Spot Container Rates Surge By 173% Due To Red Sea Disruptions

Drone and missile attacks by Yemen’s Iran-backed Houthi militants on commercial vessels in one of the world’s busiest shipping lanes have resulted in firms sending ships around the Cape of Good Hope, entirely avoiding the Red Sea region. Reroutings have added a week or more to sailings, thus straining cargo capacity, which, in return, has sent containerized shipping rates soaring.

Bloomberg cites new data from Freightos, a cargo booking and payment platform, that shows the spot rate for a 40-foot container from Asia to northern Europe has jumped 173% to $4,000 since mid-December.

The price for a 40-foot container from Asia to the Mediterranean has increased to $5,175, as reported by Freightos. Additionally, they noted that major shippers have announced even higher prices, surpassing the $6,000 mark for this route in the next two weeks. Shipping rates from Asia to the East Coast of North America also soared 55% to $3,900.

The Red Sea connects to Egypt’s Suez Canal and is the fastest way to transport consumer goods, petroleum products, and food from Asia and the Middle East to Europe and North America. About 10% to 12% of global trade flows through the critical waterway.

On Wednesday, no container ships with destinations to North America and Europe were transiting the Red Sea. These vessels were rerouted to Africa’s southern Cape of Good Hope to avoid the attacks – adding anywhere from 7 to 20 days to their voyages. This indicates that the Pentagon’s Operation Prosperity Guardian has failed to protect commercial vessels in the region.

Spot container rates are moving higher because diversions around the Cape of Good Hope add extra time to sailings, reducing capacity.

New data from the International Monetary Fund’s PortWatch platform, produced with Oxford University, shows that for the ten days through Monday, sails through the vital Suez Canal trade route plunged 28% compared with a year earlier. This means about 3.1% of global trade has been rerouted from the Red Sea.

Even though container prices are far off Covid highs, prices are more than double from early 2019 levels and come at a time when central banks have unleashed more than a year of interest rate hikes to combat inflation.

Meanwhile, Red Sea disruptions are spreading across the shipping industry, leading to a surge in oil tanker shipping costs.

Shipbroker Braemar said daily shipping costs for a tanker from the Mediterranean to Japan through the Suez jumped from $8,000 a day in early December to $26,000 earlier this week.

“Any route involving the Red Sea is red hot,” the Braemar analysts said.

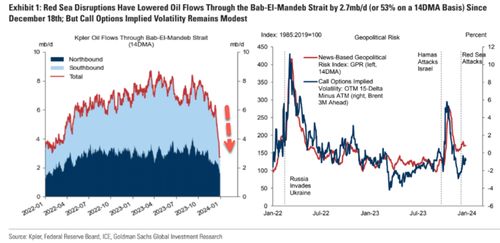

In a separate note, Goldman’s Daan Struyven shows oil flows via tankers through the Bab-El-Mandeb strait at the southern end of the Red Sea have plunged.

Struyven said, “We estimated a potential $3-4/bbl boost to crude prices from a hypothetical prolonged and full redirection of all oil flows through the Bab-El-Mandeb strait at the southern end of the Red Sea…”

The biggest fear for energy prices, shipping costs, and supply chains is if a regional conflict erupts across the Middle East.

Tyler Durden

Thu, 01/04/2024 – 07:45

via ZeroHedge News https://ift.tt/MGmVfvj Tyler Durden