Ready For Some Funflation!

Authored by Robert Aro via The Mises Institute,

Just when you thought every inflation related economic term was used up, CNBC headlines:

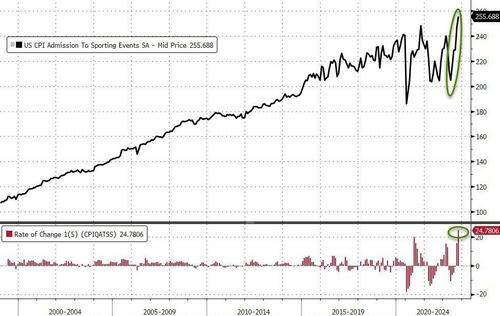

‘Funflation’ drives sporting event ticket prices up a whopping 25%

One might assume terms such as transitory, creeping, galloping, and entrenched inflation, along with shrinkflation and foodflation, would suffice. Nonetheless, we can now include “funflation” to the array of consequences resulting from the expansion of the supply of money and credit, also called inflation.

Funflation is characterized as:

…a term used by economists to explain the increasing price tags of live events as consumers hanker for the experiences they lost during the pandemic.

The economists who coined this term remain unmentioned.

In the October Consumer Price Inflation (CPI) reading of 3.2%, sporting events experienced the most significant increase among the few hundred categories comprising the index. One economist from the College of the Holy Cross attempted to explain the reason:

People are getting back to things that they enjoy doing and are willing to pay a bunch.

Despite both fun and inflation coexisting for quite some time, we’ve never seen a mashup between the two until now, yet CNBC tries to explain:

Much of the upward pressure on admission costs has come this year, underscoring the role of funflation as consumers shift their attention from Taylor Swift and Beyoncé concerts to NFL and Major League Baseball games.

Funflation has even spread as far north as Canada, where the government owned news channel CBC offers four possible causes for this growing phenomenon:

1. It’s a natural response to existential dread

2. Concerts provide a sacred experience that’s priceless

3. The post-pandemic effect is greater than a potential recession

4. Concerts are a long-term investment in your soul

It’s important to scrutinize the sources of the information we are fed. In the case of the responses from a mainstream economist, a mainstream news source, and a government-owned news channel, it seems that the explanations provided are more about filling a knowledge gap, which they may not even be aware of. It becomes a matter of explaining for the sake of providing one, rather than genuinely delving into the underlying causes.

Even if we were to accept the data showing an increase in attendance in ticket sales this year compared to the previous, or a shift from Taylor Swift to the NFL, this merely indicates changes in behavior without explaining the underlying cause of the change.

No one can definitively attribute the change to lockdowns or clarify why more people are watching the NFL this year. However, what is barely, if ever, considered by a mainstream news source is a discussion of changes in the demand and supply factors of money itself: Specifically, the demand to hold onto the money you have vis-à-vis fluctuations in the supply of money largely due to the Federal Reserve’s inflationary monetary policies.

Given a society still grappling with the repercussions of a multi-trillion-dollar monetary binge from several years ago and the threat of a continuously depreciating dollar, it’s plausible that people are allocating more funds towards leisure and enjoyment this year compared to the last. That said and oddly enough, the notion of the “natural response to existential dread” may not be too far off the mark after all!

Tyler Durden

Fri, 11/24/2023 – 09:15

via ZeroHedge News https://ift.tt/1UYuqaj Tyler Durden