Yen Plummets On Report BOJ Will Not Hike Rates Any Time Soon

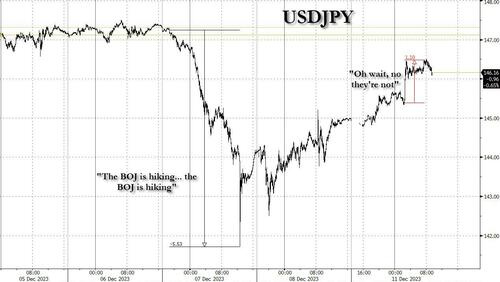

Last week, when the yen saw its biggest one-day gain in years amid a burst of speculation that the BOJ would hike rates as soon as this month, which in turn triggered a cascading short squeeze that sent the USDJPY as much as 550 pips on Thursday, we were amused for two reasons: i) more than half a year of JPY carry had just gotten wiped out, and ii) there was no way that the BOJ – which is absolutely terrified of what will happen to the $20 trillion yen carry trade if NIRP is ended – would unleash the biggest change to Japanese monetary policy in decades at a time when FX liquidity is already dismal, thus sparking untold financial destruction. That said, we certainly took advantage of the market’s stupidity to close out our top premium subscriber trade, a USDJPY short, at a solid profit.

And so, in a preview of what was to come, we warned readers that the yen would “come storming right back after the Nikkei leaks that there will be no BOJ rate hike.“

Of course, it will come storming right back after the Nikkei leaks that there will be no BOJ rate hike. https://t.co/GWxBlDSsmf

— zerohedge (@zerohedge) December 7, 2023

Fast forward just a few days to today, when that is precisely what happened when a flashing red headline (only from Bloomberg not the Nikkei) confirmed what we already knew:

- *BOJ IS SAID TO SEE LITTLE NEED TO END NEGATIVE RATE IN DECEMBER

As one can surmise from the headline, which hit just after 2am ET this morning, Bloomberg reports that according to “people familiar with the matter”, most likely Ueda himself who was suddenly facing an even more brutal market reaction after disappointment next week, Bank of Japan officials – who clearly did not anticipate the market’s furious reaction to their dovish comments from last week – now see “little need to rush into scrapping the world’s last negative interest rate this month” as they have yet to see enough evidence of wage growth that would support sustainable inflation. Indeed, this is something we first pointed out first late last week…

Japan real wages just hit an all time record low pic.twitter.com/yJFShBB159

— zerohedge (@zerohedge) December 8, 2023

… but instead of thinking rationally, the market continues to jerk around driven only by technicals and liquidity.

In any case, stagnant nominal wages (and certainly record low real wages) are an indication the central bank is “likely to keep its monetary stimulus settings unchanged at a two-day policy meeting ending Dec. 19, despite recent market speculation that the negative rate may be scrapped as soon as the December meeting.” And just in case the messaging is not clear, Bloomberg went on to say that “BOJ officials view the potential cost of waiting for more information to confirm solid wage growth as not very high.”

In other words, not only will there not be a rate hike in December, there may not be a rate hike ever, because by the time Japan will have the results of the annual spring wage negotiations, the Fed and the rest of central banks will already be cutting rates as the world heads for another brutal recession, and the last thing whoever is Japan’s PM at that point – because it certainly won’t be Kishida and his record low approval rating – will want to do is hike rates and end his (because in DEI-friendly Japan there are no women Prime Ministers) career short.

A further near-term decline of the yen (because a long-term decline is so assured, nobody even bothers to discuss it) would depend on how the Federal Reserve characterizes its policy outlook when the Open Market Committee meets on Wednesday and on the details from next week’s BOJ meeting.

The report about the BOJ has further removed the possibility of an early elimination of negative interest rates, said Fukuhiro Ezawa, head of financial markets in Tokyo at Standard Chartered Bank. “But in order to see dollar-yen above 147, it will be necessary to confirm there is nothing in the FOMC dot chart or the BOJ meeting,” Ezawa said.

After odds of a December hike rose as high as 50% last week, on Monday, markets got a hard dose of reality as they priced in just an 8% chance of a December hike and a 46% likelihood of a move by the end of January (this will plunge too in the next few weeks). Policy normalization was fully priced in by the end of April. Good luck with that.

In response to the news, the yen extended losses to more than 1%, rising as high as 146.5 per dollar level…

… and will rise much higher in coming weeks and months as it becomes clear that the BOJ never had any intentions of actually rising rates even if it means bone-crushing inflation.

Tyler Durden

Mon, 12/11/2023 – 09:45

via ZeroHedge News https://ift.tt/OUtjb79 Tyler Durden