Fed Minutes Push Back On Powell’s Dovish Pivot

Today we get to see the cherry-picked highlights from The Fed’s ‘Great Pivoting’ in December.

Will they admit what we all think happened? Of course not

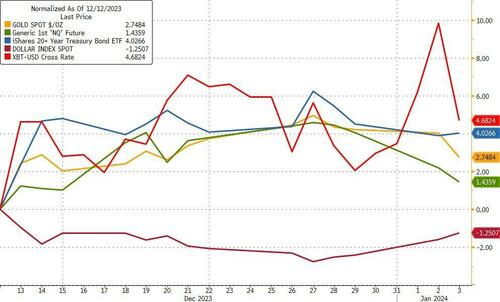

Since the ‘dovish’ flip-flop at the last FOMC meeting on December 13th, markets have mimicked ‘the QE trade’ – dollar down, everything else up (led by crypto)…

Source: Bloomberg

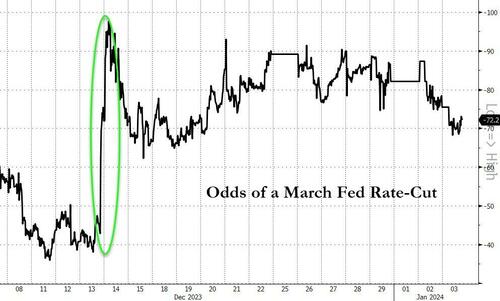

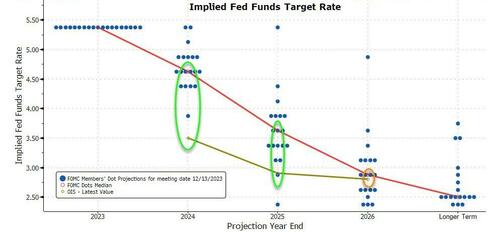

Short-term rates markets have clung to the belief that The Fed will start cutting in March – with all the hawkish jawboning failing to shift expectations too much (75% odds of March cut now)…

Source: Bloomberg

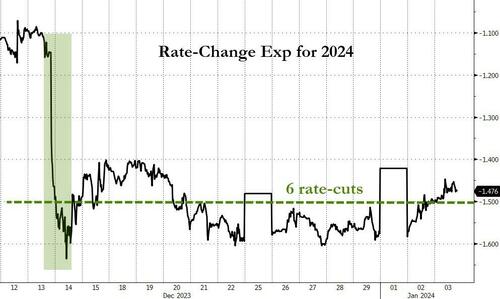

And also still expected six full rate-cuts (150bps) in 2024…

Source: Bloomberg

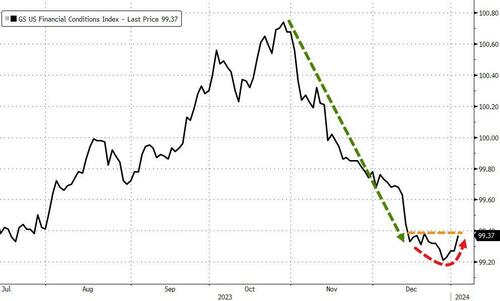

Interestingly, after the unprecedented easing of financial conditions since the start of November, the last three weeks since the Dec FOMC has seen Financial Conditions stabilize (and start to tighten very modestly)…

Source: Bloomberg

So the big question is, will The Fed use the Minutes to jawbone back these ultra-dovish expectations further after various ‘hawkish’ Fed Speakers since the FOMC have failed to change the market’s mind on 2024…

Source: Bloomberg

Will the Minutes be as dovish as Powell sounded?

So, what do they want us to know?

The Fed Minutes appear to be far less dovish than Powell suggested.

-

No sign of imminent rate cuts: Policymakers say their projections imply reductions “would be appropriate by the end of 2024” and several suggest rates could stay at current level for longer than they currently anticipate

-

The benchmark rate was seen as likely at or near its peak, though officials note that further rate hikes remain possible if the economy warrants them

-

In addition, Fed officials reaffirmed a “careful” approach to rate decisions.

-

Several participants observed that circumstances might warrant keeping policy rate at current level longer than they currently anticipate.

-

Participants generally reaffirmed it would be appropriate for policy to remain restrictive until inflation was ‘clearly moving down sustainably’.

-

At the same time, officials acknowledge “clear progress” in 2023 toward Fed’s 2% inflation goal

It seems the discussion of rate-cuts, that Powell mentioned during the press conference, was far less of a ‘thing’ than the market went with.

These Minutes in no way support a 150bps rate-cut cycle next year.

And uncertainty remains high:

“Participants generally perceived a high degree of uncertainty surrounding the economic outlook.”

Fed doves are more worried about labor market weakening too quickly, signaling a sense of urgency to cutting rates.

“Several participants noted the risk that, if labor demand were to weaken substantially further, the labor market could transition quickly from a gradual easing to a more abrupt downshift in conditions.”

Furthermore, the Minutes pushed back against too much exuberance in financial markets:

“Many participants remarked that an easing in financial conditions beyond what is appropriate could make it more difficult for the Committee to reach its inflation goal.”

And some talk of tapering QT:

“Several participants remarked that the Committee’s balance sheet plans indicated that it would slow and then stop the decline in the size of the balance sheet when reserve balances are somewhat above the level judged consistent with ample reserves.

These participants suggested that it would be appropriate for the Committee to begin to discuss the technical factors that would guide a decision to slow the pace of runoff well before such a decision was reached in order to provide appropriate advance notice to the public.”

Read the full FOMC Minutes below:

Tyler Durden

Wed, 01/03/2024 – 14:00

via ZeroHedge News https://ift.tt/gJfc5Gh Tyler Durden