Futures, Treasuries Rise Amid Growing Rate Cut Bets As Oil Bear Market Signals Recession

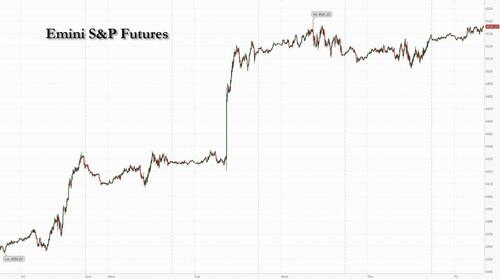

US equity futures rose and bond yields fell as the historic squeeze that started more than two weeks ago among the systematic and hedge fund communities is still going on after this week’s soft inflation and jobs data fueled conviction that aggressive tightening are finally at an end. As of 8:00am, S&P futures were 0.3% higher while Nasdaq futures rose 0.1%, both on course for a third weekly gain after Joe Biden signed the stopgap bill to extend government funding into early 2024 late last night, kicking a politically-divisive debate over federal spending into a presidential election year. Europe’s Stoxx 600 index jumped 1%, on track for an almost 3% rally this week. Asian stocks declined as Alibaba Group scrapped plans to spin off and list its $11 billion cloud business, dragging Chinese shares lower. Bonds climbed, putting the US 10-year yield on course to drop more than 25 basis points this week as markets now price a full percentage point of rate cuts next year from the ECB; the dollar slumped as the yen spiked to the highest level since Oct 31. Oil is headed for a fourth weekly loss after sinking into a bear market, in part as supply exceeds expectations.

In premarket trading, Gap soared 17% after reporting third-quarter profit that exceeded forecasts. Here are some other notable premarket movers:

- Alibaba ADRs fall 3.3%, extending Thursday’s decline after the internet giant called off a spinoff of its cloud unit, citing tightening US curbs on advanced chips for China.

- Applied Materials declines 7.3% after a report that the largest US maker of chipmaking machinery faces a US criminal investigation for allegedly violating export restrictions to China.

- ChargePoint tumbles 29% after the company replaced longtime CEO Pasquale Romano, elevating its chief operating officer following a sharp drop in the shares of the electric-vehicle charging company.

- Coherus Biosciences gains 9% after Baird initiated coverage with a bullish rating, saying the company’s broad commercial pipeline has positioned it for accelerating growth.

- Li Auto ADRs rise 3.8% after news that the Chinese carmaker and Wuxi AppTec will join the Hang Seng Index.

This week’s soft inflation and jobs data in the US has fueled conviction that the policy-tightening cycles from the Federal Reserve and other central banks are finally at an end and that rate cuts are coming. That view helped drive $23.5 billion into stock funds in the week through Nov. 15, the second-biggest inflows of the year, BofA’s Michael Hartnett said.

But there are signs the rate hikes are finally crimping economic growth. Oil prices dropped into a bear market, down 20% from their September highs while the CEO of Walmart, the world’s largest retailer, said on Thursday he sees potential for deflation.

“Eventually, we will get rate cuts, but as we see company earnings weakening and consumers cutting back on spending, that’s initially not going to be good for markets,” said Melissa R Brown, global head of research at Qontigo GmbH.

Meanwhile, Bank of America’s Michael Hartnett, who four weeks ago correctly recommended to go long ahead of a tactical rally, said that technical and macroeconomic headwinds are building and investors should offload risky assets after the recent gains, echoing what we wrote last night. While easier financial conditions — with yields dropping to 4% from 5% — have spurred risk appetite, a further slide to 3% would be perceived as recessionary, Hartnett said. A slew of central bankers from the ECB, Bank of England and Fed are due to speak on Friday and traders will be watching for possible pushback against rate-cut expectations from policy makers.

European stocks rose as investors ramp up bets on interest-rate cuts next year, while bonds also benefit. The Stoxx 600 is up 1.1% with all 20 sectors in the green: real estate and mining stocks leading gains while personal care and technology shares are the biggest laggards. Here are the biggest movers Friday:

- Vestas shares rise as much as 3.5%, after the Danish wind turbine manufacturer was upgraded to neutral from underweight at JPMorgan. The broker says the company is turning the corner as it reported onshore book-to-bill figures that underpin growth for 2024

- Orsted gains as much as 3.3%, after Citigroup opens a 3-month positive catalyst watch on the energy company, saying it welcomes a number of events coming in the short term

- Delivery Hero rises as much as 2.6%, as the potential acquisition of the company’s Foodpanda brand by Meituan is expected to be a positive for the German food delivery company, according to Barclays

- Remy Cointreau rises as much as 5.6% after Kepler Cheuvreux raised the rating of the French spirits company due to its attractive valuation and positive growth prospects

- Eiffage gains as much as 3.3%, the most in a month, after the French construction group signed a contract with French utility EDF worth more than €4b for the main civil engineering works for a pair of EPR2-type nuclear power plants

- Volvo Car shares tumble as much as 14%, to a record low, after Geely announced that it would sell around $350 million of its stake in the company due to investor concerns about the automaker’s limited free float

- London Stock Exchange Group falls as much as 1.6%, the worst performer on FTSE 100 on Friday, as a failure to upgrade earnings guidance in a statement ahead of Friday’s capital markets day disappoints analysts

- Generali falls as much as 2.6%, the most intraday since Oct. 20, as analysts highlight a Solvency ratio miss for the Italian insurer that overshadows a slight beat in nine-month operating profit, driven by the Life business

Earlier int he session, Asian stocks were undermined by a 10% drop in Alibaba Group Holding, which scrapped plans to list its $11 billion cloud unit as a fight between the US and China for technological dominance escalates. Meanwhile, Chinese billionaire Li Shufu’s Zhejiang Geely Holding Group Co. sold a $350 million stake in Volvo Car AB, responding to investor concerns about the automaker’s limited free float. Volvo Car’s stock tumbled as much as 14% in European trading.

- Hang Seng and Shanghai Comp were pressured amid heavy losses in Alibaba shares after it scrapped its cloud business spinoff due to US chip restrictions and with energy names reeling from the tumble in oil prices.

- Australia’s ASX 200 marginally declined with notable underperformance in the energy sector after oil prices slumped to their lowest since July although the downside in the index was cushioned by resilience in miners and defensives.

- Nikkei 225 was indecisive before moving higher amid a lack of fresh catalysts and after balanced comments from BoJ Governor Ueda.

- Key stock gauges in India fell on Friday, weighed down by shadow lenders and banks, which tumbled after the country’s central bank tightened rules to check a surge in risky loans. The S&P BSE Sensex Index fell 0.3% to 65,794.73 in Mumbai, while the NSE Nifty 50 Index slid 0.2%. The Sensex was still up for the week, rising 0.8% to mark the third week of gains.

In FX, the Bloomberg Dollar Spot Index is down 0.3% as the greenback declines for its second session of losses versus all its G-10 rivals after a rise in US jobless claims saw markets grow more confident the Federal Reserve is done hiking.

- USD/JPY fell as much as 0.8% to 149.53 as retreating Treasury yields eased pressure on the Japanese yen; Bank of Japan Governor Kazuo Ueda suggested he’s determined to keep stimulus unchanged

- GBP/USD fell as much as 0.3% to 1.2374 before paring losses, after weak UK retail sales data saw traders price 85bps of BOE rate hikes next year; gilts outperformed with yields down 9-11bps across the curve

In rates, Treasury yields were richer by 2bp to 3bp across the curve after touching lowest levels since September, paced by bigger rally in gilts after the release of softer-than-forecast UK retail sales data for October. 10-year TSY yields were around 4.405%, richer by ~3bp vs Thursday close, after touching 4.377%. Bunds also rally, with German 10-year yields falling by 7bps. UK 10-year borrowing costs drop 11bps as gilts got an added boost from soft UK retail sales data. The US session includes four Fed speakers, while some investors may have one eye on Monday’s 20-year bond auction, adding some supply pressure to Friday’s trading.

In commodities, oil was headed for a fourth weekly loss after sinking into a bear market, in part as supply exceeds expectations. Crude futures advanced, with WTI rising 1.1% to trade near $73.70, Spot gold gains 0.6%.

Looking to the day ahead now, US economic data includes October housing starts/building permits (8:30am) and November Kansas City Fed services activity (11am). Central bank speakers include ECB President Lagarde, and the ECB’s Villeroy, Holzmann, Vujcic, Nagel, Wunsch and Cipollone, the Fed’s Vice Chair for Supervision Barr, and the Fed’s Collins, Daly and Goolsbee, BoE Deputy Governor Ramsden, and the BoE’s Greene.

Market Snapshot

- S&P 500 futures up 0.2% to 4,531.00

- STOXX Europe 600 up 0.9% to 455.25

- MXAP little changed at 160.83

- MXAPJ down 0.6% to 500.39

- Nikkei up 0.5% to 33,585.20

- Topix up 0.9% to 2,391.05

- Hang Seng Index down 2.1% to 17,454.19

- Shanghai Composite up 0.1% to 3,054.37

- Sensex down 0.3% to 65,806.24

- Australia S&P/ASX 200 down 0.1% to 7,049.39

- Kospi down 0.7% to 2,469.85

- German 10Y yield little changed at 2.53%

- Euro little changed at $1.0854

- Brent Futures up 0.9% to $78.15/bbl

- Brent Futures up 0.9% to $78.14/bbl

- Gold spot up 0.5% to $1,991.74

- U.S. Dollar Index little changed at 104.26

Top Overnight News

- BOJ Governor Kazuo Ueda said that there are both positives and negatives to the weak yen’s impact, suggesting he’s determined to keep stimulus unchanged for now despite heightened concerns over the yen. BBG

- For the first time in years, a Chinese leader desperately needed a few things from the United States. Mr. Xi’s list at the summit started with a revival of American financial investments in China and a break in the series of technology export controls that have, at least temporarily, crimped Beijing’s ability to make the most advanced semiconductors and the artificial intelligence breakthroughs they enable. NYT

- Hyundai customers who want to skip going to a dealership will have a new option next year: shopping on Amazon.com. The South Korean automaker announced the move Thursday with Amazon at the Los Angeles Auto Show. Starting in 2024, U.S. auto dealers will be able to sell new vehicles on the tech company’s platform, making Hyundai the first automotive brand to offer such an option for customers. WSJ

- The ECB’s decision to halt interest rate increases at its October meeting is fully justified by a slowdown in inflation, Governing Council member Francois Villeroy de Galhau said. BBG

- Iran’s top diplomat has revealed that Tehran told the US through back channels that it did not want the Israel-Hamas war to spread further, but also warned Washington that regional conflict could be unavoidable if Israeli attacks on Gaza continue. FT

- UK retail sales fell unexpectedly in October, adding to the impression that a string of interest-rate hikes designed to beat down inflation is beginning to stymie economic activity. The volume of goods sold in stores and online dropped 0.3%, the Office for National Statistics said Friday. That follows a downwardly revised 1.1% decline in September, when unusually warm weather held back spending on clothing. BBG

- Rate-cut bets are back after soft inflation and US jobs data fueled conviction that central banks are done with aggressive tightening cycles. Markets now price a full point of ECB rate reductions next year and bets on BOE cuts by June may be brought forward after a surprise drop in retail sales. BBG

- GOOGL is delaying the release of its new conversational AI program, Gemini, from Nov until Q1:24, the latest setback for the company this area. The Information

- New York City will hold off on hiring new police officers, reduce trash pickups, make cuts to the city’s pre-kindergarten programs and lower spending on services for migrants to slash the city’s $110.5 billion budget. The 5% reduction will affect services for many New Yorkers and effectively trim the city’s police force to its smallest size since the 1990s by summer 2025, city budget officials said. BBG

- Foreigners no longer have an insatiable appetite for U.S. government debt. That’s bad news for Washington. The U.S. Treasury market is in the midst of major supply and demand changes. The Federal Reserve is shedding its portfolio at a rate of about $60 billion a month. Overseas buyers who were once important sources of demand—China and Japan in particular—have become less reliable lately. WSJ

A more detailed breakdown of overnight news from Newsquawk

Asia-PAcific stocks traded mixed with sentiment clouded after the recent soft US data and tumble in oil prices. ASX 200 marginally declined with notable underperformance in the energy sector after oil prices slumped to their lowest since July although the downside in the index was cushioned by resilience in miners and defensives. Nikkei 225 was indecisive before moving higher amid a lack of fresh catalysts and after balanced comments from BoJ Governor Ueda. Hang Seng and Shanghai Comp were pressured amid heavy losses in Alibaba shares after it scrapped its cloud business spinoff due to US chip restrictions and with energy names reeling from the tumble in oil prices.

Top Asian News

- China President Xi said China will continue to improve foreign investment mechanisms and is to further shorten the negative list on foreign investment. Furthermore, Chinese President Xi told Japanese PM Kishida that peaceful coexistence, lasting friendship and cooperation will serve the fundamental interests of Chinese and Japanese people, while he added that both sides should focus on common interests and properly handle differences.

- Japanese PM Kishida said there are many areas of common interests as well as issues between Japan and China, while he was able to reaffirm that they will work towards a strategic relationship based on mutual interests. Kishida also stated that he sought a calm response from China regarding the release of Fukushima wastewater and conveyed strong concerns regarding the situation over the disputed Senkaku Islands, as well as China’s increasing joint activities with Russia near Japanese waters.

- BoJ Governor Ueda said Japan’s economy is recovering moderately which will likely continue and that they will patiently maintain easy policy, while he noted they cannot say yet with conviction that the price target will be stably and sustainably met. Ueda said they will consider ending YCC and the negative rate if they can expect inflation to stably sustain the target and in what order they will change policy will depend on economic, price and market developments at the time. Furthermore, he said making strong commitments now on how they could change policy could have unintended consequences in markets and the BoJ does not have a specific plan yet on how it will sell ETFs, while he also stated they cannot say now when the BoJ will change ultra-easy policy.

- PBoC has reportedly asked some lenders to cap interest rates on an interbank debt instrument this month, according to Reuters sources, citing rising short-term yields on bank debt and strains in funding markets. Some large-sized commercial lenders were reportedly told not to sell negotiable certificates of deposit (NCDs) at very high rates, according to the sources.

- PBoC and Financial Regulators hold a meeting on financial issues; will strive to stabilise the property market; pledges to stabilise credit growth to strengthen the economy.

- Head of Japan’s largest trade union confederation says it will seek wage hikes for workers beyond 2024.

European bourses in the green, Euro Stoxx 50 +0.9%, and on track to conclude the week with upside in excess of 2.0% for the broader Stoxx 600, gains which largely derive from the US CPI and subsequent pronounced dovish price action. Sectors are higher across the board with Health Care, Real Estate & Basic Resources leading while Autos remain green but closer to stalling after reports around Volvo. Stateside, futures are also in the green but action is much more contained thus far, ES/NQ +0.2%, while the RTY +1.3% outperforms in a recovery from Thursday’s data prints. Tesla (TSLA) is set to raise prices in China again next week, according to Cailianshe citing an industry insider. “This will be the fourth time for Tesla to raise prices in China so far this year.”, according to National Business Daily.

Top European News

- ECB’s Villeroy says inflation has been lowered considerably and the recent policy pause is justified, via the ACPR conference.

- ECB’s Holzmann says “please don’t think that this is the last rate hike and there won’t be any more”; ECB ” may yet be forced to raise rates further if inflation shocks occur”, via Econostream.

FX

- DXY back on the brink of 104.00/multiple lows as yields crumble to the benefit of the Yen especially, USD/JPY retreats from 150.77 to sub-149.50 through stops at 150.00; USD/JPY currently near 149.25 lows.

- Sterling stumbles after a slump in UK retail sales, but Cable back above 1.2400 as Dollar reverses sharply.

- Euro retests key tech resistance vs Buck above 1.0850 amidst another stack of option expiries, spanning 1.0800-1.0910.

- Yuan breaks higher as Greenback weakens and PBoC moves to ease funding squeeze.

- PBoC set USD/CNY mid-point at 7.1728 vs exp. 7.2473 (prev. 7.1724)

Fixed Income

- Debt futures fly into the weekend as bullish/dovish impulses garner more momentum.

- Bunds extend to 131.74 and the 10-year yield hovers above 2.50%.

- Gilts reach 97.99 after dismal UK consumption data.

- T-note towards the top of 109-08+/108-22 range ahead of US housing metrics and another host of Fed speakers.

Commodities

- WTI and Brent Jan futures have been picking up after consolidating around USD 73.25/bbl and USD 77.50/bbl respectively overnight; though the benchmarks remain in relative proximity to Thursday’s troughs with substantial ground to recoup before that session’s peaks.

- Spot gold inches closer towards USD 2,000/oz as it trades just under the 6th November peak of USD 1,993.15/oz whilst spot silver topped USD 24/oz once again.

- Base metals are softer amid broader weakness in industrial commodities with 3M LME copper briefly dipping under USD 8,200/t, Dalian iron ore continued to slip after the week’s market intervention by China; though, a reported recovery in steel demand stemmed the downside.

- Iran set December Iranian light crude price to Asia at Oman/Dubai + USD 4.00/bbl, according to a Reuters source.

Geopolitics

- Syrian air defences confronted enemy targets and shot down Israeli missiles fired from Golan Heights.

- US Secretary of State Blinken spoke with Israeli Minister Gantz and discussed efforts to accelerate the transit of humanitarian aid into Gaza, as well as efforts to prevent the conflict from widening and to secure the release of hostages. Blinken also stressed the urgent need for affirmative steps to de-escalate tensions in the West Bank including confronting rising levels of settler extremist violence.

- Iraqi armed factions say they targeted the Harir base (hosts US forces) in northern Iraq, according to Al Arabiya

- “A truce agreement is near, including the entry of aid and release of 50 prisoners held by Hamas”, via Al Arabiya sources

US Event Calendar

- 08:30: Oct. Building Permits, est. 1.45m, prior 1.47m, revised 1.47m

- 08:30: Oct. Housing Starts, est. 1.35m, prior 1.36m

- 08:30: Oct. Building Permits MoM, est. -1.4%, prior -4.4%, revised -4.5%

- 08:30: Oct. Housing Starts MoM, est. -0.6%, prior 7.0%

- 11:00: Nov. Kansas City Fed Services Activ, prior -1

Central Bank Speakers

- 08:45: Fed’s Barr Speaks on Payments

- 08:45: Fed’s Collins Delivers Welcoming Remarks

- 09:30: Fed’s Daly Speaks in Frankfurt

- 09:45: Fed’s Goolsbee Speaks on Economy

DB’s Jim Reid concludes the overnight wrap

Speculation about a dovish pivot grew louder over the last 24 hours, as a bunch of negative data added to the sense that the Fed was done hiking rates. Time will tell whether that proves the case, but for now at least, it meant the 2yr Treasury yield (-7.4bps) almost closed at its lowest level since August, whilst investors moved to expect more aggressive rate cuts for 2024, with just under 100bps now priced in by the Fed’s December meeting. That narrative then got an added boost from a slump in oil prices, with Brent Crude (-4.63%) closing at its lowest level since July, which in turn offered fresh support to the sense that inflation was heading lower.

The initial catalyst for these moves were the latest jobless claims data from the US. That showed initial claims spiking up to their highest since August, at 231k (vs. 220k expected), whilst the continuing claims hit their highest since late-2021, at 1.865m (vs. 1.843m expected). 45 minutes later, that was then followed up by the industrial production release for October, which fell by a bigger-than-expected -0.6% (vs. -0.4% expected). And in another 45 minutes, we found out that the NAHB’s housing market index had fallen to 34 in November (vs. 40 expected), which was the lowest reading since last December. So this all added up to a more downbeat picture on the economy than previously thought.

This softening in the data has led to growing hopes for a soft landing with a smooth decline in inflation. But the problem is that if we do get a hard landing, then the data will initially soften in a way that may appear like a soft landing at first. So at some point we’d need to see a stabilisation in measures like the continuing jobless claims and the unemployment rate, as the former is now at its highest since late-2021, and the latter is now at its highest level since January 2022.

For now at least, markets are mostly taking the more positive interpretation, and November so far has seen one of the strongest performances for global markets of 2023. That’s been aided by expectations of more dovish central banks, and yesterday saw investors bring forward their expectations for rate cuts yet again. For instance, by the close fed funds futures were pricing a 35% likelihood of a cut as soon as the March meeting, and a 86% likelihood of a cut by the May meeting. Likewise at the ECB, markets were pricing in an 87% likelihood of a cut by April. So market pricing is suggesting it’s more-likely-than-not that we’ll have seen a rate cut from the Fed and the ECB in Q2 of next year.

When it came to central bankers themselves, there was no sign that the rhetoric was shifting towards imminent cuts. For instance, Cleveland Fed President Mester said that they needed to see evidence that inflation was on a downward path, and that easing policy “is just not part of the conversation right now”. Separately, Governor Cook said that momentum in demand “could keep the economy and labor market tight and slow the pace of disinflation”, but she also acknowledged the risk “of an unnecessarily sharp decline in economic activity and employment”.

For markets, the more dovish expectations of investors led to a fresh rally in sovereign bonds on both sides of the Atlantic. In the US, that saw the 10yr yield fall -9.6bps to its lowest level since September, at 4.44%, whilst the 2yr yield was down -7.4bps to 4.84%. In Europe it was much the same story, with the rally seeing yields on 10yr bunds (-5.4bps), OATs (-5.7bps) and BTPs (-8.9bps) all move lower. And the 2yr German yield (-6.3bps) even fell back to a 3-month low.

Another factor adding to the positive mood on inflation was the latest decline in oil prices yesterday, with Brent Crude down -4.63% to $77.42/bbl, whilst WTI fell -4.90% to $72.90/bbl. In both cases that’s their lowest level since early July, and we’ve also seen evidence that lower energy prices are already filtering through to retail prices. For example, the AAA’s daily gasoline price tracker in the US was down to $3.342/gallon on Wednesday, which is its lowest level since January. In part, those declines are thanks to concerns about economic demand, particularly given the weaker global data over recent weeks. But they also follow a Wednesday report from the US Energy Information Administration saying that crude inventories were at their highest level since August .

When it came to equities, there was a more mixed performance after the data releases and various earnings announcements with large caps outperforming. That meant the S&P 500 (+0.12%) posted a modest gain to close at its highest level since September 1, with insurance (+1.24%) and software (+1.17%) firms posting strong gains while energy stocks saw the worst sectoral performance thanks to the sharp decline in oil and gas prices. At the company level, Cisco Systems (-9.83%) was the worst performer in the index following the release of its weaker revenue forecast after the previous day’s close. And the second-worst performer was Walmart (-8.09%), which came as they struck a cautious outlook on the consumer. Small-cap stocks struggled in particular with the Russell 2000 down -1.52%. European equities put in a weaker performance than the US, with the STOXX 600 down -0.72%.

Overnight in Asia, equity markets are mostly falling this morning, with Alibaba down -10.08% after they said they would not spin off its cloud business. That makes it the worst performer in the Hang Seng today, with the overall index down -2.13%. Other indices have also lost ground this morning, including the CSI 300 (-0.51%), the Shanghai Comp (-0.28%) and the KOSPI (-0.85%). However, the Nikkei (+0.27%) has advanced somewhat, and US equity futures are pointing higher, with those on the S&P 500 up +0.09%.

To the day ahead now, and data releases include UK retail sales for October, along with US housing starts and building permits for October. Central bank speakers include ECB President Lagarde, and the ECB’s Villeroy, Holzmann, Vujcic, Nagel, Wunsch and Cipollone, the Fed’s Vice Chair for Supervision Barr, and the Fed’s Collins, Daly and Goolsbee, BoE Deputy Governor Ramsden, and the BoE’s Greene.

Tyler Durden

Fri, 11/17/2023 – 08:11

via ZeroHedge News https://ift.tt/YmdfFyP Tyler Durden