More Chinese Pro-Growth Signs to Come as 2024 GDP Goal Eyed

By George Lei, Bloomberg Markets Live reporter and strategist

President Xi Jinping is set to visit the Shanghai Futures Exchange and several tech giants on Tuesday, according to a report from the South China Morning Post. The trip, if confirmed, may represent most high-profile attempt yet by the leader to send a pro-business message before the country’s 2024 growth target is decided at next month’s Central Economic Work Conference.

Xi’s potential visit coincides with the 10th anniversary of the Shanghai Free-Trade Zone, a testing ground for the country’s economic reforms. Xi is expected to urge local officials to spur cross-border trade and capital flows, according to the SCMP report. Despite China’s reopening this year, the country has found it difficult to attract foreign investments thanks to the deep mental scars left on investors by pandemic-era restrictions.

But Beijing has gone into overdrive trying to spur international business over the past several weeks. Senior Chinese officials have pushed to boost international flights with the US and Europe. On Friday, Beijing permitted citizens from the biggest EU countries to visit visa-free, in yet another step to facilitate cross-border exchanges.

China’s central bank on Monday also pledged to push for lower real lending rates in its third-quarter monetary policy report. The document devoted one of its four columns to discuss fiscal and monetary policy coordination, which is “a timely clarification” amid heightened investor skepticism, according to a research report from Citigroup. Analysts from the US bank, after going through the monetary policy report, believe PBOC would “stay accommodative in managing interbank liquidity” at a time when fiscal impulse is picking up momentum.

Now, the overall policy tone is expected to stay positive in the run-up to the annual Central Economic Work Conference, which will likely take place over the coming weeks. The meeting, which sets the economic growth target for the following year, typically starts between Dec. 8 and 19, according to data compiled by Bloomberg based on public announcements since 2018.

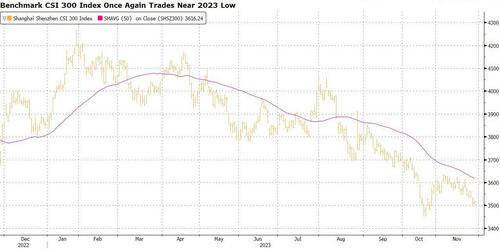

There has been a rigorous debate among market participants on whether Beijing should set a 5% GDP goal for next year — and deliver more forceful stimulus to achieve it — or simply go with consensus at around 4.5%. Recent policy moves seem to tip toward the more ambitious side, offering much needed relief to a fragile stock market.

Tyler Durden

Mon, 11/27/2023 – 21:40

via ZeroHedge News https://ift.tt/HFCqbEN Tyler Durden