Money Market Funds See Massive Inflows As Fed’s Bank Bailout Fund Holds At Record High

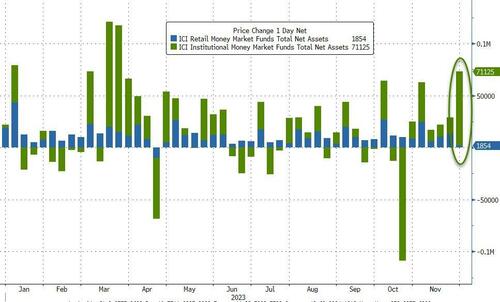

Money-market funds saw a massive $102BN inflow last week (the largest since the middle of the SVB crisis in March). The fifth straight week of inflows pushed total MM fund assets to a new record high of $5.84 TN…

Source: Bloomberg

In a breakdown for the week to Nov. 29, government funds – which invest primarily in securities like Treasury bills, repurchase agreements and agency debt – saw assets rise to $4.77TN, a $71.5BN increase.

Prime funds, which tend to invest in higher-risk assets such as commercial paper, meanwhile, saw assets climb to $940BN, a $2.19BN increase.

With the vast bulk of that being into institutional funds (+$71BN), but the unbroken trend of flows into retail funds also continued…

Source: Bloomberg

The resurgence in money-market fund inflows is diverging from bank deposits (which are gently rising on a seasonally-adjusted basis)…

Source: Bloomberg

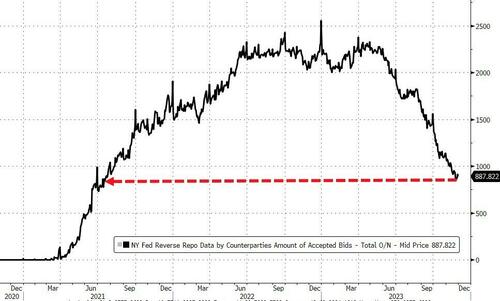

Meanwhile, despite a small uptick into month-end, November saw a massive exodus of funds from The Fed’s reverse repo facility, now at its lowest since July 2021…

Source: Bloomberg

Demand for the facility has been fading this year as the Treasury ramped up fresh bill issuance, offering an alternative for short-term investors.

While reserve scarcity is not a serious worry yet, it;s coming if this pace continues.

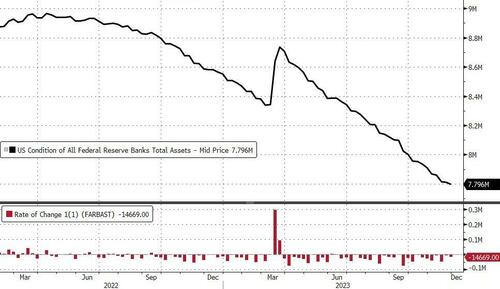

After stalling last week, The Fed’s balance sheet contracted by $14.7BN last week (to its lowest since April 2021)…

Source: Bloomberg

QT also reaccelerated last week, with Securities Held declining by $12.3BN…

Source: Bloomberg

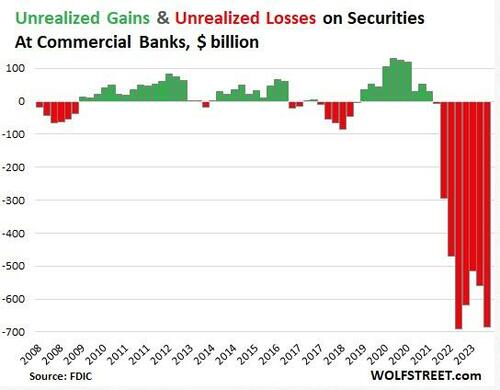

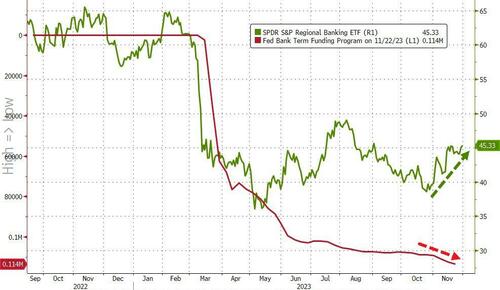

Usage of The Fed’s emergency funding facility for the banks remained at a record high of $114BN…

Source: Bloomberg

Which should be no surprise, as we detailed earlier, unrealized losses for banks surged in Q3…

And for now, banks appear to be pulling the cover over investors eyes that everything is going to be awesome (if rates keep falling)…

Source: Bloomberg

Equity market cap continued to soar, having re-coupled with its years-long relationship with bank reserves at The Fed…

Source: Bloomberg

The band-aid over bank losses may be holding for now… but what happens in March when The Fed pulls the plug on the ‘temporary’ bailout facility?

Tyler Durden

Thu, 11/30/2023 – 16:41

via ZeroHedge News https://ift.tt/3NxWenU Tyler Durden