Chinese Stocks Are Trading Near A Record Discount To Peers

By Ye Xie, Bloomberg Markets Live reporter and strategist

While stocks in India make new all-time highs, investors in Chinese stocks are staring down a dismal year of losses. In fact, equities from the world’s No. 2 economy have hardly ever traded at such a deep discount to emerging-market peers.

There’s no shortage of negative headlines in China these days. Moody’s Investors Service’s downgrade of China’s credit outlook this week is just another example, underlying the nation’s structural problems of a heady debt load, an aging population and a decline in the potential growth rate.

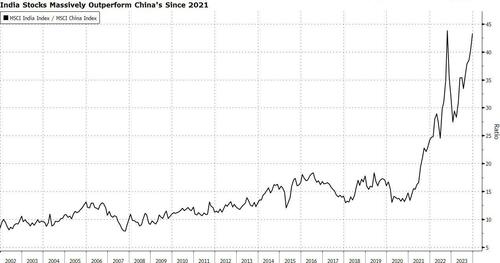

These structural issues are manifested in the stock market. The MSCI China Index has lost 15% this year, compared with a 2% increase in the gauge for emerging-market shares and a 15% gain in the MSCI India Index and In fact, the MSCI India Index has outperformed the China gauge by 100% since the beginning of 2021.

It may not be just a flash in the pan. According to Morgan Stanley, China’s underperformance versus India could be just “the beginning of a new long-run trend.”

The MSCI China Index is trading at 8.9 times of earnings over the next 12 months, compared with 11.4 of MSCI Emerging Markets Index. Apart from a brief period at the onset of the pandemic, the 22% discount marks the biggest since Bloomberg started to compare the data in 2006.

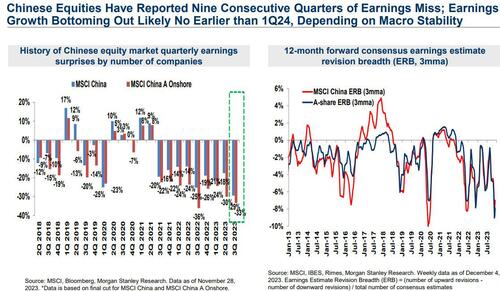

The stocks are trading cheaply for a reason. Chinese companies’ return on equity has been persistently declined since 2011, reflecting deteriorating investment opportunities.

They have missed earnings estimates for nine consecutive quarters, and bottoming isn’t likely in the first quarter, according to Morgan Stanley’s strategists including Laura Wang. The strategists expect the MSCI China to return 7% next year, with an upside potential of 25%, and a downside risk of 34%.

Investors are turning to the upcoming Central Economic Work Conference for clues on how Beijing will set the economic agendas for next year. So far, China hasn’t done enough to boost confidence. And “Incremental and baby-step support are not enough to turning around the sentiment,” said Jason Hsu, chief investment officer at Rayliant Global Advisors.

Tyler Durden

Wed, 12/06/2023 – 21:40

via ZeroHedge News https://ift.tt/Cf4joAc Tyler Durden