Empire Fed Manufacturing Unexpectedly Crashes Into ‘Contraction’

After three strong ‘beats’ in a row, the Empire State Manufacturing Survey crashed back into contraction, well below expectations in December (from +9.1 to -14.5, +2.0 exp).

The drop takes the measure from ‘expansion’ at 7-month-highs to ‘contraction’ at 4-month-lows…

Source: Bloomberg

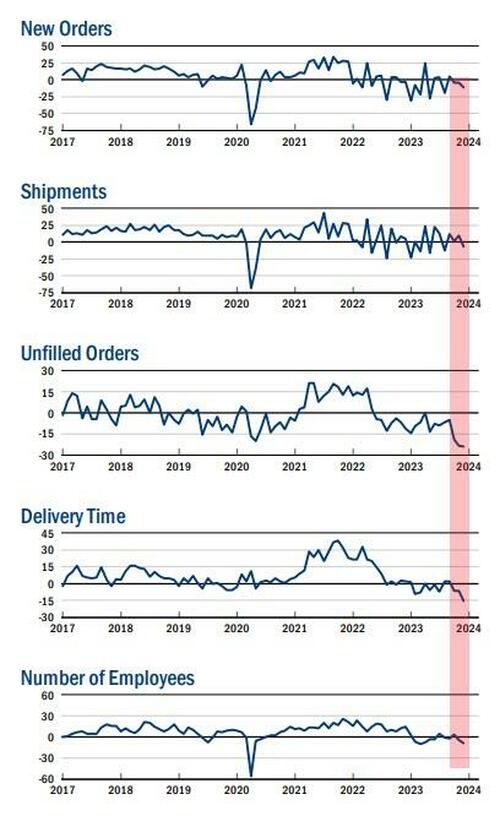

The new orders fell six points to -11.3, pointing to a decline in orders for a third consecutive month, and the shipments index fell sixteen points to -6.4, indicating that shipments fell.

The unfilled orders index held steady at -24.0, a sign that unfilled orders continued to fall significantly.

After rising into positive territory last month, the inventories index retreated fourteen points to -5.2, suggesting that inventories moved lower.

The delivery times index dropped ten points to -15.6, its lowest reading in several years, a sign that delivery times shortened.

The index for number of employees fell four points to -8.4, its lowest level in several months, pointing to a modest decline in employment levels.

On the bright side, the prices paid index moved down six points to 16.7, suggesting an ongoing moderation in input price increases, while the prices received index held steady at 11.5, a sign that selling price increases remained modest.

Is this the start of ‘soft’ data’s reversion to ‘hard’ reality?

The Fed – with its six rate-cuts – better hope so.

Tyler Durden

Fri, 12/15/2023 – 08:43

via ZeroHedge News https://ift.tt/KPfvLwy Tyler Durden