Yields Plunge, Stocks Soar, Dollar Tumbles As Fed Hikes Are Officially Over, Countdown To Cuts Begins

We have said on numerous occasions that the July rate hike was the Fed’s last, and today’s CPI data – which missed across the board and was only propped up by shelter inflation which is 12 month delayed and should be 0% – plus a tweet by Fed whisperer Nick Timiraos, aka Nikileaks, confirmed that the Fed is now done with its hiking cycle.

The October payroll report and inflation report strongly suggest the Fed’s last rate rise was in July.

The big debate at the next Fed meeting is shaping up to be over whether and how to modify the postmeeting statement to reflect the obvious: the central bank is on hold.

— Nick Timiraos (@NickTimiraos) November 14, 2023

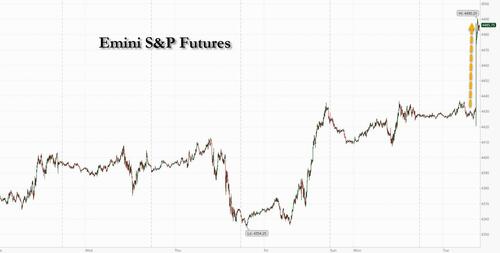

The market took the CPI miss and ran with it, sending futures soaring more than 1.4% with Nasdaq futures up 1.7%.

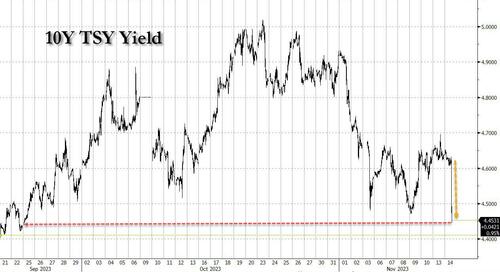

As stocks soared, so did treasuries futures which spiked to session highs and sending 10Y yields lower by almost 20 basis points, to 4.44% and the lowest since Sept 24.

That said, the long- and front-end of the curve actually led gains post-data, with the 2Y yield plunging 20 bps, while the 5s30s spread steepened by around 5bp on the day.

Finally, the dollar fell off a cliff, with the Bloomberg dollar index collapsing.

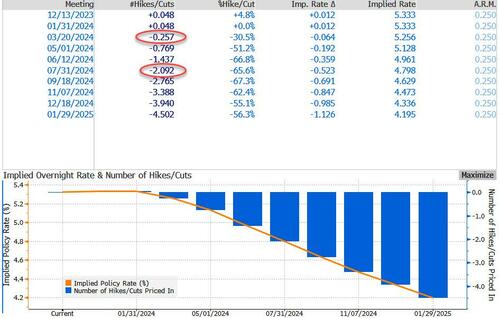

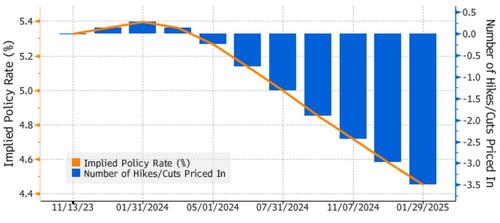

But the biggest news was that the market no longer is pricing in any more rate hikes in December or otherwise, and instead it is now giving roughly 25% odds to a rate cut in March and has fully priced in two rate cuts by July.

Compare this to yesterday’s fed funds futures chart which still gave reasonable odds to a Dec/January rate hike. Well, those are gone.

Why? Because as we pointed out immediately after the CPI print hit, it takes on average 8 months between the last rate hike and the first rate cut. That would put the first cut squarely in March.

It takes 8 months on average from the last rate hike to the first rate cut. So March https://t.co/J9IULydqcA pic.twitter.com/SXFwn95DEA

— zerohedge (@zerohedge) November 14, 2023

Tyler Durden

Tue, 11/14/2023 – 09:38

via ZeroHedge News https://ift.tt/R1HzOjG Tyler Durden