Equities Eye January Pause As Risk-On Mood Fades

By Michael Msika, BLoomberg Markets Live reporter and strateigst

After partying frenziedly for two months before the New Year, stock markets might well need to take a breather in January.

On the face of it, momentum still looks robust. But a closer look shows investors gravitating toward last year’s laggards, an oft-observed January pattern. On the first trading day of 2024, telecoms and energy, alongside value stocks such as banks and autos, benefited from the rotation, while tech slid.

There are also reasons to be cautious on markets as a whole.

Technically, global stocks have started the year in overbought territory, while Europe’s Stoxx 600 has been overbought for a record 20 sessions in a row, based on its 14-day RSI. And as our chart below shows, it’s repeatedly come up against resistance, failing yet again yesterday to breach a level that’s been unchallenged for two years. The index last broke above that barrier in January 2022, but the subsequent record high proved short-lived.

Given the recent rally was propelled by bets on big interest rate cuts, investors will probably want to make sure economic dataflow continues to back the case for aggressive policy easing. “Even if investors remain widely optimistic regarding the outcome for global economies this year, with decreasing inflation and recession fears, they will remain data dependent,” says Pierre Veyret, a technical analyst at ActivTrades.

The rate-cut optimism faces a test Friday, with euro-area inflation forecast to show a small upward bump. And final PMI readings released yesterday confirmed manufacturing activity and new orders remain stuck in contraction — a stark contrast with buoyant stock markets.

John Stoltzfus at Oppenheimer Asset Management, a big-time equity bull who correctly predicted last year’s S&P 500 surge, says “it’s not uncommon for markets to pause to digest a bull run of the magnitude experienced in the fourth quarter just ended.”

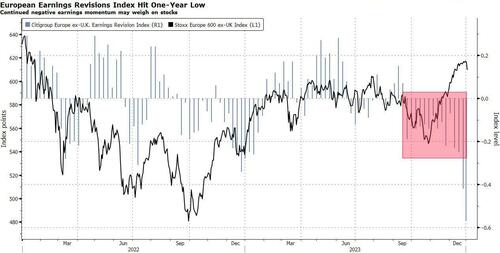

Stoltzfus sees the earnings season — officially starting in the US on Jan. 12 — as the next catalyst for markets. Yet, earnings expectations are becoming less upbeat. For the Stoxx 600, 12-month blended EPS estimates have been sliding since October. Citi’s quantitative indicator of European earnings recently hit its lowest in a year, having been negative since September.

For European companies, “a combination of margin pressure across staples, industrials and financials, along with heavy exposure to China, create challenges for first half earnings,” Bloomberg Intelligence strategists Tim Craighead and Kaidi Meng write. They predict further negative revisions, compared with upgrades in the US.

None of the above means people are turning gloomy. In fact, a January pause may be the prelude to further stock gains, according to Bank of America quantitative strategist Savita Subramanian. Her “Sell Side Indicator” (SSI), suggests equity sentiment is now the most bullish in over 18 months but remains stuck at neutral. That implies a 13.5% price return on the S&P 500 this year.

“Wall Street is now halfway over the wall of worry,” Subramanian writes, noting that while the average recommended equity allocation increased last year by 1.6 percentage points, it had dropped in 2022 by more 6 percentage points.

Tyler Durden

Wed, 01/03/2024 – 15:00

via ZeroHedge News https://ift.tt/Y1coeKF Tyler Durden