European Bonds Shaken As Germany Suspends “Debt Brake” To Allow Increased Borrowing

By Elwin de Groot and Maartje Wijffelaars, strategists at Rabobank

The agreed four-day cease fire between Israel and Hamas starts today. Both camps will release hostages and humanitarian aid will be allowed into Gaza. While perhaps promising to the outside world, both camps make sure to bring across the cease fire is temporary and should not at all be interpreted as a start of the end of the war. Indeed, according to Reuters, a spokesperson for Hamas in a video message called for an “escalation of the confrontation with (Israel) on all resistance fronts”, including the Israeli-occupied West Bank. In addition, an Israeli military spokesperson warned that “control over northern Gaza is the first step of a long war, and we are preparing for the next stages”.

While rather futile in light of such news, let’s turn to markets closer to home. Dutch bond yields hardly widened vis-à-vis their German counterparts yesterday, following the political shockwave in the Netherlands. Yet the whole European bond building shook a little as the German government decided to suspend its debt brake in order to allow for increased borrowing. That decision was a big climbdown for ‘frugal’ FDP finance minister Christian Lindner. Indeed, it was a painful defeat for the coalition as a whole, since the debt brake, which limits the amount of new debt to 0.35% of GDP in normal times, was reinstated earlier this year after being dormant for three years during the pandemic and the energy crisis.

The suspension followed on the heels of last week’s ruling by the Constitutional Court in Karlsruhe, saying that the German government unjustly relabelled EUR 60bn in unspent off-balance sheet pandemic funds for climate investments. This implies that the fund can no longer be held off-balance sheet and that any spending that was planned with the fund would have to run through the budget. Spending on projects that is not yet committed can be cancelled, but the government will have to honour any commitments already made (estimated at EUR 37bn, about 1% of GDP). This left a gaping hole in the 2023 budget, which has thus forced the government to temporarily suspend the debt brake.

More importantly than the 2023 budget, is the structural challenge the ruling poses. German policy makers have often used off-balance sheet funds that do not show up in the annual budget, to avoid the straightjacket of the debt brake. The Economic Stabilisation Fund (EUR 200bn, some 5% of GDP) is one of them and now also under scrutiny. If a complaint is filed and it is ruled to be unconstitutional as well, this could derail the German investment agenda completely. In that case, any investment planned for through the fund, would have to be made from the running budget, without taking on any (significant) extra debt. This is a serious risk for the economic outlook of Germany, which isn’t doing that great to say the least, as confirmed by yesterday’s PMI figures and with industrial production still well below pre-pandemic levels. Moreover, the need for state-led investments in (energy) infrastructure, digitalisation and new technologies is bigger than ever.

As our Germany watcher Erik-Jan van Harn notes here, the Court’s ruling has re-sparked the discussion about Germany’s self-imposed fiscal straightjacket. However, we believe the Germans will not give up their debt-brake so easily.

It would not be inconceivable, in our view, that Germany will be forced to look more to the EU, after having often said “thank you but no thank you” to European funds, such as those under the pandemic-inspired RRF. If investments can be made under the umbrella of an EU framework with EU-led financing, it could, perhaps, provide an alternative to the creative accounting tricks it has used so often in the past. On that note, Bloomberg reported yesterday that the EU/European Commission is launching an EUR584bn plan next week to overhaul the European power grid to make if future-proof. Particularly relevant in that respect are the points that “EU member states will have to prioritise projects of common European interest and identify new areas of cooperation” and that “private financing of grid investments will be incentivised through joint instruments alongside the EU and EIB”. In other words, could those new financial instruments supported by the EU (and ultimately ECB?) become a new lifeline for the ailing German economy?

Turning back to markets, developments in the energy market clearly were not responsible for the rise in yields yesterday, as crude oil prices extended their decline on reports of ‘discord’ within OPEC+, which led the oil cartel to delay its upcoming meeting and decide to hold it online on November 30. This was seen by the market as a sign that Saudi-Arabia may not get other countries into line with further production cuts. The Saudis, meanwhile, secured a USD11bn loan from a syndicate of banks to plug a widening future budget hole, which is the result of lower-than-expected oil prices, lower output and rising spending to diversify its economy.

Policy accounts of the November ECB rate setting meeting were broadly in line with Lagarde’s more dovish tone at the press conference, but the write-up underscored its warnings against complacency. Members argued in favour of keeping the door open for a possible further rate hike, but a discussion of an early termination of PEPP reinvestments at the current meeting was seen as premature. It was also acknowledged that markets had revised their expected interest rate path to higher levels, which – if maintained for some time – would contribute to a sufficiently restrictive monetary policy stance.

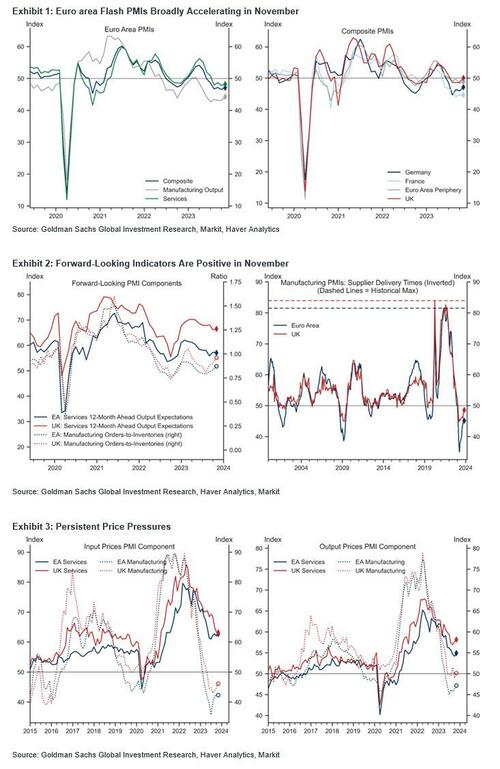

Yet, in view of the tight labor market, the current level of policy rates might not be as restrictive as generally thought. With that in mind we note that since the ECB held their October meeting, the ECB’s indicator of negotiated has been pointing at further wage pressures from collective bargaining (to 4.7% y/y in Q3). With negotiated wages growing at a clip of 4-5% over the next year or so, it is hard to see services inflation decline below 3% over the foreseeable future (between 2002 and 2019 it never fell more than 0.7% below annual wage growth). Moreover, November’s flash PMI yesterday showed that high wage growth in the service sector led to an acceleration in the increase of selling prices.

Overall, this is no cause for immediate concern, but does warrant a cautious approach and longer pause before the Council considers cuts, a view we have maintained despite increasing signs of economic weakness in recent months. That this economic weakness is at least persisting into the final part of this year was hammered home by the Eurozone flash PMIs for November, as already noted in yesterday’s Daily. Output contracted for the sixth month in a row with the composite PMI coming in at 47.1, strengthening our view that Eurozone GDP will contract for another quarter.

In the UK, surprisingly, PMI data came in better than expected, implying some stabilisation of business activity following three consecutive monthly dips. The latest PMI readings point to UK GDP holding steady in Q4. However, the survey notes that households remained reticent to spend on discretionary items and forward-looking indicators suggested that recession risks will likely remain elevated into the New Year. Service sector inflation remains a key area of concern as businesses once again reported the need to pass on higher staff costs to customers.

Tyler Durden

Fri, 11/24/2023 – 10:00

via ZeroHedge News https://ift.tt/7PQLhlJ Tyler Durden