“This Is The Big Fight!” Bitcoin Battered As Sen. Warren Unveils Bill To “Crack Down” On Crypto

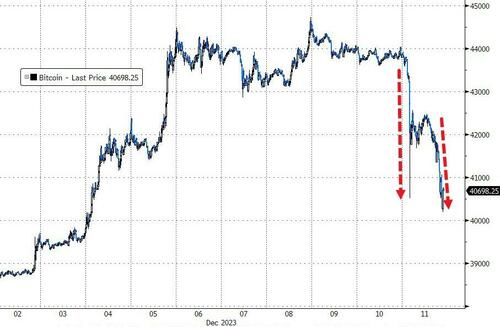

Bitcoin was hit with a double-whammy today with a large liquidation of longs overnight (around $100 million)…

Additionally, data from the statistics resource CoinGlass had cross-crypto long liquidations for the day stood at over $400 million.

And then another leg lower as US Senator Elizabeth Warren introduced legislation to address her concerns surrounding the alleged misuse of digital currencies in illicit activities, citing money laundering, drug trafficking, sanctions evasion, and more.

Which smashed BTC down to test support just above $40,000…

As Nik Hoffman reports at BitcoinMagazine, the bill, supported by a coalition within the Banking Committee, marks a significant push for increased oversight and regulation within the Bitcoin and cryptocurrency sphere. Citing risks associated with cryptocurrencies, Senator Warren stressed that digital currencies are used as an avenue for criminal activities, and that must be addressed through stringent regulatory frameworks.

“The Treasury Department is making clear that we need new laws to crack down on crypto’s use in enabling terrorist groups, rogue nations, drug lords, ransomware gangs, and fraudsters to launder billions in stolen funds, evade sanctions, fund illegal weapons programs, and profit from devastating cyberattacks,” said Warren. “I’m glad that five new senators are joining the fight to take action, including three members of the Banking Committee – our bipartisan bill is the toughest proposal on the table cracking down on crypto’s illicit use and giving regulators more tools in their toolbox.”

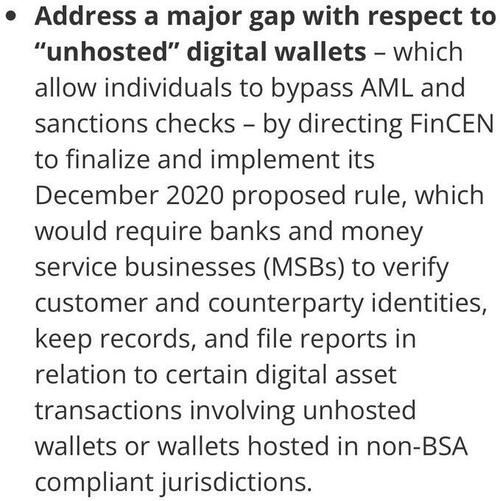

Senator Warren’s bill aims to mandate stricter reporting requirements by extending the Bank Secrecy Act (BSA) responsibilities, including Know-Your-Customer (KYC) requirements, file reports on “transactions involving unhosted wallets”, and more. All in attempt to close “loopholes and bring the digital asset ecosystem into greater compliance.”

This bill is endorsed by Bank Policy Institute, Massachusetts Bankers Association, Transparency International U.S., Global Financial Integrity, National District Attorneys Association, Major County Sheriffs of America, Massachusetts Sheriffs’ Association, AARP, National Consumer Law Center, and National Consumers League.

JUST IN: 🇺🇸 US Senator Elizabeth Warren introduces bill to “crack down” on the #Bitcoin and crypto industry and bring it “into greater compliance.” pic.twitter.com/7xOeOAzJ5S

— Bitcoin Magazine (@BitcoinMagazine) December 11, 2023

The proposed legislation comes at a time when the popularity and adoption of Bitcoin has surged worldwide, particularly in the United States. As next month, the Securities and Exchange Commission (SEC) will have to make a decision on whether to approve the US’s first spot Bitcoin exchange traded fund (ETF) or not, which if approved, could see massive institutional and retail demand for BTC.

Last Thursday, Senator Warren went live on CNBC claiming that North Korea is using Bitcoin and crypto to fund nearly half of its nuclear weapons program.

JUST IN: 🇺🇸 US Senator Elizabeth Warren claims North Korea is using #Bitcoin and crypto to fund “half” of its nuclear weapons program.

— Bitcoin Magazine (@BitcoinMagazine) December 7, 2023

As Galaxy Digital head of firmwide research Alex Thorn notes in a sobering X thread, Warren’s bill would effectively ban crypto in America.

as non-custodial and decentralized software cannot plausibly perform centralized compliance functions, warren’s bill would effectively outlaw crypto in america

— Alex Thorn (@intangiblecoins) December 11, 2023

Continued from X:

Take miners or validators as an example. these entities passively add transaction data to the blockchain. while they can exclude known sanctioned addresses, they are structurally incapable of “knowing” the identity of every user. It would be impossible for miners or validators to perform KYC on every public blockchain transactor. indeed, it cannot even be said that these entities even have a “customer” to “know.”

Warren’s bill also seeks to impose the bank secrecy act on non-custodial wallets, many of which are free and open source. to be clear, there is no such thing as “unhosted” digital wallets – these are just wallets.

Requiring non-custodial open-source software to perform bank-like compliance is *the big attack* bitcoin’s enemies have always threatened. it’s impossible for bitcoin core, for example, to comply with this, so it amounts to an effective ban of bitcoin in the USA.

These rules effectively ban crypto in america, and they fundamentally undermine the core innovation itself — P2P digital cash. if you believe humans should have the right to transact without an intermediary, you must oppose this bill. call your senators! this is the big fight!

Update: And a question…

Are we really letting this dumb bitch manipulate our price? She is the most useless legislator in DC. Look up how many bills she drafted that made it to committees, let alone an actual vote.

— Tenacious B (@GoofysConcern) December 11, 2023

Tyler Durden

Mon, 12/11/2023 – 15:05

via ZeroHedge News https://ift.tt/hFvraIP Tyler Durden