Exxon Hikes Buybacks 14%, Will Buy Back $20 Billion In Stock Next Year

Today in “more money than God” news, Exxon Mobil announced it was going to hike its share buybacks by 14% upon consummating its $60 billion acquisition of Pioneer Natural Resources Co.

Exxon plans to repurchase $20 billion of its shares next year, on a par with its main competitor, Chevron Corp., which also increased buybacks following its $53 billion acquisition of Hess Corp. in late October, Bloomberg reported on Wednesday.

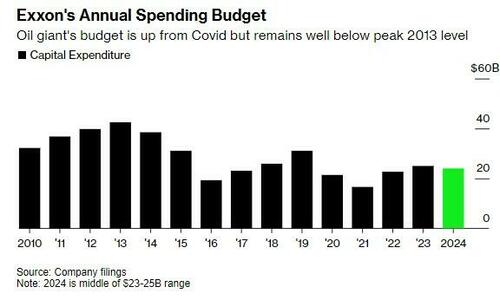

Exxon said it intends to invest between $23 billion and $25 billion in capital projects in the upcoming year and that this investment aims to enhance its presence in North America’s most productive oilfields and explore new reserves in areas like Guyana. Additionally, Exxon is also boosting its investment in low-carbon initiatives, the report says.

The company aims to reduce structural costs by $6 billion by 2027, adding to the $9 billion saved since 2019, the report says. It will also invest $20 billion in low-carbon initiatives, including lithium, carbon-capture, and hydrogen, by 2027. The acquisition of Pioneer significantly boosts Exxon’s Permian Basin output, as we have noted.

And the buybacks come at a time when ESG and “green” investing are seeing major pushback.

Recall, just 3 weeks ago we wrote about how CEO Darren Woods argued that attacking oil and gas would only slow the push to net zero. The head of the oil supermajor argued that turning big oil companies into “villains” would trap millions of people in the developing world in poverty, according to a Bloomberg report.

At the Asia Pacific Economic Cooperation CEO Summit in San Francisco in November, Woods said: “The solutions to climate change have been too focused on reducing supply. That’s a recipe, for human hardship and a poorer world.”

Instead he urged governments to “harness the industry’s capabilities for change”, Bloomberg reported. He suggested providing government funding for technologies that reduce emissions, such as carbon capture, until they become viable through market dynamics.

Meanwhile, in other “green investing” news, Jeff Ubben’s Inclusive Capital, which sought to make investments in sustainable companies, shut down.

In a new Bloomberg report, Ubben spoke out about what he is calling the “echo chamber” of traditional climate summitry. After shuttering his sustainability fund, which he said was not “rewarded” by markets, Ubben has joined a chorus of voices speaking out about “green” energy advocates who, in the name of virtue, the climate and the environment, are creating more division than they solve.

“It’s been this echo chamber of diplomats going to these conferences and putting out flowery language and goals, but it doesn’t have traction,” Ubben said, talking about climate conferences.

And now we await the Biden administration and Liz Warren’s forthcoming freakout.

Tyler Durden

Wed, 12/06/2023 – 11:20

via ZeroHedge News https://ift.tt/JzMHBPL Tyler Durden