Futures Flat In Quiet Session As ECB Signals End Of Rate Hikes

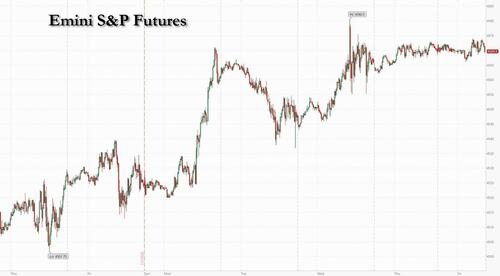

US equity futures and European stocks rose on the last day of the holiday-shortened week, with sentiment boosted after ECB President Christine Lagarde said policymakers are now in a position to pause after a tightening cycle that risks plunging the euro area into a recession. At 7:45am, both S&P and Nasdaq futures rose 0.1%, while treasuries dropped as they reopened after Thanksgiving, following a slide in European bonds after Germany suspended a constitutional limit on net new borrowing; 10Y TSY yields rise 7bps to 4.47%. The dollar dipped and bitcoin made another run for $38,000.

In premarket trading, Nvidia dropped 1.7% after a Reuters reported that the chip company has told customers in China it is delaying the launch of a new artificial intelligence chip until the first quarter. Tesla dips 0.8%, coming under pressure amid the prospect of steeper price cuts from competitor BYD for its Dynasty series models and an ongoing strike in Sweden. Some other notable premarket movers:

- CleanSpark gains 1.9% as shares of cryptocurrency-linked stocks rise in the premarket session with Bitcoin advancing.

- IRobot jumps 30% as Reuters reports that Amazon is set to win unconditional EU antitrust approval for its acquisition of the household appliance company.

Global stocks are on track for the best month in three years, with the MSCI All Country World Index up 8.6% this month amid growing hopes for peaking US interest rates. Traders are awaiting manufacturing data from the world’s biggest economy later Friday for further clues on the policy path.

“Lower bond yields are driving equity valuations, although the fundamental reason behind the drop in yields, lower inflation caused by weaker growth, isn’t completely discounted into earnings estimates,” said Kyle Rodda, a senior analyst at Capital.com in Melbourne. “Eventually, profit expectations will have to align with economic reality.”

With US markets quiet, European sentiment got a boost after Lagarde said the ECB is now at a point where it can assess the impact of its tightening, echoing other policy makers who suggested on Friday that further tightening may not be necessary. An improvement in German business confidence provided another ray of light against a gloomy economic backdrop for the region. ECB Governing Council Member Robert Holzmann said there’s equal probability of a rate hike or cut in the second quarter of 2024, while his colleague Francois Villeroy de Galhau said the central bank won’t increase borrowing costs again, unless there is an unexpected event.

“It seems the worst for the euro area economy could be behind us,” said Karsten Junius, chief economist at Bank J. Safra Sarafin Ltd. “The economic dynamic is not deteriorating further and might stabilize at low levels instead. This might provide the ground for slightly stronger private consumption in the coming quarters.”

The Stoxx Europe 600 index was about 0.2% higher on course to log a second weekly gain and on track for its best month since January. Energy and insurance stocks were the biggest gainers, while miners and consumer shares lagged.BASF SE led an advance for the chemical sector after Bloomberg News repored that Abu Dhabi National Oil Co. is exploring an acquisition of its Wintershall Dea unit. Here are the other biggest movers Friday:

- Evonik rises as much as 1.8%, as Stifel upgrades the German chemicals manufacturer to buy from hold, citing increasing confidence in its earnings recovery in 2024

- MFE shares advance as much as 5.6%, adding to a 6.2% gain on Thursday, after the broadcaster reported solid results with a positive advertising outlook. Kepler Cheuvreux upgraded the stock to hold from reduce

- U-blox shares gain as much as 3.3% after Kepler Cheuvreux lifted the Swiss wireless communications technologies provider’s price target, saying its exit from the cellular chipset research and development “arms race” against more resourceful competition is positive

- Sage falls as much as 2.3% on Friday, easing from a record high, after Canaccord Genuity downgrades the software firm to sell from hold. The stock’s strong rally since its FY23 results presents a “compelling” profit taking opportunity, analyst Kai Korschelt says

- Mercedes Benz falls as much as 1.1% and Porsche slips 2% after Barclays analysts downgrade their recommendations on the carmakers

- Ambea falls as much as 7.9%, the most since February, after investment group Triton’s ACTR Holding sold 8.4 million shares in the Swedish care-home operator at SEK43.5, representing a 9.4% discount versus Thursday’s close

- Team17 drops by a record 42% in London as the maker of the Dredge fishing adventure videogame warns some of its titles are not performing as well as it had expected, and adds it’s being “too slow to address some project overspends”

A gauge of business expectations in the euro area’s biggest economy rose for a third month in November, pointing to an impending recovery for an economy that is probably in a recession and beset by a budget crisis. Data on economic output earlier had highlighted Germany’s struggle to recover from an energy-induced downturn last winter and the mounting impact of higher borrowing costs.

Earlier in the session, Asian stocks were mixed. Hong Kong and mainland Chinese equities dropped, reversing Thursday’s rally inspired by Beijing’s widening property rescue campaign. Japanese stocks rose in catch-up play after a national holiday, while those in Australia also gained. In China, a gauge of developer stocks fell 1.9% in mid-afternoon trade, following a 8.9% jump Thursday. The previous surge came after Bloomberg News reported that China may allow banks to offer unsecured short-term loans to qualified builders.

- Hang Seng and Shanghai Comp were pressured despite the lack of obvious catalysts, while PBoC liquidity efforts and news that China is mulling unprecedented support for the property sector by allowing banks to offer unsecured short-term loans to qualified developers have failed to support the risk tone.

- ASX 200 was led higher by strength in utilities, financials and the energy sector albeit with gains capped by tech weakness and after an Australian warship sailed through the Taiwan Strait which risks stoking frictions between Australia and its largest trading partner.

- Nikkei 225 outperformed on return from its holiday closure as participants digest data releases including national CPI which printed softer than expected although mostly accelerated from the previous month.

In FX, the Bloomberg Dollar Spot Index is flat, as is the euro, with little reaction to German IFO data. JPY appreciated 0.2% before erasing gains. The pound rises 0.2% versus the greenback. The yen climbed after the nation’s key inflation measure accelerated for the first time in four months, staying well above the Bank of Japan’s 2% target. The Aussie dollar hit its session high of 0.6570 after a couple of exporters entered the market at about the same time to buy spot from local banks, according to Asia-based FX traders

In rates, Treasuries dropped after trading resumed following a holiday, paring gains for the month. The 10-year yield rose more than six basis points to 4.47%, tracking declines in European bonds following a report Thursday that Germany will suspend debt limits for a fourth consecutive year, adding to concerns over more borrowing.

In commodities, Brent oil gained above $81 a barrel after dropping 1.3% over the previous two sessions, while US counterpart West Texas Intermediate was below $77 a barrel following the US Thanksgiving break. The OPEC+ alliance was forced to delay pivotal talks amid a dispute over output quotas, casting a pall of uncertainty over the group’s production policy for next year. The delayed OPEC+ discussions next week will be held online instead of in-person, with Saudi Arabia and its allies embroiled in a dispute over African members’ production levels. Spot gold adds 0.1%.

Looking to the day ahead now, and data releases include the German Ifo business climate indicator for November, along with the US flash PMIs for November. Otherwise, central bank speakers include ECB President Lagarde and Vice President de Guindos.

Market Snapshot

- S&P 500 futures up 0.1% to 4,572.00

- MXAP down 0.4% to 161.35

- MXAPJ down 0.8% to 502.96

- Nikkei up 0.5% to 33,625.53

- Topix up 0.5% to 2,390.94

- Hang Seng Index down 2.0% to 17,559.42

- Shanghai Composite down 0.7% to 3,040.97

- Sensex little changed at 65,962.64

- Australia S&P/ASX 200 up 0.2% to 7,040.76

- Kospi down 0.7% to 2,496.63

- STOXX Europe 600 little changed at 458.39

- German 10Y yield little changed at 2.66%

- Euro little changed at $1.0911

- Brent Futures up 0.2% to $81.57/bbl

- Gold spot up 0.1% to $1,994.88

- U.S. Dollar Index down 0.21% to 103.70

Top overnight news from Bloomberg

- European shares struggled for traction after the latest economic data highlighted Germany’s struggle to recover from an energy-induced downturn last winter and the mounting impact of higher borrowing costs.

- China is ramping up pressure on banks to support struggling real estate developers, signaling President Xi Jinping’s tolerance for property sector pain is nearing its limit.

- The first truce since the war between Israel and Hamas erupted last month went into effect on Friday morning. The deal came after weeks of complex and delicate talks brokered by Qatar, the US and Egypt.

- Japan’s key inflation measure accelerated for the first time in four months, coming largely in line with market expectations that price gains will continue and heightening the Bank of Japan’s dependence on data ahead of its December policy meeting.

- Treasuries fell as they reopened after Thanksgiving, following a slide in European bonds that was caused by concerns of a burgeoning supply and the potential that central banks will keep rates higher for longer.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded mixed in the absence of a lead from Wall St and as markets headed into the start of the Israel-Hamas truce. ASX 200 was led higher by strength in utilities, financials and the energy sector albeit with gains capped by tech weakness and after an Australian warship sailed through the Taiwan Strait which risks stoking frictions between Australia and its largest trading partner. Nikkei 225 outperformed on return from its holiday closure as participants digest data releases including national CPI which printed softer than expected although mostly accelerated from the previous month. Hang Seng and Shanghai Comp were pressured despite the lack of obvious catalysts, while PBoC liquidity efforts and news that China is mulling unprecedented support for the property sector by allowing banks to offer unsecured short-term loans to qualified developers have failed to support the risk tone.

Top Asian News

- WHO held talks with Chinese health authorities in which requested data on the upsurge of respiratory illnesses among children in northern China was provided and no changes in the disease presentation were reported by Chinese health authorities. Furthermore, Chinese health authorities said the rise in respiratory illness has not resulted in patient loads exceeding hospital capacities and there has been no detection of unusual or novel pathogens or unusual clinical presentations including in Beijing and Liaoning.

- Chinese Premier Li met with the French Foreign Minister in Beijing and said that China and France’s relationship is developing better in all aspects this year, according to Reuters.

- US Navy operations chief is excited by prospects of improved communications with the Chinese military and said work is needed to solidify the next steps with the Chinese military, according to Reuters.

- New Zealand’s National, NZ First and ACT parties signed a coalition agreement to form a government with Winston Peters appointed as Deputy PM for the first half of the three-year parliamentary term and David Seymour to be Deputy PM in the second half, while Nicola Willis is to be appointed as Finance Minister. Furthermore, incoming PM Luxon said the Reserve Bank Act will be amended to focus monetary policy on price stability and the incoming government’s policy includes repealing the ban on offshore oil and gas exploration.

European bourses are essentially unchanged with newsflow very light post-Thanksgiving, Euro Stoxx 50 +0.1%. Sectors are mixed but similarly contained with incremental outperformance in defensively-biased names at times while Auto names lag after broker activity. Stateside, futures are similarly contained on Black Friday with developments light aside from NVDA ahead of US Flash PMIs. Nvidia (NVDA) has reportedly informed customers that it is delaying the launch of the China-targeted H20 AI chip until Q1 2024 with the delay due to issues server manufacturers are having integrating the H20 chip, according to Reuters sources. -2.3% in -pre-market trade

Top European News

- BoE’s Pill said the challenge for the Bank and other central banks is that headline inflation is coming down, while he added that economic activity and employment growth are weakening and that the central bank cannot afford to ease off tight monetary policy. Pill stated that UK monetary policy is in a difficult phase and warned of stubbornly high price pressures in the British economy, as well as noted that the MPC had to resist the temptation to declare victory and move on from battle to quash inflation, according to FT.

- ECB’s Villeroy said he doesn’t think the ECB will raise rates again unless there is an unexpected event, while he noted that a gradual reduction in rates will come one day, but added that they are not there yet.

- ECB’s Holzmann says the likelihood of another rate hike is not smaller than that of rate cuts; do still have high inflation numbers, via Die Presse; suggestion on PEPP would be that ECB reduces reinvestments step by step as of March.

- German Finance Minister Lindner confirmed the debt brake suspension for 2023 but added the suspension does not mean new debt.

FX

- Dollar drifts sideways pre-flash US PMIs, with DXY restrained between 103.84-62 parameters.

- Pound perky amidst elevated UK yields as Cable eclipses recent peaks, at 1.2565, and EUR/GBP probes 50 DMA.

- Kiwi underpinned as NZ retail sales defy consensus for a fall and coalition government is formed, NZD/USD 0.6050+ and AUD/NZD cross sub-1.0850.

- Euro remains capped by expiries close to 1.0900 vs the Greenback and the Yen is hampered by higher Treasury yields as USD/JPY pivots 149.50.

- Loonie straddles 1.3700 awaiting Canadian retail sales.

- PBoC set USD/CNY mid-point at 7.1151 vs exp. 7.1440 (prev. 7.1212)

Fixed Income

- Debt futures flogged on Black Friday and only enticing buyers at fresh weekly lows.

- Bunds towards the bottom of 130.11-63 range, with technical and psychological support at 130.00.

- Gilts midway between 96.07-71 parameters and T-note closer to 108-12 than 108-31 ahead of preliminary US PMIs.

- German Finance Minister Lindner says will put to Cabinet the supplementary budget for 2023 next week; says can only decide about 2024 budget once the country has a supplementary budget for 2023.. Prior to this: Germany is to suspend borrowing limit for 2023 (fourth consecutive year) after the budget ruling; German Finance Minister Lindner is to announce debt brake suspension on Thursday, according to Bloomberg.

Commodities

- WTI and Brent January futures trade horizontally but show a mismatch in intraday price changes amid the lack of settlement.

- Spot gold is flat intraday and just under the USD 2k/oz mark with base metals similarly uneventful given the non-committal tone thus far.

- Volumes remain light with newsflow similarly sparse after initial OPEC+ sources alongside the commencement of the Israel-Hamas four-day truce.

- OPEC+ is moving closer towards a compromise with African oil producers, according to Reuters citing two OPEC+ sources.

Geopolitics

- A four-day truce in the Israel-Hamas war took effect at 7:00 am local time (05:00 GMT) on Friday, with hostages held in the Gaza Strip set to be released later in the day in exchange for Palestinian prisoners, according to AFP.

- Israel’s military said achieving control over the northern half of Gaza is only the first stage in the campaign to destroy Hamas, while they are preparing for the next stages and are looking forward in the coming days in which they will focus on planning and fulfilling the next stages of the war, according to Reuters.

- Israeli military sounded sirens in two villages near Gaza warning of possible rocket launches despite the touted start of the truce.

- Hamas’ armed wing spokesperson called for an escalation of the confrontation with Israel on all resistance fronts.

- An Israeli government official has told LBC News there is scope to extend a four-day pause in fighting with Hamas; The first set of civilians held captive by Hamas are expected to be freed from Gaza this afternoon.

- “3 Palestinians injured in IDF shooting at civilians trying to return to the northern Gaza Strip”, according to Al Jazeera – DETAILS LIGHT (08:25GMT/03:25EST).

- Taiwan’s Defence Ministry said an Australian warship sailed through the Taiwan Strait.

- The White House is reportedly concerned that the UK’s Rwanda plan undermines the Good Friday agreement in Northern Ireland, according to The Times.

- Russia’s Kremlin says the idea of creating a military Schengen zone in Europe to allow NATO forces to freely move around is a cause for concern; Russia will respond if such a zone becomes a reality.

US Event Calendar

- 09:45: Nov. S&P Global US Services PMI, est. 50.3, prior 50.6

- 09:45: Nov. S&P Global US Composite PMI, est. 50.4, prior 50.7

- 09:45: Nov. S&P Global US Manufacturing PM, est. 49.9, prior 50.0

DB’s Jim Reid concludes the overnight wrap

The Thanksgiving holiday means it’s been a quiet 24 hours, since US markets were closed yesterday and they’re only open for a half-day today. In the meantime, the main story has been an ongoing bond selloff in Europe, mainly thanks to another batch of hawkish commentary from central bankers, along with some flash PMIs that were slightly better than expected. So there was a bit of a pushback to the recent narrative that rate cuts are just around the corner. Nevertheless, even as investors became more sceptical about near-term rate cuts, risk assets continued to power forward. Indeed, the STOXX 600 (+0.27%) hit a 2-month high, US equity futures were also in positive territory, and the iTraxx crossover index reached its tightest level in over 18 months .

We’ll start with the government bond selloff, which continued for a second day thanks to several developments that collectively leaned on the hawkish side. First, ECB officials continued to push back on rate cuts. For instance, Bundesbank President Nagel said that it’d be “a mistake to loosen our monetary policy stance too early”, and Irish central bank governor Makhlouf said “I would not rule out today that we have to go up another rung”. Separately, we also had the account of the ECB’s latest meeting in October, which explicitly held open the prospect of further rate hikes. It said that “the view was held that the Governing Council should be ready, on the basis of an ongoing assessment, for further interest rate hikes if necessary, even if this was not part of the current baseline scenario.”

On top of that, yesterday saw the release of the November flash PMIs in Europe, which came in slightly on the upside. That included the Euro Area composite PMI, which rose to 47.1 in November (vs. 46.8 expected), and both the manufacturing and services numbers were both slightly above consensus too. Here in the UK, there was a larger upside surprise, with the composite PMI up to 50.1 (vs. 48.7 expected), which puts it just above the expansionary 50-mark for the first time since July.

These developments contributed to a selloff in European government bonds, with yields on 10yr bunds (+5.8bps), OATs (+6.5bps) and BTPs (+7.2bps) all rising on the day. In particular, 10yr gilt yields (+10.0bps) saw the biggest increase thanks to the upside surprise in the UK PMIs, which came on top of the fiscal easing announced in the Autumn Statement the previous day. In turn, that meant that investors continued to price in a more hawkish path for the Bank of England over the months ahead. For instance, according to overnight index swaps , the chance of a rate cut by the June meeting has fallen from 97% on Monday to just 36% by the close yesterday .

That move to price out the chance of rate cuts has been evident more broadly over the last week, and we’ve seen investors dial back the more dovish expectations following the US CPI report on November 14. At the ECB, market pricing for a rate cut by April hit an intraday peak of 93% last week, but was down to 59% by the close last night. Likewise at the Fed, the chance of a cut by May has fallen from an intraday peak of 94% last week to 56% by yesterday’s close. So investors are still expecting a rate cut from the Fed and the ECB by Q2, but there’s a bit less conviction on that relative to a week ago. And overnight, we’ve seen US Treasuries catchup with yesterday’s selloff, with the 10yr yield up +5.4bps to 4.46% .

For equities, yesterday saw a continued advance across Europe that took the STOXX 600 (+0.27%) up to a 2-month high. That advance was clear across several countries, with the DAX (+0.23%), the CAC 40 (+0.24%) and the FTSE 100 (+0.19%) all posting similar moves. Although US markets were closed, futures were still open and those on the S&P 500 were pointing modestly higher throughout the European session and remain slightly higher (+0.05%) this morning.

Overnight in Asia, equity markets have seen a more negative trend, with losses for the major indices. That includes the Hang Seng (-1.46%), the CSI 300 (-0.62%) and the KOSPI (-0.50%), although in Japan the Nikkei (+0.55%) has been the exception as it resumed trading after the previous day’s holiday. The moves also follow some Japan’s inflation data, which showed headline CPI rising to +3.3% in October (vs. +3.4% expected), whilst core-core CPI fell back to +4.0% (vs. +4.1% expected). In the meantime, the flash composite PMI fell to 50.0 in November, marking its weakest level since December 2022.

Finally in Germany, the government announced they would suspend the debt brake for a fourth consecutive year. That follows last week’s ruling by the federal constitutional court that they couldn’t use €60bn of unused borrowing capacity from the pandemic for its climate fund. Finance Minister Christian Lindner is set to present a supplementary budget for 2023 next week.

To the day ahead now, and data releases include the German Ifo business climate indicator for November, along with the US flash PMIs for November. Otherwise, central bank speakers include ECB President Lagarde and Vice President de Guindos.

Tyler Durden

Fri, 11/24/2023 – 08:27

via ZeroHedge News https://ift.tt/scRlzCO Tyler Durden