High-End Retailers Face Downturn As Wealthy Americans Cut Back On Spending

As Black Friday looms, a concerning trend has emerged: Affluent Americans are cutting back on spending – a shift which signals potential trouble for an economy reliant on robust consumer expenditure to ward off recession.

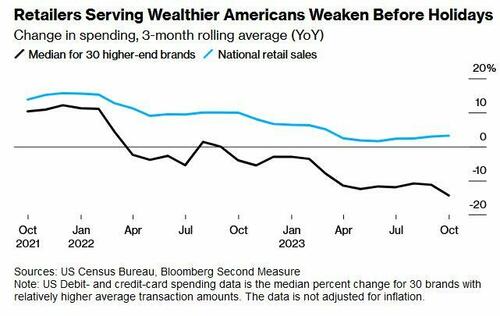

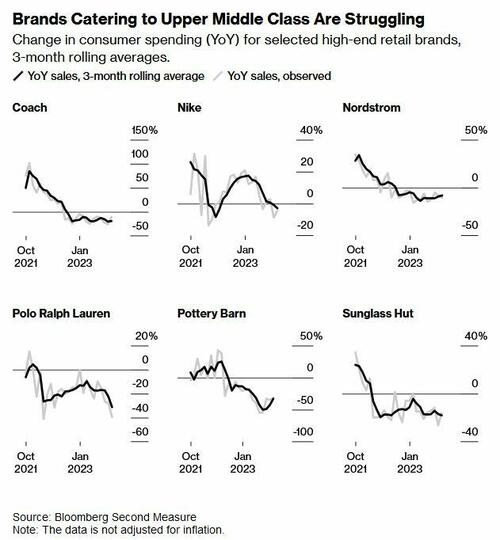

According to Bloomberg Second Measure Data of debit/credit card transactions by US consumers, in the three months leading to the holiday season, a collection of retailers serving the upper middle class, such as Apple, Coach, and Nordstrom, experienced their steepest sales decline in two years. This data, derived from Bloomberg Second Measure, also reflects a downturn in affluent mall traffic, contradicting the general uptick in retail sales figures.

On Tuesday, Best Buy Co. and Lowe’s Cos. cut their forecasts and warned that shoppers were pulling back on big-ticket items like appliances ahead of the holiday season. Kohl’s Corp. reported its seventh-straight drop in comparable sales, as a partnership with Sephora drew in customers but didn’t spur them to spend more money on other items at the department stores. Even positive results at some retailers left investors wanting more as shares slumped at Abercrombie & Fitch Co. and American Eagle Outfitters Inc. –Bloomberg

Kayla Bruun, a senior economist at Morning Consult, notesthat the upper middle class “had been driving a lot of the stronger-than-expected spending.” However, households with incomes over $100,000 are becoming more frugal.

Bloomberg’s affluence index, comprised of 30 high-end retailers across various sectors, shows a marked deterioration in sales. All of the companies in the index have an average purchase price of at least $100, with some retailers such as Apple ($267) and West Elm ($292) far surpassing that. Since January, 70% of these companies experienced a sales decline, with a median drop of 14% — the worst in two years. The few exceptions, like Ugg, are in the minority.

Seattle resident Julie Robinson-Jasper, whose household income exceeds $100,000, is planning to tighten the reins this year – capping gifts for her two kids at $600 (consistent with the past three years, but with less purchasing power thanks to Bidenonimcs). Her family is also employing cost-saving measures like dining at home and checking out thrift stores. We don’t want to be caught with our pants down if something were to happen again, like a layoff or an illness,” she told Bloomberg.

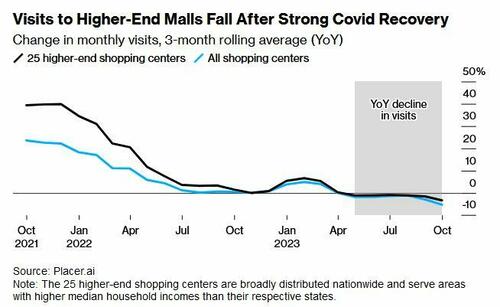

Meanwhile, according to data from Placer.ai, a similar trend is happening with mall foot traffic, particularly in affluent areas. In October, 21 out of 25 top shopping destinations across the US reported a decrease in visits – from Birmingham, Alabama, to Garden City, New York, and Bellevue, Washington. This decline, the first since early 2021, could be an early warning sign for the overall economy.

The softness extends to areas that have gained population post pandemic. On the outskirts of booming Houston, where household income is 20% higher than in Texas overall, the Baybrook Mall saw foot traffic drop by 660,000 visits this year, or about 6%, according to Placer.ai, which analyzes mobile-phone location data. -Bloomberg

“Everybody is kind of in window-shopping behavior right now,” says Bre Clinton, an assistant manager at the Body Shop in Baybrook Mall, Texas. “They don’t have many bags in their hands.“

To entice customers, the store has resorted to giving away trial-size products.

Interestingly however, Brookfield Properties, owner of Baybrook Mall, reported an increase in retail sales in the past 12 months, suggesting a complex and varied retail landscape.

However, the broader economic context cannot be ignored. Persistent high inflation and rising interest rates have dampened consumer moods. The Federal Reserve’s significant rate hikes have made credit purchases, like for luxury items and appliances, more costly.

The slowdown at malls and retailers serving the upper middle class contrasts with the headline US retail-sales numbers, which have posted year-over-year growth since 2020, when the pandemic shut the economy down. While in lockdown, higher-end shoppers began splurging on their homes and new wardrobes. As Covid faded, spending shifted to services and experiences like vacations, restaurants and Taylor Swift concerts.

But years of high inflation and rising interest rates have soured the moods of some consumers. While the job market has remained strong, real incomes have had periods of decline, with parts of the upper middle class taking a bigger hit. -Bloomberg

According to Brunn, the Morning Consult senior economist, richer Americans have grown increasingly worried about their jobs, and are opting to pay off debt after splurging on summer travel. Shoppers have already reduced spending on big-ticket items such as washing machines, Botox and teeth straightening.

Edel O’Sullivan of Harley-Davidson encapsulates the sentiment, noting customers are “sitting on the sidelines” and “just putting this level of a discretionary purchase to the side in 2023.”

Revolve Group’s Co-CEO, Mike Karanikolas, echoes this concern, pointing to the diminished spending capacity of “aspirational luxury consumers.”

“Aspirational luxury consumers who were flush with cash 18 months ago just don’t have the same capacity to spend,” he said.

The pullback in spending by wealthier Americans is not just a blip, but yet another barometer of the economy’s health. With real incomes declining and property values in major markets dropping, the upper middle class’s spending cuts could presage broader economic challenges. As this key demographic pulls back, the ripple effects may be felt across various sectors, from retail to real estate, potentially steering the US economy into uncharted waters.

Tyler Durden

Tue, 11/21/2023 – 14:45

via ZeroHedge News https://ift.tt/Xe9MfGm Tyler Durden