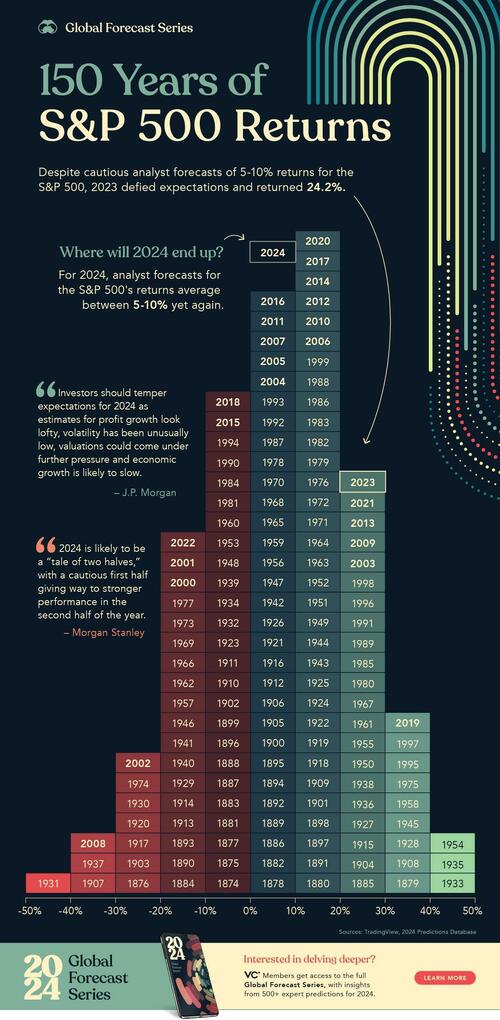

Visualizing 150 Years Of S&P 500 Returns

2023 was supposed to be a tough year for stocks.

However, consumers shrugged off higher interest rates, and investors were more optimistic than fearful largely due to exuberance around AI. As a result, the S&P 500 rallied over 24% in 2023.

To put these gains in perspective, Visual Capitalist’s Niccolo Conte created this graphic to show yearly returns for the S&P 500 since 1874, using data from TradingView.

S&P 500 Historical Returns (1874-2023)

Driving the S&P 500’s returns in 2023 was the force of the “Magnificent Seven”.

These mega caps include Amazon, Apple, Nvidia, Tesla, Microsoft, Meta, and Alphabet. Together, they generated the lion’s share of the index’s returns.

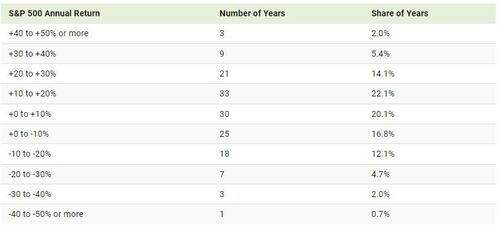

By contrast, a record 72% of stocks underperformed the S&P 500 index. Overall, 2023’s stock market returns were not only rare, but comparatively quite strong, as shown in the table below:

Like a bell curve, the majority of returns fall near the middle, with the highest number of returns in the 10% to 20% range.

The best year was in 1933, when the market soared almost 54% during the Great Depression.

After at least 1,000 banks failed, the U.S. government set up a temporary insurance policy that would soon become the Federal Deposit Insurance Corporation (FDIC). This restored confidence and drove money back into banks, increasing the money supply and supporting more production and spending.

The market faced its worst year just two years earlier, plummeting 43% amid the collapse of the U.S. banking system. The last time stocks tumbled nearly that far was in 2008.

Forecasting S&P 500 Returns for 2024

Looking back at 2023, we can see that Wall Street’s consensus was far off the mark.

“I’ve never seen the consensus as wrong as it was in 2023.”

-Andrew Pease, Chief Investment Strategist at Russell Investments

While many firms were cautious with their forecasts going into 2023, Goldman Sachs was one of the few to say the economy would avoid a recession.

Among the main reasons behind this forecast was that real disposable personal income was rebounding and U.S. GDP looked resilient in late 2022. These factors, among others, were seen to be more powerful drivers than tighter financial conditions.

This year, Goldman Sachs estimates that the S&P 500 will see more moderate returns, rising 7%. Overall, analysts forecast that the index will return 5-10%, presenting another cautiously optimistic outlook for 2024.

Tyler Durden

Mon, 01/08/2024 – 04:15

via ZeroHedge News https://ift.tt/WLvlQET Tyler Durden