitch having done so earlier this year, Moody’s is the last to follow suit — so there is no additional risk premium that investors are going to demand from US sovereign credit.

However, Moody’s action underscores why the neutral rate — a state of nirvana where the economy is at full employment without stoking inflation — has probably tilted higher in this cycle. There are a host of reasons: baby boomers and large shares of the population are already in retirement and tapping into their savings; geopolitical frisson has meant that some countries are less willing to channel their savings into the global financial system; huge capital investments required in green technology; and a possible shift in productivity from the rapid advance in artificial intelligence.

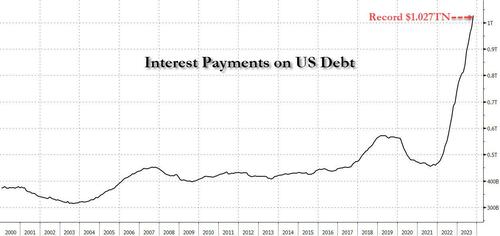

As though all these factors weren’t enough to push up the aggregate demand for capital, Moody’s downgrade offers another reason why investors are likely to be more demanding when it comes to a real rate that will offer them enough compensation for the risk of underwriting wider and wider deficits.

Moody’s itself offered a stark warning with its downgrade by commenting that “interest rates have shifted materially and structurally higher.”

Meanwhile, the possibility of a US government shutdown by the end of this week seems to be growing, but having been used to policy paralysis several times, traders are unlikely to lose sleep over the prospect.

Two-year Treasury yields have surged well more than 100 basis points since May to go past 5% as traders have recalibrated how long the economy can stay resilient.

At the margin, Moody’s action will keep it around there.

Tyler Durden

Mon, 11/13/2023 – 15:25

via ZeroHedge News https://ift.tt/7HbX1kB Tyler Durden