Inflation, Deflation, Cooperation, Confrontation

By Benjamin Picton, Senior Strategist at Rabobank

Inflation, Deflation, Cooperation, Confrontation

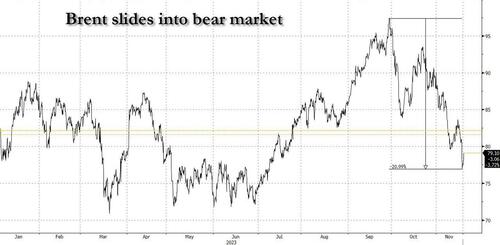

Brent crude prices were walloped yesterday; front month futures dropped more than 4.5% to close at $77.52/bbl. That’s soft enough for our own Joe DeLaura to suggest a move to $71.50/bbl is now firmly in the crosshairs. Crude has been under pressure for much of this week after the International Energy Agency suggested that the market would be in surplus early next year and the US Energy Information Administration disclosed a much larger build in inventories than had been expected. Reports that Iranian Supreme Leader Khameini told Hamas that “we will not enter the war on your behalf” (since denied by Hamas), have also added to bearish sentiment.

The big drop in oil was no doubt compounded by technical and market positioning considerations, but markets have latched on to fundamental arguments to justify lower prices (at least in the short term). Concerns that the weak residential real estate sector in China will act as a drag on activity were again highlighted this week by worse than expected property investment figures for October (-9.3% YTD) and further falls in residential property sales (-3.7% y-o-y). Similarly, US data yesterday painted a dimmer picture of the economy as October industrial production of -0.6%, manufacturing production of -0.7% and capacity utilization of 78.9% all underperformed the consensus forecasts on the Bloomberg survey.

So, the jubilant market reaction to the soft US CPI print on Tuesday appears to have been short-lived. US stocks struggled for traction yesterday with the SP500 and NASDAQ eventually posting small gains, while the Dow Jones fell slightly. Concern seems to be creeping in that the much-feted ‘soft landing’ might end up being a little less soft than originally billed. US jobless claims reinforced this perception after initial claims rose more than expected (231k vs 220k forecast) and continuing claims recorded the highest reading since November of 2021.

Rapidly falling energy prices and stalling economic activity are already being reflected in prices. US PPI followed CPI by surprising on the downside this week, and the New York Fed’s 1-year inflation expectations fell. We also learned this week that UK CPI in October fell faster than expected after the headline figure printed at 4.6% y-o-y and the core at 5.7%. Obviously there is still a long way to go from there, but monetarists will feel vindicated to see disinflation outpacing forecasts in several countries as measures of money supply contract.

Barring escalation in the Middle East, it seems reasonable to expect further disinflation in the months ahead. US trade data released on Thursday showed import prices falling by 0.8% in October versus a consensus forecast of just 0.3%, while export prices dropped even further to record a decline of 1.1% m-o-m. Those cheaper goods imports come courtesy (at least in part) of producer price deflation in China, and would have been brought in for the Black Friday sales and the lead up to Christmas. Walmart CEO Doug McMillon raised some eyebrows yesterday by suggesting that we’re in for a soft Christmas trading period despite solid retail sales in October and September. Of particular note, he said that “in the US, we may be managing a period of deflation in months to come.”

Moves in markets aside, the big event this week was the APEC conference in San Francisco, and particularly the meeting between Xi Xinping and Joe Biden. The meeting appears to have been a qualified success and led to a clear thawing in relations. The two leaders have made new commitments to restore communications between their militaries, cooperate on climate change and restrict the flow of chemicals used to produce fentanyl into the United States.

It hasn’t all been smooth sailing though. Biden drew a cringe from his Secretary of State when he referred to Xi as a dictator, and Xi told Biden to stop arming Taiwan, whose reunification with the mainland he described as “unstoppable”.

Indeed, beneath the bonhomie the red lines still intersect, and it is difficult to see either side giving ground. An official statement from the Chinese foreign ministry quoted Xi as saying that China and the USA are faced with two options: “One is to enhance solidarity and cooperation and join hands to meet global challenges and promote global security and prosperity; and the other is to cling to the zero-sum mentality, provoke rivalry and confrontation.”

Which one will they choose?

Tyler Durden

Fri, 11/17/2023 – 10:25

via ZeroHedge News https://ift.tt/0M3PkWT Tyler Durden