“Largest Ever” Options Expiration Imminent With Massive Gamma ‘Unclench’

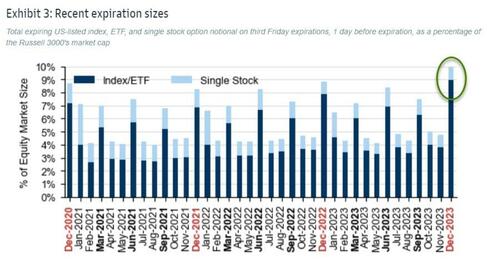

Goldman’s John Marshall estimates that today’s options expiration will be the largest ever with over $4.9 trillion of notional options exposure expiring, including $490 billion notional of single stock options.

While December expirations are typically the largest of the year, this one breaks all past records.

Options expiring today represent a notional value that is equal to 10% of the Russell 3000 market capitalization. The largest expiration on record.

And with a record $8BN long gamma position about to be unclenched…

As SpotGamma notes, today we see ~30% of S&P500/Nasdaq/Russel gamma expiring, with the bulk of that centered in the:

-

4,700-4,750 area for S&P (470-475 SPY),

-

near the 400-405 strikes for QQQ,

-

and 200 strike for IWM.

The removal of this gamma with expiration should allow for index volatility to increase – a factor which has already started to come into play.

As you can see below, December expiration is huge with ~1.3trillion of call delta notional set to expire. Puts are essentially nonexistent.

A blow-off-top seems to be consensus now, but options positions seem poised to support a sharp move. Seasonality, rates, and sentiment seem to support higher stocks into year end – and a “stock up, vol up” scenario would accelerate movement. Further, single stock call skews are not all that heavy when we look broadly across names (i.e. calls are not bid to the extremes).

Tyler Durden

Fri, 12/15/2023 – 09:05

via ZeroHedge News https://ift.tt/YlABzEZ Tyler Durden