“Echo Chamber Of Diplomats”: Jeff Ubben The Latest Fund Manager To Criticize “Green” Investing

Just days after it was reported that Jeff Ubben would be shutting down his “green” Inclusive Capital fund, the former ValueAct manager isn’t pulling any punches with what he thinks about green investing.

In a new Bloomberg report, Ubben spoke out about what he is calling the “echo chamber” of traditional climate summitry. After shuttering his sustainability fund, which he said was not “rewarded” by markets, Ubben has joined a chorus of voices speaking out about “green” energy advocates who, in the name of virtue, the climate and the environment, are creating more division than they solve.

“It’s been this echo chamber of diplomats going to these conferences and putting out flowery language and goals, but it doesn’t have traction,” Ubben said, talking about climate conferences.

“There’s no money behind it, which is why company balance sheets are so important,” he added. “We all need to work together.”

Ubber originally had the goal to “collaborate with companies whose core businesses address essential societal needs with a focus on reducing negative externalities” when he started Inclusive Capital. But, as the report notes, the “exact opposite” played out over the last 3 years.

“Shares of companies pursuing capital-intensive projects needed to drive lower greenhouse gas emissions have been ‘sold off’ in the public markets as being too risky or too far out in terms of any potential reward,” he said.

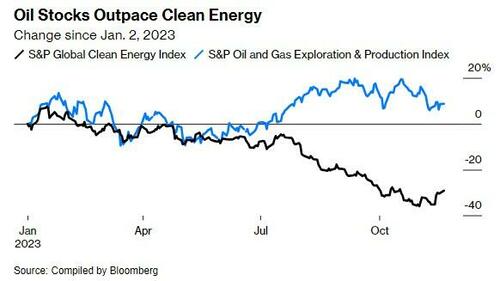

Recall less than a week ago we noted that $30 billion has been shaved off the value of clean energy stocks over the last 6 months.

Rate hikes, which affect the profitability of large-scale projects like solar and wind farms, have led to project cancellations and even bankruptcies in the field, the report says. The optimism spurred by the Inflation Reduction Act has faded, resulting in a 25% reduction in the market value of U.S. companies listed in the S&P Global Clean Energy Index in the half-year period ending November 27.

The report noted that the downturn highlights the significant challenges facing Biden’s climate objectives. Clean energy firms not only grapple with steep financing costs but also face hurdles in community acceptance, obtaining government permits, and integrating into an aging power grid that struggles to support the influx of renewable energy.

Meanwhile, oil and gas companies are intensifying their extraction activities – and, according to Biden, making ‘more money than God’ in the process. Either way the message is clear: the U.S.’s journey towards a carbon-neutral electricity grid by 2035 is becoming increasingly difficult.

Eric Scheriff, senior managing director at Capstone, told Bloomberg: “We’re in the moment of realization now where some of the euphoria has worn off and we’re starting to realize it’s still not going to be easy.”

We also pointed out just days ago how the ESG grift was reaching endgame after Markus Müller, chief investment officer ESG at Deutsche Bank’s Private Bank stated that sustainability funds should include traditional energy stocks, arguing that not doing so deprives investors of a prime opportunity to invest in the transition to renewable energy.

“When we think about clean energy, these are business models which are quite new and sensitive to interest rates,” he said.

It’s not surprising, as we have been calling out ESG as a grift since the virtue signaling “trend” was born from the soil of near-unlimited liquidity during the Covid years. Recall, back in August we noted that companies with good ESG scores polluted just as much as those with low ones.

Tyler Durden

Wed, 12/06/2023 – 05:45

via ZeroHedge News https://ift.tt/GzbBhWp Tyler Durden