“Only Conviction For 2024 Is Market Consensus Won’t Equal Success”

By Ven Ram, Bloomberg Markets Liver reporter and strategist

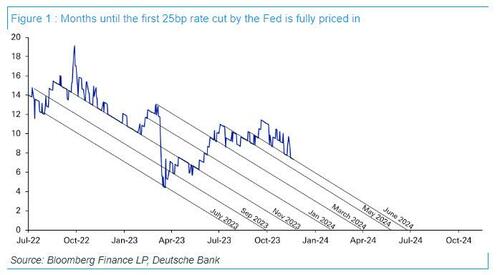

Come June, the macroeconomic landscape will be so fundamentally different that central banks in most developed economies will be doing an about-turn to start slashing interest rates. Or so the markets reckon. But beware the consensus trade.

There are instances in life when there is strength in numbers, but sticking with the consensus doesn’t often work out well from the perspective of managing a portfolio. You don’t have to rewind too far back into the past to find some glaring examples. At the start of the year, median expectations from our MLIV Pulse survey were that the 10-year Treasury yield would end 2023 at 3.50%. Yet we are here at 4.40% despite a rally over the past week.

The S&P 500 was supposed to be hovering around 4,000. Never mind that we are now almost 15% higher. Six months ago, traders were pricing almost 50 basis points of policy loosening from the Federal Reserve by the end of 2023. We all know that barring a catastrophe, that pricing isn’t about to fructify.

The markets had similarly priced out the prospect of further tightening from Australia. And yet not only did the nation’s central bank raise rates earlier this month, but its governor also sounded a warning shot across the bow just this morning by pointing to elevated inflation expectations.

Heading into 2024, investors are now convinced that inflation will recede so obediently as to persuade the major central banks to start cutting rates to accommodate weaker economies. That conviction seems to be growing by the day. But it’s often the contrarian trade that pays off.

Not too long ago, when asked about the assessment of inflation dynamics in the aftermath of the pandemic, Fed Chair Jerome Powell said: “We are going to have to be humble, but a bit nimble.” What he said on inflation may well resonate for positioning oneself relative to consensus.

Tyler Durden

Tue, 11/21/2023 – 10:35

via ZeroHedge News https://ift.tt/gTu0cK7 Tyler Durden