Nvidia Reports Blowout Earnings, But Warns Of “Significant” China Slowdown, Guidance Matches Whisper Range; Stock Drops

As we wrote in our preview of NVDA’s Q3 earnings, it is safe to say that more were paying attention to today’s earnings report from Nvidia than did to all of the other giga caps or frankly any other company this quarter, thanks to the thunderous, impact Nvidia has had on the broader market in general, and the AI bubble in particular. And while the excitement may not have been as palpable as last quarter when JPM trader Stuart Humphrey said “The anticipation is LITERALLY killing us!” (clearly he was LITERALLY wrong since he is still alive), UBS said that while positioning has come down from a scale of 10 in last print to 9 now, expectations remain stratospheric and while sentiment is better than last print, it isn’t as strong as the Goldilocks scenario into May Print that saw a +25% move (spoiler alert: they were right).

Well, the anticipation is finally over, and moments ago NVDA reported Q3 earnings that crushed estimates, but warned of a “significant” slowdown in China sales and gave Q4 guidance that while also above consensus, at best matched the top end of the whisper range, which may have disappointed some as it shows that even NVDA may have finally hit limit to its growth.

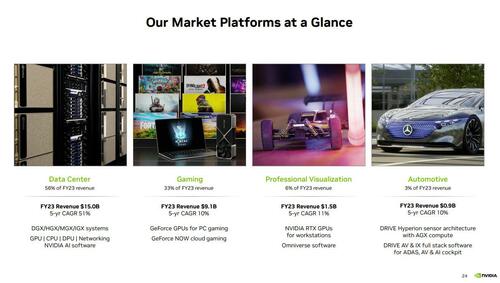

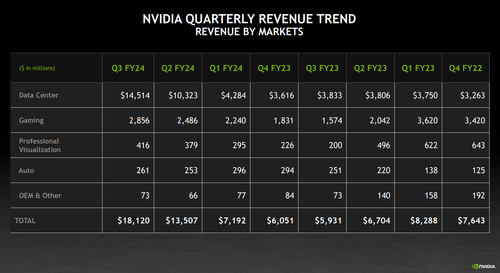

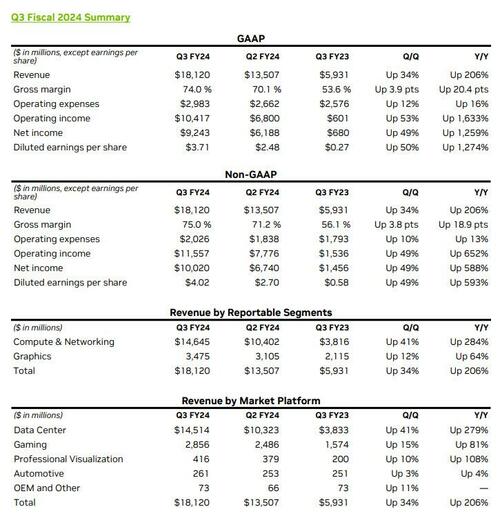

Here are the Q3 results that NVDA just reported (press release link; CFO commentary link).

- Adjusted EPS $4.02 vs. 58c y/y, smashing estimate $3.36

- Revenue $18.12 billion vs. $5.93 billion y/y, blowing away estimates $16.09 billion

- Data center revenue $14.51 billion vs. $3.83 billion y/y, beating estimates of $12.82 billion

- Gaming revenue $2.86 billion, +82% y/y, beating estimates of $2.7 billion

- Professional Visualization revenue $416 million vs. $200 million y/y, beating estimate $409.2 million

- Automotive revenue $261 million, +4% y/y, estimate $266.9 million

Some more details on the revenue breakdown:

- Data Center revenue was a record, up 279% from a year ago and up 41% sequentially. Strong sales of the NVIDIA HGX platform were driven by global demand for the training and inferencing of large language models, recommendation engines, and generative AI applications. Data Center compute grew 324% from a year ago and 38% sequentially, largely reflecting the strong ramp of our Hopper GPU architecture-based HGX platform from cloud service providers (CSPs), including GPU-specialized CSPs; consumer internet companies; and enterprises.

The chart below shows all you need to know about the company’s main revenue driver

- Gaming revenue was up 81% from a year ago and up 15% sequentially. Strong year-on-year growth reflects higher sell-in to partners following normalization of channel inventory levels. Sequential growth reflects strong demand for our GeForce RTX 40 Series GPUs for back-to-school and the start of the holiday season.

- Professional Visualization revenue was up 108% from a year ago and up 10% sequentially. The year-on-year increase reflects higher sell-in to partners following normalization of channel inventory levels. The sequential increase was primarily due to stronger enterprise workstation demand and the ramp of notebook workstations based on the Ada Lovelace GPU architecture.

- Automotive revenue was up 4% from a year ago and up 3% sequentially. The year-on-year increase primarily reflects growth in sales of auto cockpit solutions and self-driving platforms. The sequential increase was driven by sales of self-driving platforms.

Going down the line:

- Adjusted gross margin 75% vs. 56.1% y/y, beating the estimate 72.5%

- R&D expenses $2.29 billion, +18% y/y, higher than the estimate $2.21 billion

- Adjusted operating expenses $2.03 billion, +13% y/y, beating the estimate $2 billion

- Adjusted operating income $11.56 billion vs. $1.54 billion y/y, beating the estimate $9.67 billion

- Free cash flow $7.04 billion vs. negative $156 million y/y, missing estimates $7.17 billion

Gross Margin:

- GAAP and non-GAAP gross margins increased significantly from a year ago and sequentially, driven by improved product mix from Data Center revenue growth and lower net inventory provisions and related charges.

Expenses:

- GAAP operating expenses were up 16% from a year ago and up 12% sequentially, driven by compensation and benefits, including stock-based compensation, primarily reflecting growth in employees and compensation increases.

- Non-GAAP operating expenses were up 13% from a year ago and up 10% sequentially, primarily reflecting growth in employees and compensation increases.

- “We are monitoring the impact of the geopolitical conflict in and around Israel on our operations, including the health and safety of our approximately 3,400 employees in the region who primarily support the research and development, operations, and sales and marketing of our networking products. Our operating expenses in the third quarter of fiscal 2024 include expenses for financial support to impacted employees and charitable activity.”

The financial results in a nutshell:

Commenting on the results, CEO Jensen Huang said that “our strong growth reflects the broad industry platform transition from general-purpose to accelerated computing and generative AI…. Large language model startups, consumer internet companies and global cloud service providers were the first movers, and the next waves are starting to build. Nations and regional CSPs are investing in AI clouds to serve local demand, enterprise software companies are adding AI copilots and assistants to their platforms, and enterprises are creating custom AI to automate the world’s largest industries…. NVIDIA GPUs, CPUs, networking, AI foundry services and NVIDIA AI Enterprise software are all growth engines in full throttle. The era of generative AI is taking off,” he said.

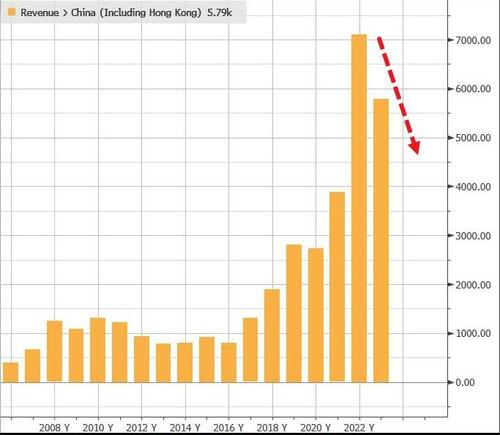

Maybe it is… but China is starting to stumble, because as the company admitted, sales to China “will decline significantly in the fourth quarter of fiscal 2024, though we believe the decline will be more than offset by strong growth in other regions” to wit:

Our sales to China and other affected destinations, derived from products that are now subject to licensing requirements, have consistently contributed approximately 20-25% of Data Center revenue over the past few quarters. We expect that our sales to these destinations will decline significantly in the fourth quarter of fiscal 2024, though we believe the decline will be more than offset by strong growth in other regions.

The market did not like that. It also did not like that the guidance (which handily beat consensus) was only inside the top end of the whisper range, which recall according to JPM, cash trader Stu Humphrey was $18.5-21.6bn, with the company guiding $20BN, or about $1.6 billion below the top end of the range. Here is NVDA’s Q4 guidance:

- Revenue is expected to be $20.00 billion, plus or minus 2%.

- GAAP and non-GAAP gross margins 74.5% and 75.5%, plus or minus 50 basis points.

- GAAP and non-GAAP operating expenses $3.17 billion and $2.20 billion, respectively.

- GAAP and non-GAAP other income and expense $200 million

- GAAP and non-GAAP tax rates 15.0%, plus or minus 1%.

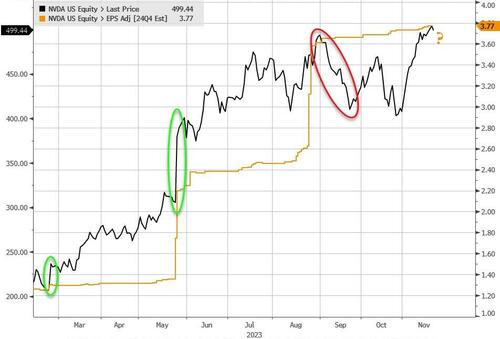

So how did the market react? Well, the solid Q3 earnings were certainly good news… but the warning about declining China sales and especially the Q4 guidance which was inside the top end of the whisper guidance, was not quite as exciting as the last two quarter and as a result the stock initially dumped as much as $30 after hours, before recovering most of its losses, but has since resumed drifting lower again…

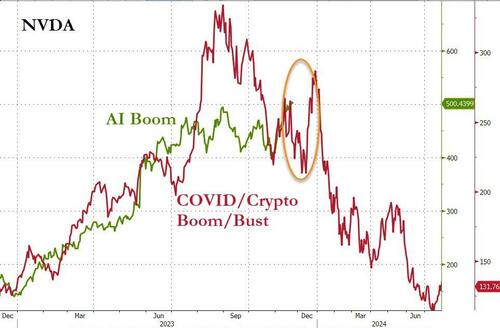

… setting up the stock for its first post-earnings drop since the advent of ChatGPT almost exactly one year ago.

Which begs the question: now that Nvidia performed only in line, was this it for the tech/Mag 7 rally?

For those who missed it, here is Nvidia latest investor presentation from October (pdf link)

Tyler Durden

Tue, 11/21/2023 – 17:23

via ZeroHedge News https://ift.tt/8dMKXDn Tyler Durden