The World Has “Fundamentally Changed” – Jeff Gundlach Warns Tucker Carlson of “Large, Multi-Generational Reset”

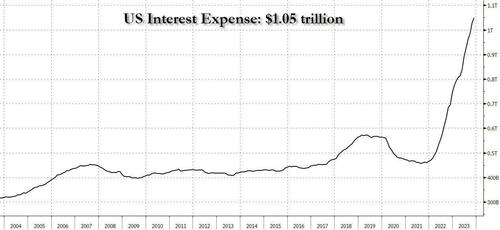

While DoubleLine founder Jeffrey Gundlach does not believe politics was the “primary factor” behind Fed Chair Powell’s shockingly fast-flop in November/December from uber-hawk to unter-dove, he warns Tucker Carlson in the following interview that The Fed’s regime-change is more driven by systemic fears as debt is soaring unsustainably – and interest costs are rising exponentially (as we detailed here) with rates so high.

“This is a really big problem because we have such a large amount of expenditures that are mandatory. We don’t have the money right to to to have interest expense that high.”

Gundlach comments grow more ominous about the implications of Washington’s largesse:

“there is a real problem with this massive deficit. We’re going to not be able to really refinance this debt.

And I think that’s going to lead to a crisis in the dollar, which will lead to a crisis in the economy.“

What will really move The Fed is simple:

“The stock market dropping is really the thing that is the straw that breaks the Fed’s back when it comes to giving up on maintaining higher interest rates.”

But, Gundlach believes “the world has fundamentally changed.”

“You know, when I was in college, there was this Green Peace movement and there and their motto was Save the Whales. And now the environmentalists movement is killing the whales with windmill construction in the ocean.

…There were a lot of sort of hippie types that had bumper stickers that said “Split wood, not atoms.” And now what are we doing? We’re saying zero carbon. We’re now saying anything but split wood, anything but burned coal.

“So everything changes,” the bond king laments:

“You know, the women’s movement was a big deal back in the seventies. Women’s rights, equal opportunity. Now it’s the opposite of that. At least in athletics, women are under attack.

So it’s weird how everything changes, but that’s the way society and long term economic cycles work is that things that were norms in the past become outdated as as societal conditions change, attitudes change, the means of production change, and those norms just can’t hold up.”

And Gundlach concludes by pointing out that “we’re in one of those radical transformations” now:

“Of course, we see that in the political spectrum where, you know, everyone thought the 2016 election was wacky and then the 2020 election turned out to be wackier. And I think everybody can sense that the 2024 election is going to be the wackiest of our lifetime.”

“I think we’re looking at a very large generational, multi-generational reset.

We don’t make the mistakes our parents made.

We make the mistakes that our grandparents and great grandparents made.

And that’s why these cycles seem to be sort of 75 years in length. And there was the Civil War, then there was World War II, and now look where we are.

We’re about 75 years after that. And so this is somewhat predictable, if not totally predictable…”

Watch the abbreviated interview below:

Is the Fed lowering rates to get Joe Biden reelected, or is the truth actually much scarier than that? Jeffrey Gundlach explains. pic.twitter.com/2Sko3CFRp9

— Tucker Carlson (@TuckerCarlson) January 2, 2024

Tyler Durden

Wed, 01/03/2024 – 12:00

via ZeroHedge News https://ift.tt/w2Cj0iY Tyler Durden